Citibank 2015 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.141

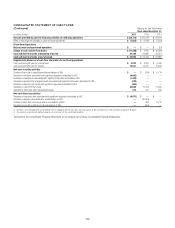

Allowance for Loan Losses

Allowance for loan losses represents management’s best estimate of probable

losses inherent in the portfolio, including probable losses related to large

individually evaluated impaired loans and troubled debt restructurings.

Attribution of the allowance is made for analytical purposes only, and

the entire allowance is available to absorb probable loan losses inherent

in the overall portfolio. Additions to the allowance are made through the

Provision for loan losses. Loan losses are deducted from the allowance and

subsequent recoveries are added. Assets received in exchange for loan claims

in a restructuring are initially recorded at fair value, with any gain or loss

reflected as a recovery or charge-off to the provision.

Consumer Loans

For consumer loans, each portfolio of non-modified smaller-balance,

homogeneous loans is independently evaluated for impairment by product

type (e.g., residential mortgage, credit card, etc.) in accordance with

ASC 450, Contingencies. The allowance for loan losses attributed to these

loans is established via a process that estimates the probable losses inherent

in the specific portfolio. This process includes migration analysis, in which

historical delinquency and credit loss experience is applied to the current

aging of the portfolio, together with analyses that reflect current and

anticipated economic conditions, including changes in housing prices and

unemployment trends. Citi’s allowance for loan losses under ASC 450 only

considers contractual principal amounts due, except for credit card loans

where estimated loss amounts related to accrued interest receivable are

also included.

Management also considers overall portfolio indicators, including

historical credit losses, delinquent, non-performing and classified loans,

trends in volumes and terms of loans, an evaluation of overall credit quality,

the credit process, including lending policies and procedures, and economic,

geographical, product and other environmental factors.

Separate valuation allowances are determined for impaired smaller-

balance homogeneous loans whose terms have been modified in a troubled

debt restructuring (TDR). Long-term modification programs, and short-term

(less than 12 months) modifications that provide concessions (such as

interest rate reductions) to borrowers in financial difficulty, are reported as

TDRs. In addition, loan modifications that involve a trial period are reported

as TDRs at the start of the trial period. The allowance for loan losses for TDRs

is determined in accordance with ASC 310-10-35, Receivables—Subsequent

Measurement (formerly SFAS 114) considering all available evidence,

including, as appropriate, the present value of the expected future cash flows

discounted at the loan’s original contractual effective rate, the secondary

market value of the loan and the fair value of collateral less disposal costs.

These expected cash flows incorporate modification program default rate

assumptions. The original contractual effective rate for credit card loans is

the pre-modification rate, which may include interest rate increases under

the original contractual agreement with the borrower.

Valuation allowances for commercial market loans, which are classifiably

managed Consumer loans, are determined in the same manner as for

Corporate loans and are described in more detail in the following section.

Generally, an asset-specific component is calculated under ASC 310-10-35

on an individual basis for larger-balance, non-homogeneous loans

that are considered impaired and the allowance for the remainder of

the classifiably managed Consumer loan portfolio is calculated under

ASC 450 using a statistical methodology that may be supplemented by

management adjustment.

Corporate Loans

In the corporate portfolios, the Allowance for loan losses includes an asset-

specific component and a statistically based component. The asset-specific

component is calculated under ASC 310-10-35, on an individual basis for

larger-balance, non-homogeneous loans, which are considered impaired.

An asset-specific allowance is established when the discounted cash flows,

collateral value (less disposal costs) or observable market price of the

impaired loan are lower than its carrying value. This allowance considers the

borrower’s overall financial condition, resources, and payment record, the

prospects for support from any financially responsible guarantors (discussed

further below) and, if appropriate, the realizable value of any collateral.

The asset-specific component of the allowance for smaller balance impaired

loans is calculated on a pool basis considering historical loss experience.

The allowance for the remainder of the loan portfolio is determined under

ASC 450 using a statistical methodology, supplemented by management

judgment. The statistical analysis considers the portfolio’s size, remaining

tenor and credit quality as measured by internal risk ratings assigned to

individual credit facilities, which reflect probability of default and loss

given default. The statistical analysis considers historical default rates

and historical loss severity in the event of default, including historical

average levels and historical variability. The result is an estimated range

for inherent losses. The best estimate within the range is then determined

by management’s quantitative and qualitative assessment of current

conditions, including general economic conditions, specific industry and

geographic trends, and internal factors including portfolio concentrations,

trends in internal credit quality indicators, and current and past

underwriting standards.

For both the asset-specific and the statistically based components of the

Allowance for loan losses, management may incorporate guarantor support.

The financial wherewithal of the guarantor is evaluated, as applicable,

based on net worth, cash flow statements and personal or company financial

statements which are updated and reviewed at least annually. Citi seeks

performance on guarantee arrangements in the normal course of business.

Seeking performance entails obtaining satisfactory cooperation from the

guarantor or borrower in the specific situation. This regular cooperation

is indicative of pursuit and successful enforcement of the guarantee; the

exposure is reduced without the expense and burden of pursuing a legal

remedy. A guarantor’s reputation and willingness to work with Citigroup

is evaluated based on the historical experience with the guarantor and

the knowledge of the marketplace. In the rare event that the guarantor

is unwilling or unable to perform or facilitate borrower cooperation, Citi

pursues a legal remedy; however, enforcing a guarantee via legal action

against the guarantor is not the primary means of resolving a troubled