Citibank 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

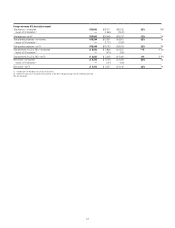

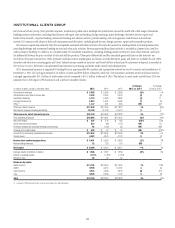

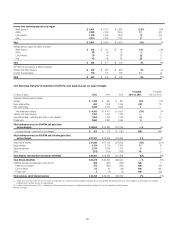

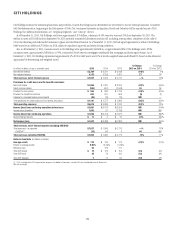

2014 vs. 2013

Net income increased 1%, primarily driven by lower expenses, largely offset

by lower revenues. Excluding the impact of the net fraud loss of $360 million

in Mexico in the fourth quarter of 2013, net income decreased 1%, primarily

driven by the lower revenues and higher expenses, largely offset by lower

credit costs.

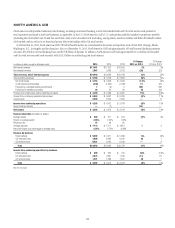

• Revenues decreased 1%, reflecting lower revenues in Markets and

securities services (decrease of 8%), partially offset by higher revenues in

Banking (increase of 7%, or 5% excluding the gains/(losses) on hedges

on accrual loans).

Within Banking:

• Investment banking revenues increased 7%, reflecting a stronger overall

market environment and improved wallet share with ICG’s target clients,

partially offset by a modest decline in overall wallet share. The decline in

overall wallet share was primarily driven by equity and debt underwriting

and reflected market fragmentation. Advisory revenues increased 12%,

reflecting the increased target client activity and an expansion of the

overall M&A market. Equity underwriting revenues increased 18% largely

in line with overall growth in market fees. Debt underwriting revenues

were largely unchanged.

• Treasury and trade solutions revenues increased 1%. Excluding the

impact of FX translation, revenues increased 3% as continued higher

deposit balances, fee growth and trade activity were partially offset

by the impact of spread compression globally. End-of-period deposit

balances were unchanged, but increased 3% excluding the impact of

FX translation, largely driven by North America. Average trade loans

decreased 9% (7% excluding the impact of FX translation).

• Corporate lending revenues increased 52%. Excluding the impact of

gains/(losses) on hedges on accrual loans, revenues increased 15%,

primarily due to continued growth in average loan balances and lower

funding costs.

• Private bank revenues increased 7% due to growth in client business

volumes and improved spreads in banking, higher capital markets activity

and an increase in assets under management in managed investments,

partially offset by continued spread compression in lending.

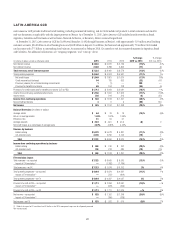

Within Markets and securities services:

• Fixed income markets revenues decreased 11%, driven by a decrease

in rates and currencies revenues, partially offset by increased securitized

products and commodities revenues. Rates and currencies revenues

declined due to historically muted levels of volatility, uncertainties around

Russia and Greece and lower client activity in the first half of 2014. In

addition, the first half of 2013 included a strong performance in rates and

currencies, driven in part by the impact of quantitative easing globally.

Municipals and credit markets revenues declined due to challenging

trading conditions resulting from macroeconomic uncertainties,

particularly in the fourth quarter of 2014. These declines were partially

offset by increased securitized products and commodities revenues, largely

in North America.

• Equity markets revenues decreased 1%, primarily reflecting weakness in

EMEA, particularly cash equities, driven by volatility in Europe, largely

offset by improved performance in prime finance due to increased

customer flows.

• Securities services revenues increased 4%. Excluding the impact of FX

translation, revenues increased 5% due to increased volumes, assets under

custody and overall client activity.

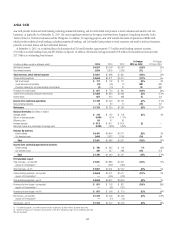

Expenses decreased 1% as efficiency savings, the absence of the net

fraud loss and lower performance-based compensation were partially

offset by higher repositioning charges and legal and related expenses as

well as increased regulatory and compliance costs. Excluding the impact

of the net fraud loss, expenses increased 1%, as higher repositioning

charges and legal and related expenses as well as increased regulatory

and compliance costs were partially offset by efficiency savings and lower

performance-based compensation.

Provisions decreased 27%, primarily reflecting a release for unfunded

lending commitments in the corporate loan portfolio, compared to a build

in 2013, partially offset by higher net credit losses and a lower loan loss

reserve release driven by the overall economic environment. Net credit losses

increased 52%, largely related to the Pemex supplier program during 2014 as

well as write-offs related to a specific counterparty.