PNC Bank 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

R

ESIDENTIAL

M

ORTGAGE

-B

ACKED

S

ECURITIES

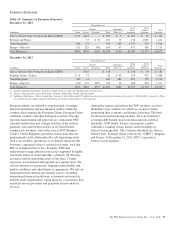

At December 31, 2012, our residential mortgage-backed

securities portfolio was comprised of $31.4 billion fair value

of US government agency-backed securities and $6.1 billion

fair value of non-agency (private issuer) securities. The

agency securities are generally collateralized by 1-4 family,

conforming, fixed-rate residential mortgages.The non-agency

securities are also generally collateralized by 1-4 family

residential mortgages. The mortgage loans underlying the

non-agency securities are generally non-conforming

(i.e., original balances in excess of the amount qualifying for

agency securities) and predominately have interest rates that

are fixed for a period of time, after which the rate adjusts to a

floating rate based upon a contractual spread that is indexed to

a market rate (i.e., a “hybrid ARM”), or interest rates that are

fixed for the term of the loan.

Substantially all of the non-agency securities are senior

tranches in the securitization structure and at origination had

credit protection in the form of credit enhancement, over-

collateralization and/or excess spread accounts.

During 2012, we recorded OTTI credit losses of $99 million

on non-agency residential mortgage-backed securities. All of

the losses were associated with securities rated below

investment grade. As of December 31, 2012, the noncredit

portion of impairment recorded in Accumulated other

comprehensive income for non-agency residential mortgage-

backed securities for which we have recorded an OTTI credit

loss totaled $150 million and the related securities had a fair

value of $3.7 billion.

The fair value of sub-investment grade investment securities

for which we have not recorded an OTTI credit loss as of

December 31, 2012 totaled $1.9 billion, with unrealized net

gains of $114 million.

C

OMMERCIAL

M

ORTGAGE

-B

ACKED

S

ECURITIES

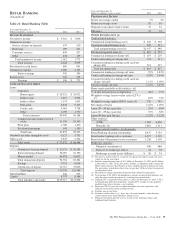

The fair value of the non-agency commercial mortgage-

backed securities portfolio was $5.9 billion at December 31,

2012 and consisted of fixed-rate, private-issuer securities

collateralized by non-residential properties, primarily retail

properties, office buildings, and multi-family housing. The

agency commercial mortgage-backed securities portfolio was

$2.0 billion fair value at December 31, 2012 consisting of

multi-family housing. Substantially all of the securities are the

most senior tranches in the subordination structure.

There were no OTTI credit losses on commercial mortgage-

backed securities during 2012.

A

SSET

-B

ACKED

S

ECURITIES

The fair value of the asset-backed securities portfolio was $6.5

billion at December 31, 2012 and consisted of fixed-rate and

floating-rate, private-issuer securities collateralized primarily

by various consumer credit products, including residential

mortgage loans, credit cards, automobile loans, and student

loans. Substantially all of the securities are senior tranches in

the securitization structure and have credit protection in the

form of credit enhancement, over-collateralization and/or

excess spread accounts.

We recorded OTTI credit losses of $11 million on asset-

backed securities during 2012. All of the securities are

collateralized by first lien and second lien residential

mortgage loans and are rated below investment grade. As of

December 31, 2012, the noncredit portion of impairment

recorded in Accumulated other comprehensive income for

asset-backed securities for which we have recorded an OTTI

credit loss totaled $52 million and the related securities had a

fair value of $603 million.

For the sub-investment grade investment securities (available

for sale and held to maturity) for which we have not recorded

an OTTI loss through December 31, 2012, the fair value was

$47 million, with unrealized net losses of $3 million. The

results of our security-level assessments indicate that we will

recover the cost basis of these securities.

Note 8 Investment Securities in the Notes To Consolidated

Financial Statements in Item 8 of this Report provides

additional information on OTTI losses and further detail

regarding our process for assessing OTTI.

If current housing and economic conditions were to worsen,

and if market volatility and illiquidity were to worsen, or if

market interest rates were to increase appreciably, the

valuation of our investment securities portfolio could be

adversely affected and we could incur additional OTTI credit

losses that would impact our Consolidated Income Statement.

