PNC Bank 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.derecognition of a foreign entity, subsidiary or a group of

assets within a foreign entity and in step acquisitions.

Specifically, 1) Upon deconsolidation or derecognition of a

foreign entity, CTA would be released; 2) Upon sale of a

subsidiary or a group of assets within a foreign entity, CTA

would not be released, unless it also represents the complete

or substantially complete liquidation of the foreign entity in

which it resides; and 3) In a step acquisition, the AOCI related

to the previously held investment would be included in the

calculation of gain or loss upon change in control. The

proposed standard would be applied prospectively from the

date of adoption with early adoption permitted. An effective

date has not yet been determined. We are evaluating the

impact of this proposal on our financial statements.

In July 2012, the FASB issued Proposed ASU Liabilities

(Topic 405): Obligations Resulting from Joint and Several

Liability Arrangements. This exposure draft would require an

entity to measure obligations resulting from joint and several

liability arrangements for which the total amount under the

arrangement is fixed at the reporting date per ASC 450-20,

Contingencies—Loss Contingencies. This exposure draft

would also require an entity to disclose the nature and amount

of the obligation as well as information about the risks that

such obligations pose to an entity’s future cash flows. If the

primary role of a reporting entity in the joint and several

liability arrangement is that of a guarantor, then it should

account for the obligation under ASC 460, Guarantees. This

guidance would be applied retrospectively to all prior periods

presented for those obligations resulting from joint and several

liability arrangements that exist at the beginning of an entity’s

fiscal year of adoption. The effective date has not yet been

determined. The comment period ended September 20, 2012.

We are evaluating the impact of this proposal on our financial

statements.

Recent Accounting Pronouncements

See Note 1 Accounting Policies in the Notes To the

Consolidated Financial Statements in Item 8 of this Report

regarding the impact of new accounting pronouncements.

S

TATUS

O

F

Q

UALIFIED

D

EFINED

B

ENEFIT

P

ENSION

P

LAN

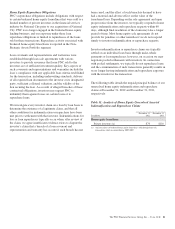

We have a noncontributory, qualified defined benefit pension

plan (plan or pension plan) covering eligible employees.

Benefits are determined using a cash balance formula where

earnings credits are applied as a percentage of eligible

compensation. Pension contributions are based on an

actuarially determined amount necessary to fund total benefits

payable to plan participants. Consistent with our investment

strategy, plan assets are primarily invested in equity

investments and fixed income instruments. Plan fiduciaries

determine and review the plan’s investment policy, which is

described more fully in Note 15 Employee Benefit Plans in

the Notes To Consolidated Financial Statements in Item 8 of

this Report.

We calculate the expense associated with the pension plan and

the assumptions and methods that we use include a policy of

reflecting trust assets at their fair market value. On an annual

basis, we review the actuarial assumptions related to the

pension plan. The primary assumptions used to measure

pension obligations and costs are the discount rate,

compensation increase and expected long-term return on

assets. Among these, the compensation increase assumption

does not significantly affect pension expense.

The discount rate used to measure pension obligations is

determined by comparing the expected future benefits that

will be paid under the plan with yields available on high

quality corporate bonds of similar duration. The impact on

pension expense of a 0.5% decrease in discount rate in the

current environment is $21 million per year. In contrast, the

sensitivity to the same change in discount rate in a higher

interest rate environment is less significant.

The expected long-term return on assets assumption also has a

significant effect on pension expense. The expected return on

plan assets is a long-term assumption established by

considering historical and anticipated returns of the asset

classes invested in by the pension plan and the asset allocation

policy currently in place. For purposes of setting and

reviewing this assumption, “long term” refers to the period

over which the plan’s projected benefit obligations will be

disbursed. We review this assumption at each measurement

date and adjust it if warranted. Our selection process

references certain historical data and the current environment,

but primarily utilizes qualitative judgment regarding future

return expectations. Accordingly, we generally do not change

the assumption unless we modify our investment strategy or

identify events that would alter our expectations of future

returns.

To evaluate the continued reasonableness of our assumption,

we examine a variety of viewpoints and data. Various studies

have shown that portfolios comprised primarily of U.S. equity

76 The PNC Financial Services Group, Inc. – Form 10-K