PNC Bank 2012 Annual Report Download - page 120

Download and view the complete annual report

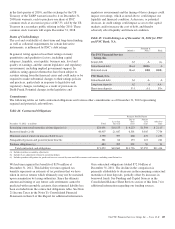

Please find page 120 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition to the customer deposit base, which has

historically provided the single largest source of relatively

stable and low-cost funding, the bank also obtains liquidity

through the issuance of traditional forms of funding including

long-term debt (senior notes and subordinated debt and FHLB

advances) and short-term borrowings (Federal funds

purchased, securities sold under repurchase agreements,

commercial paper issuances, and other short-term

borrowings).

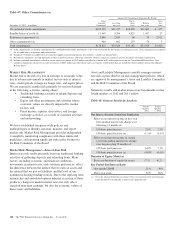

PNC Bank, N.A. is authorized by its board to offer up to $20

billion in senior and subordinated unsecured debt obligations with

maturities of more than nine months. Through December 31,

2012, PNC Bank, N.A. had issued $10.4 billion of debt under this

program, including the following during 2012:

• $100 million of senior bank notes issued March 8,

2012 and due April 8, 2015. Interest is paid semi-

annually at a fixed rate of 1.07%,

• $1.0 billion of senior extendible floating rate bank

notes issued June 20, 2012 with an initial maturity

date of July 20, 2013, subject to the holder’s monthly

option to extend, and a final maturity date of June 20,

2014. Interest is paid at the 3-month LIBOR rate,

reset quarterly, plus a spread of 22.5 basis points,

which spread is subject to four potential one basis

point increases in the event of certain extensions of

maturity by the holder,

• $900 million of senior extendible floating rate bank

notes issued to an affiliate on June 27, 2012 with an

initial maturity date of July 27, 2013, subject to the

holder’s monthly option to extend, and a final

maturity date of April 27, 2014. Interest is paid at the

3-month LIBOR rate, reset quarterly, plus a spread of

22.5 basis points,

• $500 million of senior extendible floating rate bank

notes issued to an affiliate on June 27, 2012 with an

initial maturity date of July 27, 2013, subject to the

holder’s monthly option to extend, and a final

maturity date of January 27, 2014. Interest is paid at

the 3-month LIBOR rate, reset quarterly, plus a

spread of 22.5 basis points, and

• $1.0 billion of subordinated notes issued October 22,

2012 and due November 1, 2022. Interest is paid

semi-annually at a fixed rate of 2.70%.

See Capital and Liquidity Actions in the Executive Summary

section of this Item 7 for additional information regarding our

2013 issuances under this program, which totaled $1.8 billion.

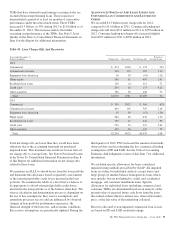

Total senior and subordinated debt increased to $7.6 billion at

December 31, 2012 from $4.1 billion at December 31, 2011

due to issuances.

PNC Bank, N.A. is a member of the FHLB-Pittsburgh and as

such has access to advances from FHLB-Pittsburgh secured

generally by residential mortgage and other mortgage-related

loans. At December 31, 2012, our unused secured borrowing

capacity was $10.5 billion with FHLB-Pittsburgh. Total

FHLB borrowings increased to $9.4 billion at December 31,

2012 from $7.0 billion at December 31, 2011 due to $13.5

billion in new borrowings partially offset by $11.0 billion in

maturities.

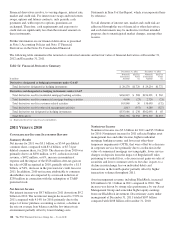

PNC Bank, N.A. has the ability to offer up to $10.0 billion of

its commercial paper to provide additional liquidity. As of

December 31, 2012, there was $2.4 billion outstanding under

this program. Commercial paper on our Consolidated Balance

Sheet also includes $6.1 billion of commercial paper issued by

Market Street Funding LLC, a consolidated VIE.

PNC Bank, N.A. can also borrow from the Federal Reserve

Bank of Cleveland’s (Federal Reserve Bank) discount window

to meet short-term liquidity requirements. The Federal

Reserve Bank, however, is not viewed as the primary means

of funding our routine business activities, but rather as a

potential source of liquidity in a stressed environment or

during a market disruption. These potential borrowings are

secured by securities and commercial loans. At December 31,

2012, our unused secured borrowing capacity was $28.6

billion with the Federal Reserve Bank.

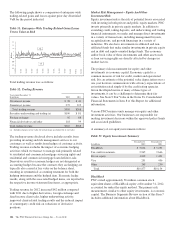

Parent Company Liquidity – Uses

Obligations requiring the use of liquidity can generally be

characterized as either contractual or discretionary. The parent

company’s contractual obligations consist primarily of debt

service related to parent company borrowings and funding

non-bank affiliates. As of December 31, 2012, there were

approximately $300 million of parent company borrowings

with maturities of less than one year.

Additionally, the parent company maintains adequate liquidity

to fund discretionary activities such as paying dividends to

PNC shareholders, share repurchases, and acquisitions. See

the Parent Company Liquidity – Sources section below. In

March 2012, we used approximately $3.6 billion of parent

company cash to acquire both RBC Bank (USA) and a credit

card portfolio from RBC Bank (Georgia), National

Association. Additionally, in June 2012, we used $1.4 billion

of parent company cash to purchase senior extendible floating

rate bank notes issued by PNC Bank, N.A noted above.

See Supervision and Regulation in Item 1 of this Report for

information regarding the Federal Reserve’s CCAR process,

including its impact on our ability to take certain capital

actions, including plans to pay or increase common stock

dividends, reinstate or increase common stock repurchase

programs, or redeem preferred stock or other regulatory

capital instruments.

See Capital and Liquidity Actions in the Executive Summary

section of this Item 7 for additional information regarding our

2012 and 2013 capital activities.

The PNC Financial Services Group, Inc. – Form 10-K 101