L

OANS

H

ELD FOR

S

ALE

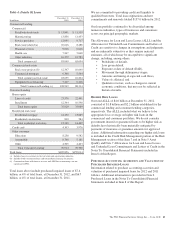

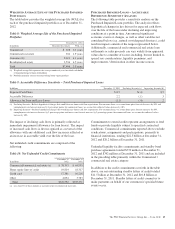

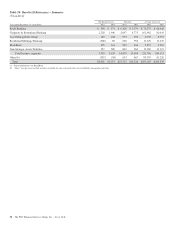

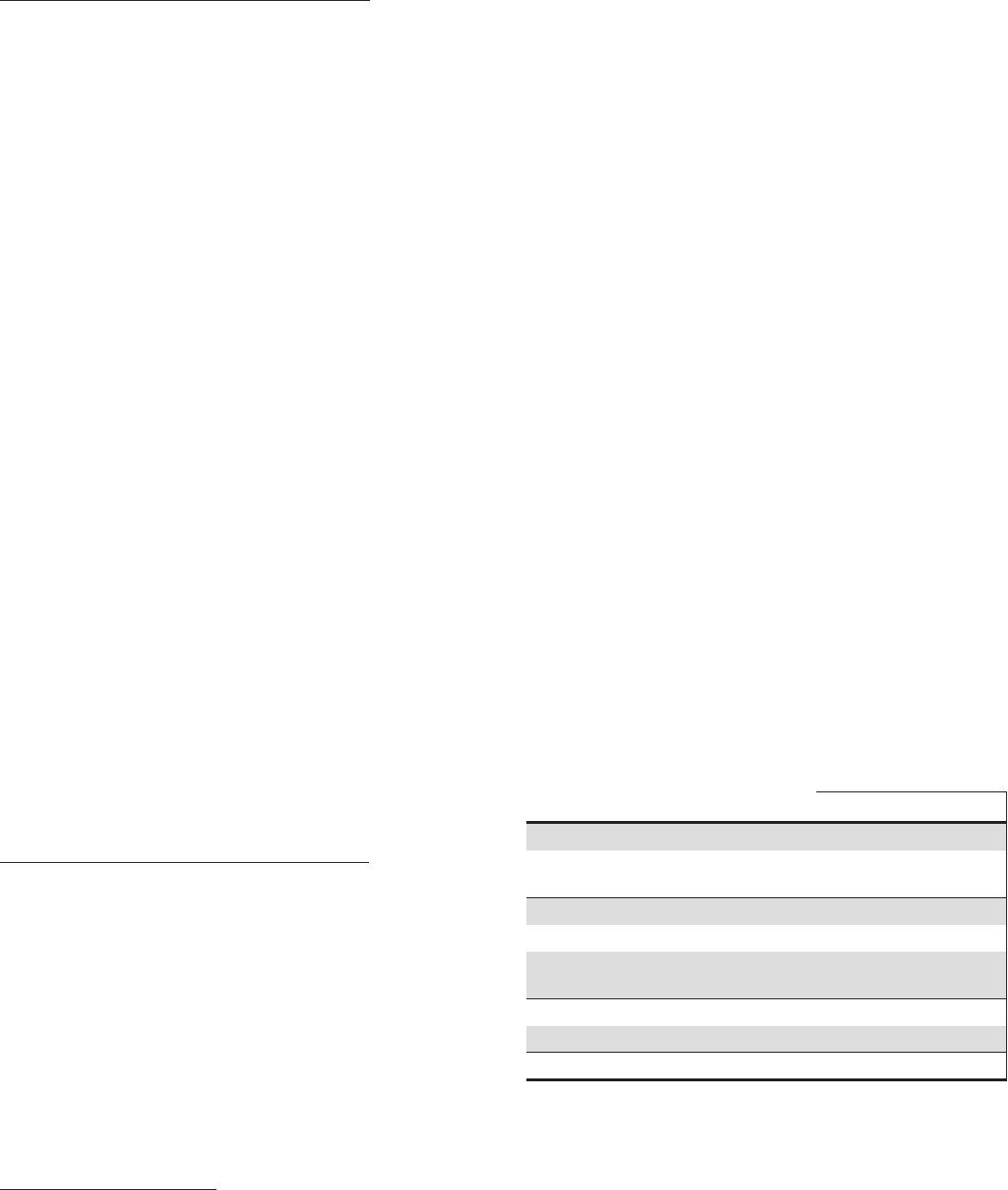

Table 15: Loans Held For Sale

In millions

December 31

2012

December 31

2011

Commercial mortgages at fair value $ 772 $ 843

Commercial mortgages at lower of cost or

market 620 451

Total commercial mortgages 1,392 1,294

Residential mortgages at fair value 2,096 1,415

Residential mortgages at lower of cost or

market 124 107

Total residential mortgages 2,220 1,522

Other 81 120

Total $3,693 $2,936

We stopped originating commercial mortgage loans held for

sale designated at fair value in 2008 and continue pursuing

opportunities to reduce these positions at appropriate prices.

At December 31, 2012, the balance relating to these loans was

$772 million, compared to $843 million at December 31,

2011. We sold $32 million in unpaid principal balances of

these commercial mortgage loans held for sale carried at fair

value in 2012 and sold $25 million in 2011.

The PNC Financial Services Group, Inc. – Form 10-K 49