Citibank 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

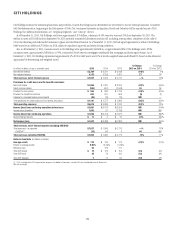

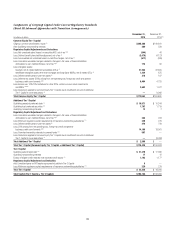

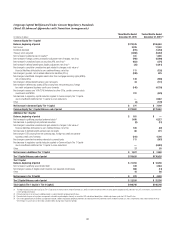

Tier 1 Leverage Ratio

Under the U.S. Basel III rules, Citi, as with principally all U.S. banking

organizations, is also required to maintain a minimum Tier 1 Leverage

ratio of 4%. The Tier 1 Leverage ratio, a non-risk-based measure of capital

adequacy, is defined as Tier 1 Capital as a percentage of quarterly adjusted

average total assets less amounts deducted from Tier 1 Capital.

Supplementary Leverage Ratio

Advanced Approaches banking organizations are additionally required

to calculate a Supplementary Leverage ratio, which significantly differs

from the Tier 1 Leverage ratio by also including certain off-balance sheet

exposures within the denominator of the ratio (Total Leverage Exposure).

The Supplementary Leverage ratio represents end of period Tier 1 Capital

to Total Leverage Exposure, with the latter defined as the sum of the daily

average of on-balance sheet assets for the quarter and the average of certain

off-balance sheet exposures calculated as of the last day of each month in

the quarter, less applicable Tier 1 Capital deductions. Advanced Approaches

banking organizations will be required to maintain a stated minimum

Supplementary Leverage ratio of 3% commencing on January 1, 2018, but

commenced publicly disclosing this ratio on January 1, 2015.

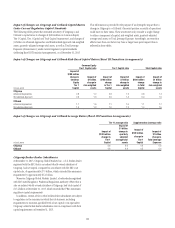

Further, U.S. GSIBs, and their subsidiary insured depository institutions,

including Citi and Citibank, are subject to enhanced Supplementary Leverage

ratio standards. The enhanced Supplementary Leverage ratio standards

establish a 2% leverage buffer for U.S. GSIBs in addition to the stated 3%

minimum Supplementary Leverage ratio requirement in the U.S. Basel III

rules. If a U.S. GSIB fails to exceed the 2% leverage buffer, it will be subject

to increasingly onerous restrictions (depending upon the extent of the

shortfall) regarding capital distributions and discretionary executive bonus

payments. Accordingly, U.S. GSIBs are effectively subject to a 5% minimum

Supplementary Leverage ratio requirement. Additionally, insured depository

institution subsidiaries of U.S. GSIBs, such as Citibank, are required to

maintain a Supplementary Leverage ratio of 6% to be considered “well

capitalized” under the revised Prompt Corrective Action (PCA) framework

established by the U.S. Basel III rules. Citi and Citibank are required to

be compliant with these higher effective minimum ratio requirements on

January 1, 2018.

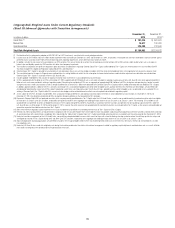

Prompt Corrective Action Framework

The U.S. Basel III rules revised the PCA regulations applicable to insured

depository institutions in certain respects.

In general, the PCA regulations direct the U.S. banking agencies to

enforce increasingly strict limitations on the activities of insured depository

institutions that fail to meet certain regulatory capital thresholds. The PCA

framework contains five categories of capital adequacy as measured by

risk-based capital and leverage ratios: (i) “well capitalized”; (ii) “adequately

capitalized”; (iii) “undercapitalized”; (iv) “significantly undercapitalized”;

and (v) “critically undercapitalized.”

Accordingly, beginning January 1, 2015, an insured depository institution,

such as Citibank, must maintain minimum Common Equity Tier 1 Capital,

Tier 1 Capital, Total Capital, and Tier 1 Leverage ratios of 6.5%, 8%, 10% and

5%, respectively, to be considered “well capitalized.” Additionally, Advanced

Approaches insured depository institutions, such as Citibank, must maintain

a minimum Supplementary Leverage ratio of 6%, effective January 1, 2018,

to be considered “well capitalized.”

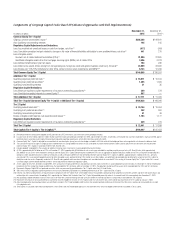

Capital Planning and Stress Testing

Citi is subject to an annual assessment by the Federal Reserve Board as to

whether Citi has effective capital planning processes as well as sufficient

regulatory capital to absorb losses during stressful economic and financial

conditions, while also meeting obligations to creditors and counterparties

and continuing to serve as a credit intermediary. This annual assessment

includes two related programs:

• The Comprehensive Capital Analysis and Review (CCAR) evaluates Citi’s

capital adequacy, capital adequacy process, and its planned capital

distributions, such as dividend payments and common stock repurchases.

As part of CCAR, the Federal Reserve Board assesses whether Citi has

sufficient capital to continue operations throughout times of economic

and financial market stress and whether Citi has robust, forward-looking

capital planning processes that account for its unique risks. The Federal

Reserve Board may object to Citi’s annual capital plan based on either

quantitative or qualitative grounds. If the Federal Reserve Board objects to

Citi’s annual capital plan, Citi may not undertake any capital distribution

unless the Federal Reserve Board indicates in writing that it does not

object to the distribution.

• Dodd-Frank Act Stress Testing (DFAST) is a forward-looking quantitative

evaluation of the impact of stressful economic and financial market

conditions on Citi’s regulatory capital. This program serves to inform the

Federal Reserve Board, the financial companies, and the general public,

how Citi’s regulatory capital ratios might change using a hypothetical set

of adverse economic conditions as designed by the Federal Reserve Board.

In addition to the annual supervisory stress test conducted by the Federal

Reserve Board, Citi is required to conduct annual company-run stress tests

under the same three supervisory scenarios as well as conduct a mid-cycle

stress test under company-developed scenarios.

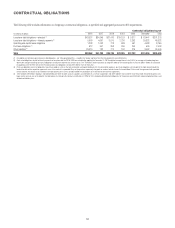

Both CCAR and DFAST include an estimate of projected revenues, losses,

reserves, certain pro forma regulatory capital ratios (i.e., Common Equity

Tier 1 Capital, Tier 1 Capital, Total Capital, and Tier 1 Leverage ratios), and

any other additional capital measures deemed relevant by Citi. Projections

are required over a nine-quarter planning horizon under baseline conditions

and under a range of stressed scenarios. All risk-based capital ratios reflect

application of the Standardized Approach framework only and the transition

arrangements under the U.S. Basel III rules.

In November 2015, the Federal Reserve Board released a final rule, which

for purposes of CCAR, adopted targeted amendments to its capital plan

and stress test rules. Effective January 1, 2016, the final rule removed all

requirements related to the Tier 1 Common Capital ratio (originally defined

in conjunction with the 2009 Supervisory Capital Assessment Program), as

it has effectively been replaced by the Common Equity Tier 1 Capital ratio

requirement subsequent to the implementation of the U.S. Basel III rules.

Moreover, the final rule delayed the use of the Supplementary Leverage ratio

until the 2017 capital planning cycle, and deferred the use of the Advanced

Approaches framework indefinitely. For additional information regarding

CCAR, see “Risk Factors—Regulatory Risks” below.