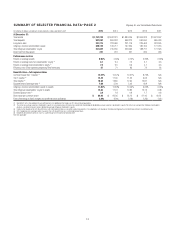

Citibank 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

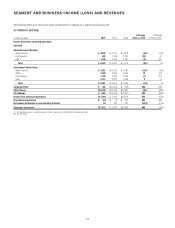

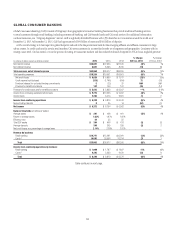

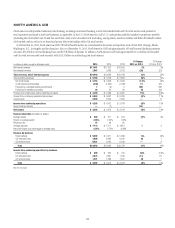

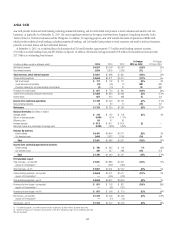

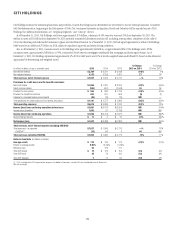

2015 vs. 2014

Net income decreased by 4% due to lower loan loss reserve releases and lower

revenues, partially offset by lower expenses and lower net credit losses.

Revenues decreased 1%, reflecting lower revenues in Citi-branded cards,

partially offset by higher revenues in retail banking.

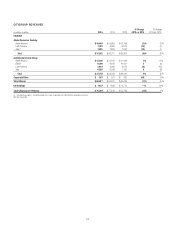

Retail banking revenues increased 6%. The increase was primarily

driven by 7% growth in average loans, 9% growth in average checking

deposits, improved deposit spreads and slightly higher mortgage origination

revenues, partially offset by lower net gains on branch sales (approximately

$40 million) and mortgage portfolio sales (approximately $80 million)

as well as a lower mortgage repurchase reserve release (approximately

$50 million) compared to 2014. This growth in retail banking revenues

occurred despite the fact that, consistent with GCB’s strategy, during 2015,

North America GCB closed or sold 69 branches (a 9% decline from the prior

year), with announced plans to sell or close an additional 50 branches in the

first quarter of 2016. With these actions, over 90% of North America GCB’s

retail banking footprint will be concentrated in its six key metropolitan areas.

Cards revenues decreased 3% due to a 2% decline in average loans,

partially offset by a 4% increase in purchase sales. In Citi-branded cards,

revenues decreased 6%, primarily reflecting an increase in acquisition and

rewards costs, particularly during the second half of 2015 as North America

GCB deployed its investment spending (as discussed below) to grow its new

account acquisitions in its core products. North America GCB expects the

increased acquisition and rewards costs within Citi-branded cards to continue

to negatively impact revenues in 2016. The decrease in Citi-branded cards

revenues was also due to the continued impact of lower average loans (down

4%), driven primarily by continued high customer payment rates during the

year, partially offset by a 6% increase in purchase sales.

Citi retail services revenues were largely unchanged as the continued

impact of lower fuel prices, which negatively impacts purchase sales in the

fuel portfolios, and higher contractual partner payments was offset by the

impact of higher spreads and volumes (1% increase in average loans). The

higher contractual partner payments resulted from the business sharing the

benefits of higher yields and lower net credit losses with its retail partners.

Purchase sales were unchanged as the continued impact of lower fuel prices

was offset by volume growth. North America GCB expects the negative

impact of lower fuel prices on Citi retail services revenues to continue in the

near term.

Expenses decreased 5%, primarily due to ongoing cost reduction

initiatives, including as a result of the branch rationalization strategy, and

lower repositioning charges, partially offset by increased investment spending

(including marketing, among other areas) in Citi-branded cards, which is

expected to continue into 2016.

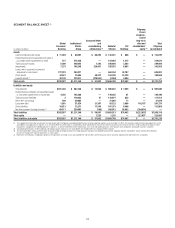

Provisions increased 15% largely due to lower net loan loss reserve

releases (73%), partially offset by lower net credit losses (11%). Net credit

losses declined in Citi-branded cards (down 14% to $1.9 billion) and in Citi

retail services (down 8% to $1.7 billion). The lower loan loss reserve release

reflected overall credit stabilization in the cards portfolios during 2015. As a

result of this stabilization, North America GCB expects to experience modest

loan loss reserve builds during 2016.

In addition to the trends discussed above expected to impact North

America GCB’s results of operations in 2016, North America GCB expects

to make additional investments in its U.S. cards businesses during 2016,

including investments in connection with Citi’s planned acquisition of

the Costco portfolio, the closing of which is currently expected to occur

mid-2016, as well as the expected impact of renewing certain important

partnership programs in a competitive environment (see also “Risk

Factors—Operational Risks” below). While North America GCB believes

these investments are necessary for the growth of its U.S. cards businesses,

they will reduce the pretax earnings of the businesses during 2016.

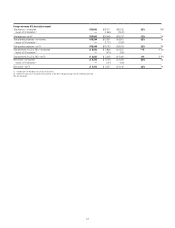

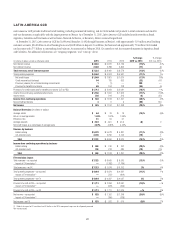

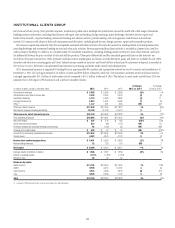

2014 vs. 2013

Net income increased by 13% due to lower net credit losses, higher loan loss

reserve releases and lower expenses, partially offset by lower revenues.

Revenues decreased 1%, with lower revenues in retail banking, partially

offset by higher revenues in Citi-branded cards and Citi retail services.

Retail banking revenues of $4.9 billion decreased 9% due to lower mortgage

origination revenues and spread compression in the deposit portfolios,

partially offset by continued volume-related growth (average loans increased

9% and average deposits increased 3%) and gains from branch sales.

Cards revenues increased 2% as average loans increased 3% versus 2013.

In Citi-branded cards, revenues increased 1% as a 4% increase in purchase

sales and higher net interest spreads, driven by the continued reduction of

promotional balances in the portfolio, mostly offset lower average loans.

The decline in average loans was driven primarily by the reduction in

promotional balances, and to a lesser extent, increased customer payment

rates during the year.

Citi retail services revenues increased 4%, primarily due to a 12% increase

in average loans driven by the Best Buy acquisition in September 2013,

partially offset by continued declines in fee revenues primarily reflecting

higher yields and improving credit and the resulting increase in contractual

partner payments. Citi retail services revenues also benefited from lower

funding costs, partially offset by a decline in net interest spreads due to a

higher percentage of promotional balances within the portfolio.

Expenses decreased 1% as ongoing cost reduction initiatives were partially

offset by higher repositioning charges, increased investment spending and

an increase in Citi retail services expenses due to the impact of the Best Buy

portfolio acquisition.

Provisions decreased 18% due to lower net credit losses (9%) and higher

loan loss reserve releases (21%). Net credit losses declined in Citi-branded

cards (down 14% to $2.2 billion) and in Citi retail services (down 2% to

$1.9 billion). The loan loss reserve release increased due to the continued

improvement in Citi-branded cards, partially offset by a lower loan loss

reserve release in Citi retail services due to reserve builds for new loans

originated in the Best Buy portfolio.