Citibank 2015 Annual Report Download - page 297

Download and view the complete annual report

Please find page 297 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.279

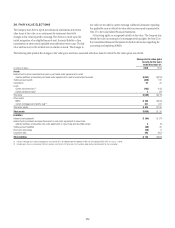

Value-Transfer Networks

Citi is a member of, or shareholder in, hundreds of value-transfer networks

(VTNs) (payment, clearing and settlement systems as well as exchanges)

around the world. As a condition of membership, many of these VTNs require

that members stand ready to pay a pro rata share of the losses incurred by

the organization due to another member’s default on its obligations. Citi’s

potential obligations may be limited to its membership interests in the VTNs,

contributions to the VTN’s funds, or, in limited cases, the obligation may

be unlimited. The maximum exposure cannot be estimated as this would

require an assessment of future claims that have not yet occurred. Citi

believes the risk of loss is remote given historical experience with the VTNs.

Accordingly, Citi’s participation in VTNs is not reported in the guarantees

tables above, and there are no amounts reflected on the Consolidated Balance

Sheet as of December 31, 2015 or 2014 for potential obligations that could

arise from Citi’s involvement with VTN associations.

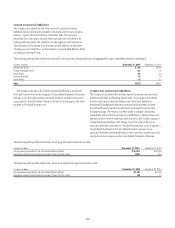

Long-Term Care Insurance Indemnification

In the sale of an insurance subsidiary, the Company provided an

indemnification to an insurance company for policyholder claims and

other liabilities relating to a book of long-term care (LTC) business (for the

entire term of the LTC policies) that is fully reinsured by another insurance

company. The reinsurer has funded two trusts with securities whose fair

value (approximately $6.3 billion at December 31, 2015, compared to

$6.2 billion at December 31, 2014) is designed to cover the insurance

company’s statutory liabilities for the LTC policies. The assets in these trusts

are evaluated and adjusted periodically to ensure that the fair value of the

assets continues to cover the estimated statutory liabilities related to the LTC

policies, as those statutory liabilities change over time.

If the reinsurer fails to perform under the reinsurance agreement for any

reason, including insolvency, and the assets in the two trusts are insufficient

or unavailable to the ceding insurance company, then Citi must indemnify

the ceding insurance company for any losses actually incurred in connection

with the LTC policies. Since both events would have to occur before Citi

would become responsible for any payment to the ceding insurance company

pursuant to its indemnification obligation, and the likelihood of such events

occurring is currently not probable, there is no liability reflected in the

Consolidated Balance Sheet as of December 31, 2015 and 2014 related to

this indemnification. Citi continues to closely monitor its potential exposure

under this indemnification obligation.

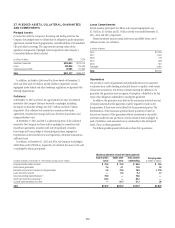

Futures and Over-the-Counter Derivatives Clearing

Citi provides clearing services for clients executing exchange-traded

futures and over-the-counter (OTC) derivatives contracts with central

counterparties (CCPs). Based on all relevant facts and circumstances,

Citi has concluded that it acts as an agent for accounting purposes in its

role as clearing member for these client transactions. As such, Citi does

not reflect the underlying exchange-traded futures or OTC derivatives

contracts in its Consolidated Financial Statements. See Note 23 for a

discussion of Citi’s derivatives activities that are reflected in its Consolidated

Financial Statements.

As a clearing member, Citi collects and remits cash and securities

collateral (margin) between its clients and the respective CCP. There are two

types of margin: initial margin and variation margin. Where Citi obtains

benefits from or controls cash initial margin (e.g., retains an interest

spread), cash initial margin collected from clients and remitted to the

CCP is reflected within Brokerage Payables (payables to customers) and

Brokerage Receivables (receivables from brokers, dealers and clearing

organizations), respectively. However, for OTC derivatives contracts where

Citi has contractually agreed with the client that (i) Citi will pass through

to the client all interest paid by the CCP on cash initial margin; (ii) Citi will

not utilize its right as clearing member to transform cash margin into other

assets; and (iii) Citi does not guarantee and is not liable to the client for

the performance of the CCP, cash initial margin collected from clients and

remitted to the CCP is not reflected on Citi’s Consolidated Balance Sheet. The

total amount of cash initial margin collected and remitted in this manner

was approximately $4.3 billion and $3.2 billion as of December 31, 2015 and

2014, respectively.

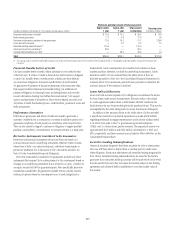

Variation margin due from clients to the respective CCP, or from the CCP

to clients, reflects changes in the value of the client’s derivative contracts

for each trading day. As a clearing member, Citi is exposed to the risk

of non-performance by clients (e.g., failure of a client to post variation

margin to the CCP for negative changes in the value of the client’s derivative

contracts). In the event of non-performance by a client, Citi would move

to close out the client’s positions. The CCP would typically utilize initial

margin posted by the client and held by the CCP, with any remaining

shortfalls required to be paid by Citi as clearing member. Citi generally holds

incremental cash or securities margin posted by the client, which would

typically be expected to be sufficient to mitigate Citi’s credit risk in the event

the client fails to perform.

As required by ASC 860-30-25-5, securities collateral posted by clients is

not recognized on Citi’s Consolidated Balance Sheet.