Citibank 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

Credit Ratings

Citigroup’s funding and liquidity, its funding capacity, ability to access

capital markets and other sources of funds, the cost of these funds, and

its ability to maintain certain deposits are partially dependent on its

credit ratings.

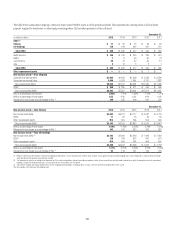

The table below sets forth the ratings for Citigroup and Citibank as of

December 31, 2015. While not included in the table below, the long-term

and short-term ratings of Citigroup Global Markets Inc. (CGMI) were A/A-1

at Standard & Poor’s and A+/F1 at Fitch as of December 31, 2015. The

long-term and short-term ratings of Citigroup Global Markets Holdings

Inc. (CGMHI) were BBB+/A-2 at Standard & Poor’s and A/F1 at Fitch as of

December 31, 2015.

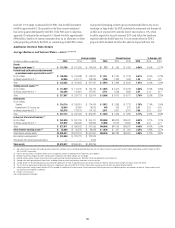

Citigroup Inc. Citibank, N.A.

Senior

debt

Commercial

paper Outlook

Long-

term

Short-

term Outlook

Fitch Ratings (Fitch) A F1 Stable A+ F1 Stable

Moody’s Investors Service (Moody’s) Baa1 P-2 Stable A1 P-1 Stable

Standard & Poor’s (S&P) BBB+ A-2 Stable A A-1 Watch Positive

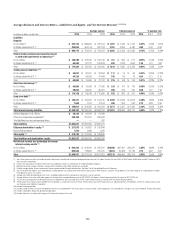

Recent Credit Rating Developments

On December 8, 2015, Fitch affirmed Citigroup Inc.’s Viability Rating (VR)

and Long-Term Issuer Default Rating (IDR) at ‘a/A’, respectively. At the

same time, Fitch affirmed Citibank’s VR and IDR at ‘a/A+’, respectively. The

outlooks for the Long-Term IDRs are stable.

On December 2, 2015, as expected, S&P downgraded the holding company

ratings of all eight U.S. GSIBs, including Citigroup Inc., by one notch,

reflecting its view of the likelihood of extraordinary government support to

be “uncertain.” As a result, Citigroup Inc.’s long-term rating now stands

at BBB+ and the outlook was upgraded to “Stable.” The short-term rating

of Citigroup Inc. remained at A-2. The operating company ratings of the

GSIBs, including Citibank, N.A. and Citigroup Global Markets Inc., remained

unchanged, with a “Watch Positive” outlook, as S&P waits for further clarity

from the regulators regarding TLAC eligibility of certain instruments. S&P

has stated it expects to conclude its credit watch within the first half of 2016.

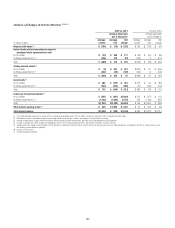

Potential Impacts of Ratings Downgrades

Ratings downgrades by Moody’s, Fitch or S&P could negatively impact

Citigroup’s and/or Citibank’s funding and liquidity due to reduced funding

capacity, including derivatives triggers, which could take the form of cash

obligations and collateral requirements.

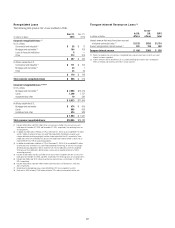

The following information is provided for the purpose of analyzing

the potential funding and liquidity impact to Citigroup and Citibank of

a hypothetical, simultaneous ratings downgrade across all three major

rating agencies. This analysis is subject to certain estimates, estimation

methodologies, and judgments and uncertainties. Uncertainties include

potential ratings limitations that certain entities may have with respect

to permissible counterparties, as well as general subjective counterparty

behavior. For example, certain corporate customers and markets

counterparties could re-evaluate their business relationships with Citi and

limit transactions in certain contracts or market instruments with Citi.

Changes in counterparty behavior could impact Citi’s funding and liquidity,

as well as the results of operations of certain of its businesses. The actual

impact to Citigroup or Citibank is unpredictable and may differ materially

from the potential funding and liquidity impacts described below. For

additional information on the impact of credit rating changes on Citi and its

applicable subsidiaries, see “Risk Factors—Liquidity Risks” above.

Citigroup Inc. and Citibank—Potential Derivative Triggers

As of December 31, 2015, Citi estimates that a hypothetical one-notch

downgrade of the senior debt/long-term rating of Citigroup Inc. across

all three major rating agencies could impact Citigroup’s funding and

liquidity due to derivative triggers by approximately $0.6 billion, compared

to $0.7 billion as of September 30, 2015. Other funding sources, such as

securities financing transactions and other margin requirements, for which

there are no explicit triggers, could also be adversely affected.

As of December 31, 2015, Citi estimates that a hypothetical one-notch

downgrade of the senior debt/long-term rating of Citibank across all three

major rating agencies could impact Citibank’s funding and liquidity by

approximately $1.3 billion, compared to $1.5 billion as of September 30,

2015, due to derivative triggers.