Citibank 2015 Annual Report Download - page 267

Download and view the complete annual report

Please find page 267 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.249

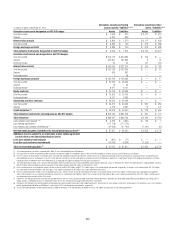

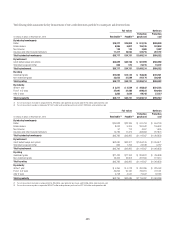

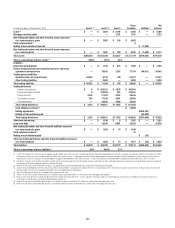

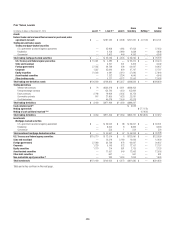

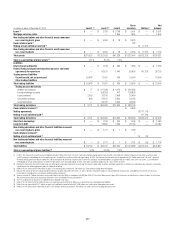

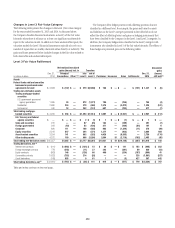

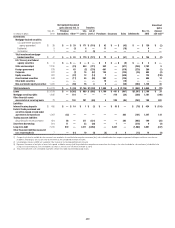

25. FAIR VALUE MEASUREMENT

ASC 820-10 Fair Value Measurement, defines fair value, establishes a

consistent framework for measuring fair value and requires disclosures about

fair value measurements. Fair value is defined as the price that would be

received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. Among other things,

the standard requires the Company to maximize the use of observable inputs

and minimize the use of unobservable inputs when measuring fair value.

Under ASC 820-10, the probability of default of a counterparty is factored

into the valuation of derivative and other positions as well as the impact of

Citigroup’s own credit risk on derivatives and other liabilities measured at

fair value.

Fair Value Hierarchy

ASC 820-10 specifies a hierarchy of inputs based on whether the inputs are

observable or unobservable. Observable inputs are developed using market

data and reflect market participant assumptions, while unobservable inputs

reflect the Company’s market assumptions. These two types of inputs have

created the following fair value hierarchy:

• Level 1: Quoted prices for identical instruments in active markets.

• Level 2: Quoted prices for similar instruments in active markets; quoted

prices for identical or similar instruments in markets that are not

active; and model-derived valuations in which all significant inputs and

significant value drivers are observable in active markets.

• Level 3: Valuations derived from valuation techniques in which one or

more significant inputs or significant value drivers are unobservable.

As required under the fair value hierarchy, the Company considers

relevant and observable market inputs in its valuations where possible. The

frequency of transactions, the size of the bid-ask spread and the amount of

adjustment necessary when comparing similar transactions are all factors in

determining the liquidity of markets and the relevance of observed prices in

those markets.

The Company’s policy with respect to transfers between levels of the fair

value hierarchy is to recognize transfers into and out of each level as of the

end of the reporting period.

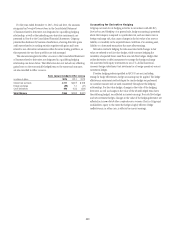

Determination of Fair Value

For assets and liabilities carried at fair value, the Company measures fair

value using the procedures set out below, irrespective of whether the assets

and liabilities are measured at fair value as a result of an election or whether

they are required to be measured at fair value.

When available, the Company uses quoted market prices to determine fair

value and classifies such items as Level 1. In some cases where a market price

is available, the Company will make use of acceptable practical expedients

(such as matrix pricing) to calculate fair value, in which case the items are

classified as Level 2.

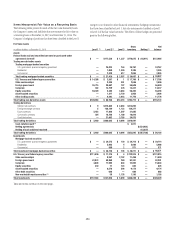

The Company may also apply a price-based methodology, which utilizes,

where available, quoted prices or other market information obtained from

recent trading activity in positions with the same or similar characteristics

to the position being valued. The market activity and the amount of the

bid-ask spread are among the factors considered in determining the liquidity

of markets and the observability of prices from those markets. If relevant and

observable prices are available, those valuations may be classified as Level 2.

When less liquidity exists for a security or loan, a quoted price is stale, a

significant adjustment to the price of a similar security is necessary to reflect

differences in the terms of the actual security or loan being valued, or prices

from independent sources are insufficient to corroborate the valuation, the

“price” inputs are considered unobservable and the fair value measurements

are classified as Level 3.

If quoted market prices are not available, fair value is based upon

internally developed valuation techniques that use, where possible, current

market-based parameters, such as interest rates, currency rates and

option volatilities. Items valued using such internally generated valuation

techniques are classified according to the lowest level input or value driver

that is significant to the valuation. Thus, an item may be classified as Level 3

even though there may be some significant inputs that are readily observable.

Fair value estimates from internal valuation techniques are verified,

where possible, to prices obtained from independent vendors or brokers.

Vendors’ and brokers’ valuations may be based on a variety of inputs ranging

from observed prices to proprietary valuation models.

The following section describes the valuation methodologies used by

the Company to measure various financial instruments at fair value,

including an indication of the level in the fair value hierarchy in which each

instrument is generally classified. Where appropriate, the description includes

details of the valuation models, the key inputs to those models and any

significant assumptions.

Market Valuation Adjustments

Generally, the unit of account for a financial instrument is the individual

financial instrument. The Company applies market valuation adjustments

that are consistent with the unit of account, which does not include

adjustment due to the size of the Company’s position, except as follows.

ASC 820-10 permits an exception, through an accounting policy election,

to measure the fair value of a portfolio of financial assets and financial

liabilities on the basis of the net open risk position when certain criteria are

met. Citi has elected to measure certain portfolios of financial instruments,

such as derivatives, that meet those criteria on the basis of the net open risk

position. The Company applies market valuation adjustments, including

adjustments to account for the size of the net open risk position, consistent

with market participant assumptions and in accordance with the unit

of account.