PNC Bank 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

APITAL

We manage our capital position by making adjustments to our

balance sheet size and composition, issuing debt, equity or

other capital instruments, executing treasury stock transactions

and capital redemptions, managing dividend policies and

retaining earnings.

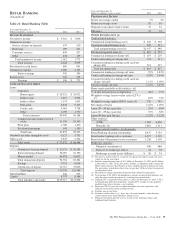

Total shareholders’ equity increased $5.0 billion, to $39.0

billion at December 31, 2012 compared with December 31,

2011, reflecting an increase in retained earnings of $2.0 billion

and the issuance of $480 million of preferred stock in

September and October 2012 and $1.5 billion in April 2012.

This contributed to the increase in capital surplus – preferred

stock from $1.6 billion at December 31, 2011 to $3.6 billion at

December 31, 2012. Accumulated other comprehensive

income increased $.9 billion, to $.8 billion, at December 31,

2012 compared with a loss of $.1 billion at December 31,

2011 due to higher net unrealized gains on securities, partially

offset by lower unrealized gains on cash flow hedge

derivatives. Common shares outstanding were 528 million at

December 31, 2012 and 527 million at December 31, 2011.

Our current common stock repurchase program permits us to

purchase up to 25 million shares of PNC common stock on the

open market or in privately negotiated transactions. This

program will remain in effect until fully utilized or until

modified, superseded or terminated. The extent and timing of

share repurchases under this program will depend on a number

of factors including, among others, market and general

economic conditions, economic and regulatory capital

considerations, alternative uses of capital, and the potential

impact on our credit ratings. Consistent with our capital plan

submitted to the Federal Reserve in the first quarter of 2012,

PNC purchased $190 million of common stock in 2012 under

a $250 million authorization for 2012 as part of its existing

25 million share repurchase program in open market or

privately negotiated transactions. During 2013, management

does not expect to repurchase any common stock under this

repurchase program. See “Supervision and Regulation” in

Item 1 of this Report for further information concerning

restrictions on dividends and stock repurchases, including the

impact of the Federal Reserve’s current supervisory

assessment of capital adequacy program, which is also

discussed in the Capital and Liquidity Actions portion of the

Executive Summary section of this Item 7.

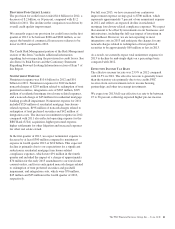

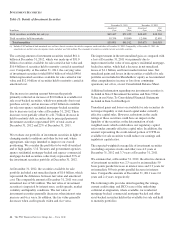

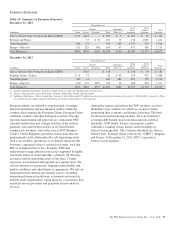

Table 17: Risk-Based Capital

Dollars in millions

December 31

2012

December 31

2011

Capital components

Shareholders’ equity

Common $ 35,413 $ 32,417

Preferred 3,590 1,636

Trust preferred capital securities 331 2,354

Noncontrolling interests 1,354 1,351

Goodwill and other intangible

assets (9,798) (9,027)

Eligible deferred income taxes on

goodwill and other intangible

assets 354 431

Pension, other postretirement

benefit plan adjustments 777 755

Net unrealized securities (gains)/

losses, after-tax (1,052) 41

Net unrealized gains on cash flow

hedge derivatives, after-tax (578) (717)

Other (165) (168)

Tier 1 risk-based capital 30,226 29,073

Subordinated debt 4,735 4,571

Eligible allowance for credit losses 3,273 2,904

Total risk-based capital $ 38,234 $ 36,548

Tier 1 common capital

Tier 1 risk-based capital $ 30,226 $ 29,073

Preferred equity (3,590) (1,636)

Trust preferred capital securities (331) (2,354)

Noncontrolling interests (1,354) (1,351)

Tier 1 common capital $ 24,951 $ 23,732

Assets

Risk-weighted assets, including off-

balance sheet instruments and

market risk equivalent assets $260,847 $230,705

Adjusted average total assets 291,426 261,958

Capital ratios

Tier 1 common 9.6% 10.3%

Tier 1 risk-based 11.6% 12.6%

Total risk-based 14.7% 15.8%

Leverage 10.4% 11.1%

Federal banking regulators have stated that they expect all

bank holding companies to have a level and composition of

Tier 1 capital well in excess of the 4% Basel I regulatory

minimum, and they have required the largest US bank holding

companies, including PNC, to have a capital buffer sufficient

to withstand losses and allow them to meet credit needs of

their customers through estimated stress scenarios. They have

also stated their view that common equity should be the

The PNC Financial Services Group, Inc. – Form 10-K 51