Citibank 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• As a testament to Citi’s commitment

to provide clients with a consistent,

full-service product offering in more

than 100 countries, International

Financing Review (IFR) named Citi the

top Global Emerging Markets Bond

capital markets intelligence and services

across all product lines. Through web,

mobile and trading applications, clients

can find Citi research, commentary,

and proprietary data and analytics;

execute fast, seamless and stable foreign

exchange and rates trades; and utilize

Citi’s suite of sophisticated, post-trade

analysis tools.

Private Banking

Citi operates one of the world’s leading

global private banks, whose teamwork,

commitment to service, and ability to

see and seize opportunities for clients

set it apart. Our 800 private bankers and

product specialists, located in 51 offices

in 16 countries, act as trusted advisors to

many of the world’s most successful and

influential individuals and families.

Citi’s comprehensive services are

tailored to individuals and families,

including entrepreneurs and business

owners, single- and multi-family offices,

senior corporate executives, next-

generation/inherited wealth, law firms

and attorneys. Through banking and

cash management to lending, investment

strategies, and trust and wealth advisory

services, Citi’s goal is to deliver expertise

and a premier level of service while

helping grow, manage and preserve

wealth. As Citi partners with clients, it

can provide global thinking informed by

deep local insight and can help deliver

the complete financial management

strategies that today’s wealth requires.

Treasury and Trade Solutions

Citi’s Treasury and Trade Solutions

(TTS) business provides integrated

cash management and trade finance

services to multinational corporations,

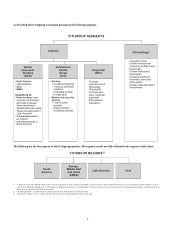

Institutional

Clients Group

Capital Partners. Citi also served as a

financial advisor to Baxter International

on the spin-off of its $20 billion

biopharmaceuticals business, Baxalta.

The spin-off created two separate

global health care companies: Baxter,

which will focus on lifesaving medical

products; and Baxalta, which will focus

on developing and marketing innovative

biopharmaceuticals.

Markets and Securities Services

Citi’s Markets and Securities Services

business provides world-class financial

products and services as diverse as the

needs of the thousands of corporations,

institutions, governments and investors

that Citi serves. Citi works to enrich the

relationships, products and technology

that define its market-making presence.

The breadth, depth and strength of

Citi’s sales and trading, distribution

and research capabilities span a broad

range of asset classes, currencies,

sectors and products, including equities,

commodities, credit, futures, foreign

exchange (FX), emerging markets,

G10 rates, municipals, prime finance

and securitized markets. Our Investor

Services and Direct Custody and Clearing

businesses provide customized solutions

that support the diverse investment and

transaction strategies of investors and

intermediaries worldwide.

The Citi VelocitySM platform delivers

electronic access to Citi’s global

footprint and real-time information,

giving clients unprecedented access to

House and Global Loan House. IFR and

Risk Magazine both named Citi the top

Global Derivatives House and Global

Credit Derivatives House. IFR cited

Citi for “taking advantage of being

ahead of the curve, and cementing

its position as a global full-service

provider” amid increasing regulatory

pressures that are causing banks

to restructure their businesses. IFR

also noted Citi’s “solid shape” and

“superior capital position” as new

regulations kicked in during 2015.

• Following a steady improvement in

performance over the past several

years, Citi secured Greenwich

Associates’ #1 ranking in Global Fixed

2015 Highlights

financial institutions and public sector

organizations across the globe. With the

industry’s most comprehensive suite

of digital-enabled platforms, tools and

analytics, TTS leads the way in delivering

innovative and tailored solutions to our

clients. Offerings include payments,

receivables, liquidity management and

investment services, working capital

solutions, commercial card programs and

trade finance.

Based on the belief that client

experience is the driver of sustainable

differentiation, TTS has focused its

efforts on transforming its business to

deliver a seamless, end-to-end client

experience through the development

of its capabilities, client advocacy,

network management and service

delivery across the entire organization.

New client mandates cemented

Citi’s position as leading provider for

multinational corporations seeking

full-scale regional cash management

solutions across regions and globally.

Shell appointed Citi TTS as its sole

bank provider for cash management

services across 16 countries in Europe.

Samsung Electronics selected Citi to

implement a global renminbi (RMB)

netting solution, conducting the world’s

first intercompany cross-border netting

transaction using RMB.

Following the successful launch of the

same service in the U.S., Citi® Payment

Exchange was introduced in Canada.

Payment Exchange is an integrated and

highly flexible institutional payment-

processing solution used in making

payments to suppliers and third parties.

12