Citibank 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

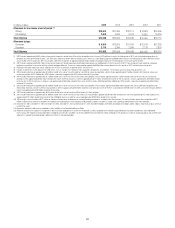

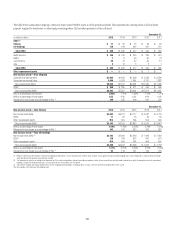

As set forth in the table above, Citi’s HQLA decreased both year-over-year

as well as sequentially, driven primarily by reductions in long-term debt

and short-term borrowings, as discussed further under “Secured Funding

Transactions and Short-Term Borrowings” below.

Citi’s HQLA as set forth above does not include Citi’s available borrowing

capacity from the Federal Home Loan Banks (FHLB) of which Citi is a

member, which was approximately $36 billion as of December 31, 2015

(unchanged from September 30, 2015 and compared to $26 billion as of

December 31, 2014) and maintained by eligible collateral pledged to such

banks. The HQLA also does not include Citi’s borrowing capacity at the U.S.

Federal Reserve Bank discount window or other central banks, which would

be in addition to the resources noted above.

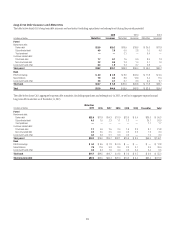

In general, Citi’s liquidity is fungible across legal entities within its

bank group. Citi’s bank subsidiaries, including Citibank, can lend to the

Citi parent and broker-dealer entities in accordance with Section 23A of

the Federal Reserve Act. As of December 31, 2015, the capacity available for

lending to these entities under Section 23A was approximately $17 billion,

largely unchanged from prior periods, subject to certain eligible non-cash

collateral requirements.

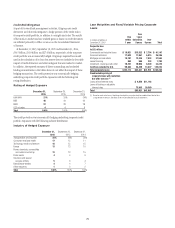

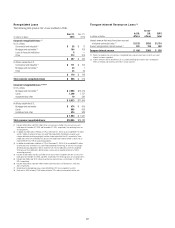

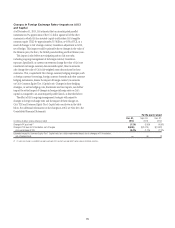

Loans

As part of its funding and liquidity objectives, Citi seeks to fund its existing

asset base appropriately as well as maintain sufficient liquidity to grow its

core businesses in Citicorp, including its loan portfolio. Citi maintains a

diversified portfolio of loans to its consumer and institutional clients. The

table below sets forth the end-of-period loans, by business and/or segment,

and the total average loans for each of the periods indicated:

In billions of dollars

Dec. 31,

2015

Sept. 30,

2015

Dec. 31,

2014

Global Consumer Banking

North America $165.1 $158.5 $160.8

Latin America 31.5 31.4 35.5

Asia (1) 88.7 88.4 94.8

Total $285.3 $278.3 $291.1

Institutional Clients Group

Corporate lending 114.9 116.5 108.4

Treasury and trade solutions (TTS) 71.3 73.4 76.0

Private bank, markets and securities services

and other 101.3 98.9 89.9

Total $287.5 $288.8 $274.3

Total Citicorp 572.8 567.1 565.4

Total Citi Holdings 44.8 55.3 79.2

Total Citigroup loans (EOP) $617.6 $622.4 $644.6

Total Citigroup loans (AVG) $625.1 $623.2 $650.8

(1) For reporting purposes, includes EMEA GCB for all periods presented.

End-of-period loans declined 4% year-over-year and 1% quarter-over-

quarter. Excluding the impact of FX translation, Citigroup’s end-of-period

loans decreased 1% both year-over-year and sequentially, in each case driven

by continued overall declines in Citi Holdings.

Excluding the impact of FX translation, Citicorp loans increased 5%

year-over-year. GCB loans grew 2% year-over-year, driven by 3% growth in

North America. ICG loans increased 8% year-over-year. Within ICG, corporate

loans increased 9% driven by both new business and the funding of prior

commitments. Treasury and trade solutions loans declined 3%, as Citi

continued to distribute a significant portion of its trade loan originations,

which allows it to support its clients while maintaining balance sheet

discipline in a continued low spread environment. Private bank, markets and

securities services and other loans grew 14% year-over-year.

Citi Holdings loans decreased 43% year-over-year driven by over $21

billion of reductions in North America mortgages, including transfers to

held-for-sale (see Note 15 to the Consolidated Financial Statements), as well

as the sale of OneMain Financial, which was completed during the fourth

quarter of 2015.

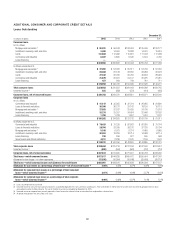

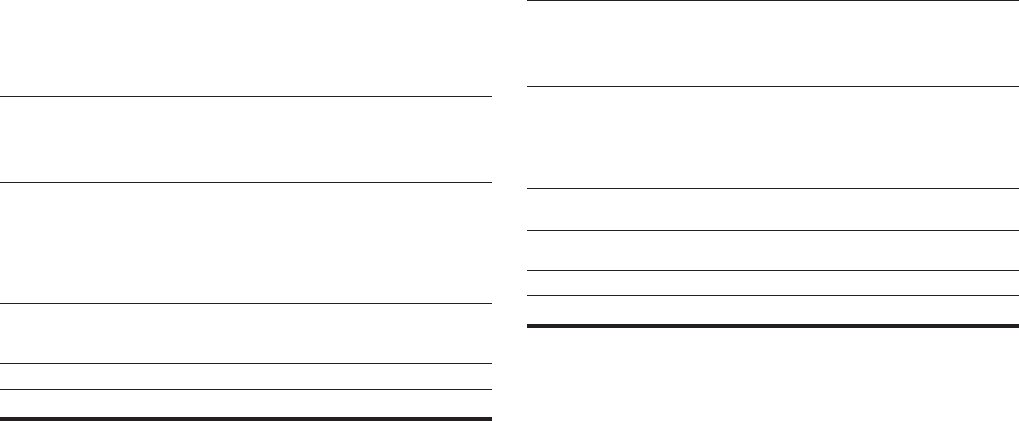

Deposits

Deposits are Citi’s primary and lowest cost funding source. The table below

sets forth the end-of-period deposits, by business and/or segment, and the

total average deposits for each of the periods indicated:

In billions of dollars

Dec. 31,

2015

Sept. 30,

2015

Dec. 31,

2014

Global Consumer Banking

North America $172.8 $170.9 $171.4

Latin America 40.8 38.8 43.7

Asia (1) 87.8 87.1 89.2

Total $301.4 $296.8 $304.3

Institutional Clients Group

Treasury and trade solutions (TTS) 392.2 398.7 378.0

Banking ex-TTS 118.8 117.4 94.5

Markets and securities services 76.3 78.8 82.9

Total $587.3 $594.9 $555.4

Corporate/Other 12.1 5.4 22.8

Total Citicorp $900.8 $897.1 $882.5

Total Citi Holdings 7.1 7.1 16.8

Total Citigroup deposits (EOP) $907.9 $904.2 $899.3

Total Citigroup deposits (AVG) $908.8 $903.1 $938.7

(1) For reporting purposes, includes EMEA GCB for all periods presented.