Citibank 2015 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

180

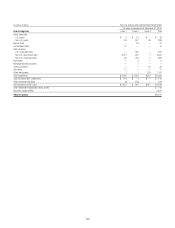

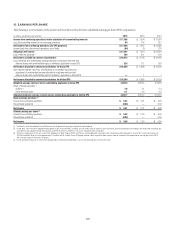

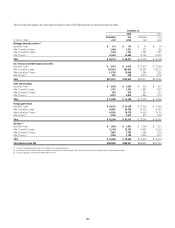

11. FEDERAL FUNDS, SECURITIES BORROWED, LOANED

AND SUBJECT TO REPURCHASE AGREEMENTS

Federal funds sold and securities borrowed or purchased under

agreements to resell, at their respective carrying values, consisted of the

following:

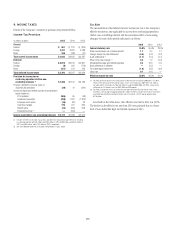

In millions of dollars 2015 2014

Federal funds sold $ 25 $ —

Securities purchased under agreements to resell 119,777 123,979

Deposits paid for securities borrowed 99,873 118,591

Total $219,675 $242,570

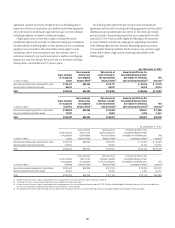

Federal funds purchased and securities loaned or sold under

agreements to repurchase, at their respective carrying values, consisted of

the following:

In millions of dollars 2015 2014

Federal funds purchased $ 189 $ 334

Securities sold under agreements to repurchase 131,650 147,204

Deposits received for securities loaned 14,657 25,900

Total $146,496 $173,438

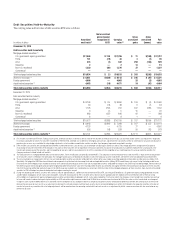

The resale and repurchase agreements represent collateralized financing

transactions. The Company executes these transactions primarily through its

broker-dealer subsidiaries to facilitate customer matched-book activity and

to efficiently fund a portion of the Company’s trading inventory. Transactions

executed by the Company’s bank subsidiaries primarily facilitate customer

financing activity.

To maintain reliable funding under a wide range of market conditions,

including under periods of stress, Citi manages these activities by taking

into consideration the quality of the underlying collateral, and stipulating

financing tenor. Citi manages the risks in its collateralized financing

transactions by conducting daily stress tests to account for changes in

capacity, tenors, haircut, collateral profile and client actions. Additionally,

Citi maintains counterparty diversification by establishing concentration

triggers and assessing counterparty reliability and stability under stress.

It is the Company’s policy to take possession of the underlying collateral,

monitor its market value relative to the amounts due under the agreements

and, when necessary, require prompt transfer of additional collateral in

order to maintain contractual margin protection. For resale and repurchase

agreements, when necessary, the Company posts additional collateral in order

to maintain contractual margin protection.

Collateral typically consists of government and government-agency

securities, corporate and municipal bonds, equities, and mortgage-backed

and other asset-backed securities.

The resale and repurchase agreements are generally documented

under industry standard agreements that allow the prompt close-out of all

transactions (including the liquidation of securities held) and the offsetting

of obligations to return cash or securities by the non-defaulting party,

following a payment default or other type of default under the relevant

master agreement. Events of default generally include (i) failure to deliver

cash or securities as required under the transaction, (ii) failure to provide

or return cash or securities as used for margining purposes, (iii) breach

of representation, (iv) cross-default to another transaction entered into

among the parties, or, in some cases, their affiliates, and (v) a repudiation

of obligations under the agreement. The counterparty that receives the

securities in these transactions is generally unrestricted in its use of the

securities, with the exception of transactions executed on a tri-party basis,

where the collateral is maintained by a custodian and operational limitations

may restrict its use of the securities.

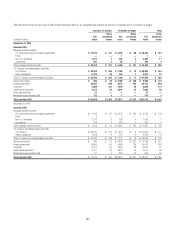

A substantial portion of the resale and repurchase agreements is

recorded at fair value, as described in Notes 25 and 26 to the Consolidated

Financial Statements. The remaining portion is carried at the amount of

cash initially advanced or received, plus accrued interest, as specified in the

respective agreements.

The securities borrowing and lending agreements also represent

collateralized financing transactions similar to the resale and repurchase

agreements. Collateral typically consists of government and government-

agency securities and corporate debt and equity securities.

Similar to the resale and repurchase agreements, securities borrowing

and lending agreements are generally documented under industry standard

agreements that allow the prompt close-out of all transactions (including

the liquidation of securities held) and the offsetting of obligations to return

cash or securities by the non-defaulting party, following a payment default

or other default by the other party under the relevant master agreement.

Events of default and rights to use securities under the securities borrowing

and lending agreements are similar to the resale and repurchase agreements

referenced above.

A substantial portion of securities borrowing and lending agreements is

recorded at the amount of cash advanced or received. The remaining portion

is recorded at fair value as the Company elected the fair value option for

certain securities borrowed and loaned portfolios, as described in Note 26

to the Consolidated Financial Statements. With respect to securities loaned,

the Company receives cash collateral in an amount generally in excess

of the market value of the securities loaned. The Company monitors the

market value of securities borrowed and securities loaned on a daily basis

and obtains or posts additional collateral in order to maintain contractual

margin protection.

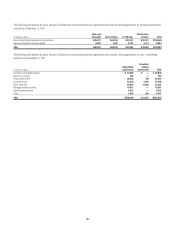

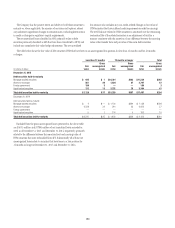

The enforceability of offsetting rights incorporated in the master netting

agreements for resale and repurchase agreements and securities borrowing

and lending agreements is evidenced to the extent that a supportive legal

opinion has been obtained from counsel of recognized standing that

provides the requisite level of certainty regarding the enforceability of these