PNC Bank 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

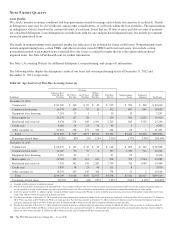

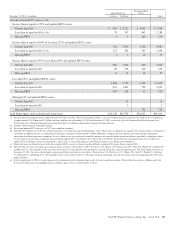

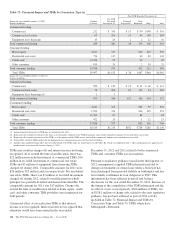

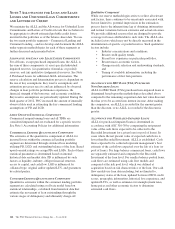

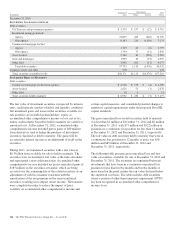

Table 72: Financial Impact and TDRs by Concession Type (a)

Post-TDR Recorded Investment (c)

During the year ended December 31, 2012

Dollars in millions

Number

of Loans

Pre-TDR

Recorded

Investment (b)

Principal

Forgiveness

Rate

Reduction Other Total

Commercial lending

Commercial 212 $ 355 $ 13 $ 90 $198 $ 301

Commercial real estate 67 201 23 43 118 184

Equipment lease financing 10 24 2 2 12 16

Total commercial lending 289 580 38 135 328 501

Consumer lending

Home equity 4,813 313 200 110 310

Residential real estate 754 147 60 83 143

Credit card 13,306 93 90 90

Other consumer 835 20 2 19 21

Total consumer lending 19,708 573 352 212 564

Total TDRs 19,997 $1,153 $ 38 $487 $540 $1,065

During the year ended December 31, 2011 (e)

Dollars in millions

Commercial lending

Commercial 599 $ 129 $ 19 $ 33 $ 60 $ 112

Commercial real estate 78 286 83 123 54 260

Equipment lease financing (d) 2 1

Total commercial lending 679 416 102 156 114 372

Consumer lending

Home equity 4,013 321 281 39 320

Residential real estate 1,590 376 236 115 351

Credit card 11,761 87 84 84

Other consumer 472 13 1 12 13

Total consumer lending 17,836 797 602 166 768

Total TDRs 18,515 $1,213 $102 $758 $280 $1,140

(a) Impact of partial charge-offs at TDR date are included in this table.

(b) Represents the recorded investment of the loans as of the quarter end prior to the TDR designation, and excludes immaterial amounts of accrued interest receivable.

(c) Represents the recorded investment of the TDRs as of the quarter end the TDR occurs, and excludes immaterial amounts of accrued interest receivable.

(d) During 2011, the Post-TDR amounts for the Equipment lease financing loan class total less than $1 million.

(e) Includes loans modified during 2011 that were determined to be TDRs under the requirements of ASU 2011-02, which was adopted on July 1, 2011 and prospectively applied to all

modifications entered into on and after January 1, 2011.

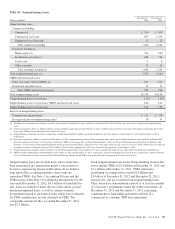

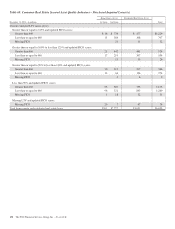

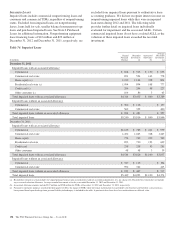

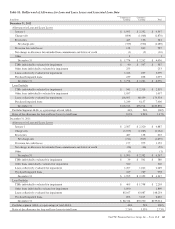

TDRs may result in charge-offs and interest income not being

recognized. At or around the time of modification, there was

$22 million in recorded investment of commercial TDRs, $10

million in recorded investment of commercial real estate

TDRs and $5 million of equipment lease financing TDRs

charged off during 2012. Comparable amounts for 2011 were

$26 million, $15 million and zero respectively. For residential

real estate TDRs, there was $7 million of recorded investment

charged off during 2012, related to modifications in which

principal was partially deferred and deemed uncollectible. The

comparable amount for 2011 was $17 million. Charge-offs

around the time of modification related to home equity, credit

card, and other consumer TDR portfolios were immaterial for

both periods.

A financial effect of rate reduction TDRs is that interest

income is not recognized. Interest income not recognized that

otherwise would have been earned in the year ended

December 31, 2012 and 2011 related to both commercial

TDRs and consumer TDRs was not material.

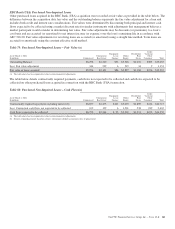

Pursuant to regulatory guidance issued in the third quarter of

2012, management compiled TDR information related to

changes in treatment of certain loans where a borrower has

been discharged from personal liability in bankruptcy and has

not formally reaffirmed its loan obligation to PNC. This

information has been reflected in period end balance

disclosures for the year ended December 31, 2012. Because of

the timing of the compilation of the TDR information and the

fact that it covers several periods, $366 million of TDRs, net

of $128.1 million of charge-offs, related to this new regulatory

guidance, has not been reflected as part of 2012 activity

included in Table 72: Financial Impact and TDRs by

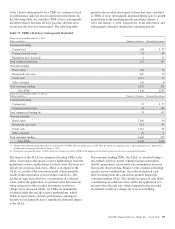

Concession Type and Table 73: TDRs which have

Subsequently Defaulted.

156 The PNC Financial Services Group, Inc. – Form 10-K