Citibank 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

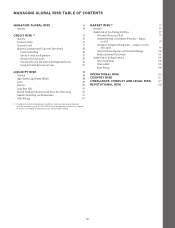

RISK FACTORS

The following discussion sets forth what management currently believes

could be the most significant risks and uncertainties that could impact

Citi’s businesses, results of operations and financial condition. Other

risks and uncertainties, including those not currently known to Citi or

its management, could also negatively impact Citi’s businesses, results

of operations and financial condition. Thus, the following should not be

considered a complete discussion of all of the risks and uncertainties Citi

may face.

REGULATORY RISKS

Citi’s Inability to Enhance Its 2015 Resolution Plan

Submission Could Subject It to More Stringent Capital,

Leverage or Liquidity Requirements, or Restrictions on Its

Growth, Activities or Operations, and Could Eventually

Require Citi to Divest Assets or Operations.

Title I of the Dodd-Frank Act requires Citi to annually prepare and submit

a plan to the Federal Reserve Board and the FDIC for the orderly resolution

of Citigroup (the bank holding company), and its significant legal entities,

under the U.S. Bankruptcy Code or other applicable insolvency law in the

event of future material financial distress or failure (Title I Resolution

Plan). The Title I Resolution Plan requires significant effort, time and cost

across all of Citi’s businesses and geographies, and is subject to review by the

Federal Reserve Board and the FDIC.

Under Title I, if the Federal Reserve Board and the FDIC jointly determine

that Citi’s 2015 Title I Resolution Plan is not “credible” (which, although not

defined, is generally believed to mean the regulators do not believe the plan

is feasible or would otherwise allow the regulators to resolve Citi in a way that

protects systemically important functions without severe systemic disruption),

or would not facilitate an orderly resolution of Citi under the U.S. Bankruptcy

Code, and Citi fails to resubmit a resolution plan that remedies any identified

deficiencies, Citi could be subjected to more stringent capital, leverage or

liquidity requirements, or restrictions on its growth, activities or operations. If

within two years from the imposition of any requirements or restrictions Citi

has still not remediated any identified deficiencies, then Citi could eventually

be required to divest certain assets or operations. Any such restrictions or

actions would negatively impact Citi’s reputation, market and investor

perception, operations and strategy.

In August 2014, the Federal Reserve Board and the FDIC announced the

completion of reviews of the 2013 Title I Resolution Plans submitted by Citi

and 10 other financial institutions. The agencies identified shortcomings

with the firms’ 2013 Title I Resolution Plans, including Citi’s. These

shortcomings generally included (i) assumptions that the agencies regarded

as unrealistic or inadequately supported, such as assumptions about the

likely behavior of customers, counterparties, investors, central clearing

facilities and regulators; and (ii) the failure to make, or identify, the kinds of

changes in firm structure and practices that would be necessary to enhance

the prospects for orderly resolution. Significantly, the FDIC determined that

the 2013 Title I Resolution Plans submitted by the 11 institutions, including

Citi, were “not credible” and did not facilitate an orderly resolution under the

U.S. Bankruptcy Code. The Federal Reserve Board determined that the plans

of the 11 institutions were required to take immediate action to improve

their resolvability and reflect those improvements in their 2015 plans. At

the same time, the Federal Reserve Board and FDIC indicated that if the

identified shortcomings were not addressed in the 2015 Title I Resolution

Plan submissions, the agencies expected to use their authority under Title I,

as discussed above. Like other similarly-situated institutions, Citi submitted

its 2015 Title I Resolution Plan on July 1, 2015 and the industry has not yet

received a formal response from the regulators.

Citi’s Ability to Return Capital to Shareholders

Substantially Depends on the CCAR Process and the

Results of Regulatory Stress Tests.

In addition to Board of Directors’ approval, any decision by Citi to return

capital to shareholders, whether through an increase in its common stock

dividend or through a share repurchase program, substantially depends

on regulatory approval, including through the CCAR process required by

the Federal Reserve Board and the supervisory stress tests required under

the Dodd-Frank Act. In March 2014, the Federal Reserve Board announced

that it objected to the capital plan submitted by Citi as part of the 2014

CCAR process, meaning Citi was not able to increase its return of capital to

shareholders as it had requested. Restrictions on Citi’s ability to return capital

to shareholders as a result of the 2014 CCAR process negatively impacted

market and investor perceptions of Citi, and continued restrictions could do

so in the future.

Citi’s ability to accurately predict or explain to stakeholders the outcome

of the CCAR process, and thus address any such market or investor

perceptions, is difficult as the Federal Reserve Board’s assessment of Citi is

conducted not only by using the Board’s proprietary stress test models, but

also a number of qualitative factors, including a detailed assessment of

Citi’s “capital adequacy process,” as defined by the Federal Reserve Board.

These qualitative factors were cited by the Federal Reserve Board in its

objection to Citi’s 2014 capital plan, and the Board has stated that it expects

leading capital adequacy practices will continue to evolve and will likely

be determined by the Board each year as a result of its cross-firm review of

capital plan submissions.

Similarly, the Federal Reserve Board has indicated that, as part of its stated

goal to continually evolve its annual stress testing requirements, several

parameters of the annual stress testing process may be altered from time to

time, including the severity of the stress test scenario, Federal Reserve Board

modeling of Citi’s balance sheet and the addition of components deemed

important by the Federal Reserve Board (e.g., a counterparty failure). In

addition, the Federal Reserve Board indicated that it may consider that some

or all of Citi’s GSIB surcharge be integrated into its post-stress test minimum

capital requirements. These parameter and other alterations could further

increase the level of capital Citi must meet as part of the stress tests, thus

potentially impacting the level of capital returns to shareholders.