PNC Bank 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.C

REDIT

Q

UALITY

H

IGHLIGHTS

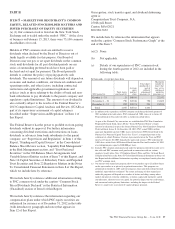

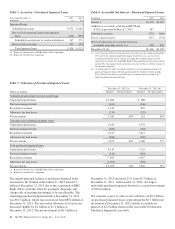

• Overall credit quality improved during 2012.

• Nonperforming assets of $3.8 billion at

December 31, 2012 decreased 9 percent compared to

December 31, 2011. The decrease in nonperforming

assets from December 31, 2011 was primarily

attributable to decreases in commercial real estate

and commercial nonperforming loans. This decrease

was partially offset by the acquisition of RBC Bank

(USA) and higher nonperforming home equity loans

from a change in policy for home equity loans past

due 90 days being placed on nonaccrual status,

compared to a prior policy of past due 180 days.

Additionally, pursuant to regulatory guidance issued

in the third quarter of 2012, nonperforming consumer

loans increased related to changes in treatment of

certain loans classified as TDRs resulting from

bankruptcy. Of these loans, approximately 78% were

current on their payments as of December 31, 2012.

Further detail is included in the Credit Risk

Management portion of the Risk Management section

of this Item 7.

• Accruing loans past due 90 days or more of $2.4

billion at December 31, 2012 decreased $.6 billion,

or 21 percent, from December 31, 2011, primarily

due to a decline in government insured delinquent

residential real estate loans, a decline in delinquent

home equity loans due to a change in policy for home

equity loans past due 90 days being placed on

nonaccrual status, compared to prior policy of past

due 180 days, and a decrease in non government

insured residential real estate loans pursuant to

regulatory guidance issued in the third quarter of

2012 related to changes in treatment of certain loans

classified as TDRs resulting from bankruptcy.

Further detail is included in the Credit Risk

Management portion of the Risk Management section

of this Item 7.

• Net charge-offs of $1.3 billion for 2012 were down

21 percent compared to net charge-offs of $1.6

billion for 2011. The allowance for loan and lease

losses was 2.17% of total loans and 124% of

nonperforming loans at December 31, 2012,

compared with 2.73% and 122% at December 31,

2011, respectively.

B

ALANCE

S

HEET

H

IGHLIGHTS

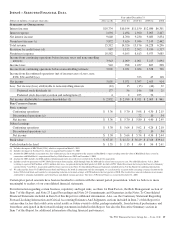

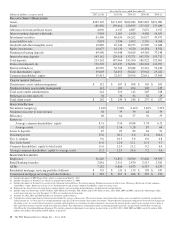

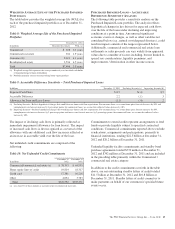

• Total loans increased by $27 billion, or 17 percent, to

$186 billion at December 31, 2012 compared to $159

billion at December 31, 2011.

• Total commercial lending increased by $20.6

billion, or 23 percent, from December 31,

2011, due to strong organic growth and the

impact from the RBC Bank (USA) acquisition.

• Total consumer lending increased $6.2 billion,

or 9 percent, from December 31, 2011

primarily in home equity and automobile loans,

including the impact from the RBC Bank

(USA) acquisition.

• Total deposits were $213 billion at December 31,

2012 compared with $188 billion at December 31,

2011.

• Transaction deposits increased to $177 billion

at December 31, 2012 compared to $148 billion

at December 31, 2011, including the impact

from the RBC Bank (USA) acquisition as well

as organic transaction deposit growth from

increases in both consumer and commercial

liquidity. Transaction deposits were 83%

percent of total deposits at December 31, 2012,

reflecting our strong customer focus and core

strategy to grow checking relationships.

• Retail certificates of deposit declined by $5.7

billion at December 31, 2012 from

December 31, 2011 due to runoff of maturing

accounts.

• As of February 22, 2013, deposits have

declined by approximately 2.7% from the

December 31, 2012 level as a result of seasonal

and normal business activity. Deposit

fluctuations due to the Transaction Account

Guarantee Program’s expiration have not been

significant. Management expects that in the

current interest rate environment, additional

deposit runoff will not be significant.

• PNC’s balance sheet remained core funded with a

loans to deposits ratio of 87 percent at December 31,

2012 and retained a strong bank holding company

liquidity position.

• Trust preferred securities and hybrid capital

securities redeemed in 2012 totaled $2.3 billion with

a weighted average rate of 8.3 percent, effectively

lowering funding costs.

• PNC issued approximately $2 billion of preferred

stock in 2012 with a weighted average rate of 5.9

percent.

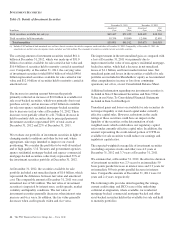

• PNC had strong capital levels at December 31, 2012

with a Tier 1 common capital ratio of 9.6 percent

compared to 10.3 percent at December 31, 2011,

which reflected a decrease of approximately 1.2

percentage points from the acquisition of RBC Bank

(USA), partially offset by retention of earnings.

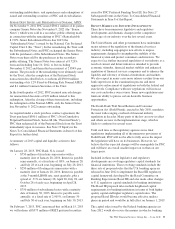

• PNC’s estimated proforma Basel III Tier 1 common

capital ratio was 7.5 percent at December 31, 2012

without benefit of phase-ins, based on current

understanding of Basel III proposed rules, estimates

of Basel II (with proposed modifications) risk-

weighted assets, and application of Basel II.5 rules.

PNC’s goal is to be within a Basel III Tier 1 common

capital ratio range of between 8.0 to 8.5 percent by

year end 2013 without benefit of phase-ins. We

believe we are positioned to reach this goal.

• In April 2012 the PNC board of directors raised the

quarterly cash dividend on common stock to 40 cents

36 The PNC Financial Services Group, Inc. – Form 10-K