Citibank 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

The accounting treatment for realization of DTAs, including FTCs, is

complex and requires significant judgment and estimates regarding future

taxable earnings in the jurisdictions in which the DTAs arise and available

tax planning strategies. Citi’s ability to utilize its DTAs, including the

FTC components, and thus use the capital supporting the DTAs for more

productive purposes, will be dependent upon Citi’s ability to generate U.S.

taxable income in the relevant tax carry-forward periods. Failure to realize

any portion of the DTAs would also have a corresponding negative impact on

Citi’s net income.

In addition, with regard to FTCs, utilization will be influenced by

actions to optimize U.S. taxable earnings for the purpose of consuming the

FTC carry-forward component of the DTAs prior to expiration. These FTC

actions, however, may serve to increase the DTAs for other less time sensitive

components. Moreover, tax return limitations on FTCs and general business

credits that cause Citi to incur current tax expense, notwithstanding its tax

carry-forward position, could impact the rate of overall DTA utilization. DTA

utilization will also continue to be driven by movements in Citi’s AOCI, which

can be impacted by changes in interest rates and foreign exchange rates.

For additional information on Citi’s DTAs, including the FTCs, see

“Significant Accounting Policies and Significant Estimates—Income Taxes”

below and Note 9 to the Consolidated Financial Statements.

Citi’s Interpretation or Application of the Extensive Tax

Laws to Which It Is Subject Could Differ from Those of the

Relevant Governmental Authorities, Which Could Result in

the Payment of Additional Taxes, Penalties or Interest.

Citi is subject to the various tax laws of the U.S. and its states and

municipalities, as well as the numerous foreign jurisdictions in which

it operates. These tax laws are inherently complex and Citi must make

judgments and interpretations about the application of these laws to its

entities, operations and businesses. Citi’s interpretations and application

of the tax laws, including with respect to withholding tax obligations and

stamp and other transactional taxes, could differ from that of the relevant

governmental taxing authority, which could result in the potential for the

payment of additional taxes, penalties or interest, which could be material.

The Value of Citi’s DTAs Could Be Significantly Reduced

if Corporate Tax Rates in the U.S. or Certain State, Local

or Foreign Jurisdictions Decline or as a Result of Other

Changes in the U.S. Corporate Tax System.

There have been discussions regarding decreasing the U.S. federal corporate

tax rate. Similar discussions have taken place in certain local, state and

foreign jurisdictions. While Citi may benefit in some respects from any

decrease in corporate tax rates, a reduction in the U.S. federal, or state, local

or foreign corporate tax rates could result in a decrease, perhaps significant,

in the value of Citi’s DTAs, which would result in a reduction to Citi’s net

income during the period in which the change is enacted. There have also

been recent discussions of more sweeping changes to the U.S. tax system. It

is uncertain whether or when any such tax reform proposals will be enacted

into law, and whether or how they will affect Citi’s DTAs.

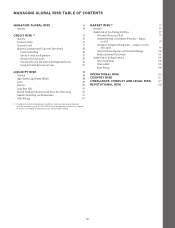

If Citi’s Risk Models Are Ineffective or Require Modification

or Enhancement, Citi Could Incur Significant Losses

or Its Regulatory Capital and Capital Ratios Could Be

Negatively Impacted.

Citi utilizes models extensively as part of its risk management and mitigation

strategies, including in analyzing and monitoring the various risks Citi

assumes in conducting its activities. For example, Citi uses models as part of

its various stress testing initiatives across the firm. Management of these risks

is made even more challenging within a global financial institution such as

Citi, particularly given the complex, diverse and rapidly changing financial

markets and conditions in which Citi operates.

These models and strategies are inherently limited because they involve

techniques, including the use of historical data in many circumstances, and

judgments that cannot anticipate every economic and financial outcome

in the markets in which Citi operates, nor can they anticipate the specifics

and timing of such outcomes. Citi could incur significant losses if its risk

management models or strategies are ineffective in properly anticipating or

managing these risks.

Moreover, Citi’s Basel III regulatory capital models, including its

credit, market and operational risk models, continue to be subject to

ongoing regulatory review and approval, which may result in refinements,

modifications or enhancements (required or otherwise) to these models.

Modifications or requirements resulting from these ongoing reviews, as well

as any future changes or guidance provided by the U.S. banking agencies

regarding the regulatory capital framework applicable to Citi, have resulted

in, and could continue to result in, significant changes to Citi’s risk-weighted

assets, total leverage exposure or other components of Citi’s capital ratios.

These changes can negatively impact Citi’s capital ratios and its ability to

achieve its regulatory capital requirements as it projects or as required.

Citi Must Continually Pursue Expense Management and Its

Investments in Its Businesses May Not Be as Successful as

Citi Projects or Expects.

Citi continues to pursue its disciplined expense management strategy,

including ongoing repositioning and efficiency targets. However, there is no

guarantee that Citi will be able to maintain or reduce its level of expenses

as a result of its repositioning actions, efficiency initiatives or otherwise.

Moreover, Citi’s ability to maintain or reduce its expenses in part depends

on factors which it cannot control, such as ongoing regulatory changes,

continued higher regulatory and compliance costs, legal and regulatory

proceedings and inquiries and macroeconomic conditions, among others.

In addition, investments Citi has made, or may make, in its businesses or

operations, such as those in technology systems or in its U.S. credit card

businesses, may not be as productive or effective as Citi expects or at all.