Citibank 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

CREDIT RISK

OVERVIEW

Credit risk is the potential for financial loss resulting from the failure of a

borrower or counterparty to honor its financial or contractual obligations.

Credit risk arises in many of Citigroup’s business activities, including:

• wholesale and retail lending;

• capital markets derivative transactions;

• structured finance; and

• repurchase and reverse repurchase transactions.

Credit risk also arises from settlement and clearing activities, when Citi

transfers an asset in advance of receiving its counter-value or advances funds

to settle a transaction on behalf of a client. Concentration risk, within credit

risk, is the risk associated with having credit exposure concentrated within a

specific client, industry, region or other category.

Credit risk is one of the most significant risks Citi faces as an institution.

As a result, Citi has a well-established framework in place for managing

credit risk across all businesses. This includes a defined risk appetite,

credit limits and credit policies, both at the business level as well as at the

company-wide level. Citi’s credit risk management also includes processes

and policies with respect to problem recognition, including “watch lists,”

portfolio review, updated risk ratings and classification triggers.

With respect to Citi’s settlement and clearing activities, intra-day client

usage of lines is closely monitored against limits, as well as against “normal”

usage patterns. To the extent a problem develops, Citi typically moves

the client to a secured (collateralized) operating model. Generally, Citi’s

intra-day settlement and clearing lines are uncommitted and cancellable

at any time.

To manage concentration of risk within credit risk, Citi has in place

a concentration management framework consisting of industry limits,

obligor limits and single-name triggers. In addition, the independent

Risk organization reviews concentration of risk across Citi’s regions and

businesses to assist in managing this type of risk.

Credit exposures are generally reported in notional terms for accrual

loans, reflecting the value at which the loans as well as loan and other off-

balance sheet commitments are carried on the Consolidated Balance Sheet.

Credit exposure arising from capital markets activities is generally expressed

as the current mark-to-market, net of margin, reflecting the net value owed

to Citi by a given counterparty.

The credit risk associated with these credit exposures is a function of

the creditworthiness of the obligor, as well as the terms and conditions of

the specific obligation. Citi assesses the credit risk associated with its credit

exposures on a regular basis through its loan loss reserve process (see

“Significant Accounting Policies and Significant Estimates” below and Notes

1 and 16 to the Consolidated Financial Statements), as well as through

regular stress testing at the company, business, geography and product levels.

These stress-testing processes typically estimate potential incremental credit

costs that would occur as a result of either downgrades in the credit quality or

defaults of the obligors or counterparties.

For additional information on Citi’s credit risk management, see Note 15

to the Consolidated Financial Statements.

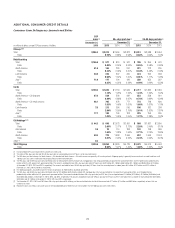

CONSUMER CREDIT

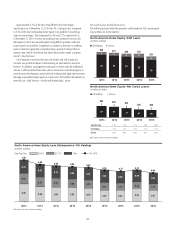

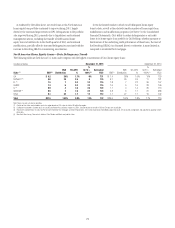

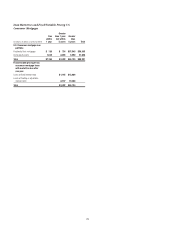

North America Consumer Mortgage Lending

Overview

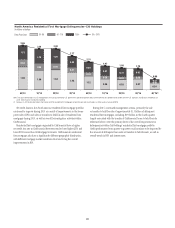

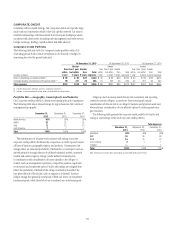

Citi’s North America consumer mortgage portfolio consists of both

residential first mortgages and home equity loans. At December 31, 2015,

Citi’s North America consumer mortgage portfolio was $79.7 billion

(compared to $95.9 billion at December 31, 2014), of which the residential

first mortgage portfolio was $56.9 billion (compared to $67.8 billion at

December 31, 2014), and the home equity loan portfolio was $22.8 billion

(compared to $28.1 billion at December 31, 2014). The decline during the

year was primarily attributed to $14.7 billion of North America consumer

mortgages sold or transferred to held-for-sale, including $6.6 billion of

CitiFinancial consumer mortgages ($5.4 billion of residential first mortgages

and $1.2 billion of home equity loans) transferred to held-for-sale and

classified as Other assets in the fourth quarter of 2015. At December 31, 2015,

$18.7 billion of residential first mortgages were recorded in Citi Holdings,

with the remaining $38.2 billion recorded in Citicorp. At December 31, 2015,

$19.1 billion of home equity loans was recorded in Citi Holdings, with the

remaining $3.6 billion recorded in Citicorp.

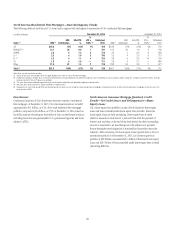

Citi’s residential first mortgage portfolio included $3.4 billion of loans

with Federal Housing Administration (FHA) insurance or Department

of Veterans Affairs (VA) guarantees at December 31, 2015, compared to

$5.2 billion at December 31, 2014. The decline during the year was primarily

due to mortgage loans with FHA insurance sold or transferred to held-for-

sale. Citi’s FHA/VA portfolio consists of loans to low-to-moderate-income

borrowers with lower FICO (Fair Isaac Corporation) scores and generally

higher loan-to-value ratios (LTVs). Credit losses on FHA loans are borne

by the sponsoring governmental agency, provided that the insurance terms

have not been rescinded as a result of an origination defect. With respect

to VA loans, the VA establishes a loan-level loss cap, beyond which Citi is

liable for loss. While FHA and VA loans have high delinquency rates, given

the insurance and guarantees, respectively, Citi has experienced negligible

credit losses on these loans.