PNC Bank 2012 Annual Report Download - page 234

Download and view the complete annual report

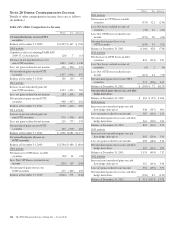

Please find page 234 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.II Securities and the Trust III Securities), these Trust

Securities are automatically exchangeable into shares of PNC

preferred stock (Series I and Series J, respectively) in each

case under certain conditions relating to the capitalization or

the financial condition of PNC Bank, N.A. and upon the

direction of the Office of the Comptroller of the Currency.

The Series preferred stock of PNC REIT Corp. is also

automatically exchangeable under similar conditions into

shares of PNC Series H preferred stock.

As a part of the National City transaction, we established the

PNC Non-Cumulative Perpetual Preferred Stock, Series M

(the Series M Preferred Stock), which mirrored in all material

respects the former National City Non-Cumulative Perpetual

Preferred Stock, Series E. On December 10, 2012, PNC issued

$500.1 million (5,001 shares) of the Series M Preferred Stock

as required under a Stock Purchase Contract Agreement

between PNC and National City Preferred Capital Trust I (the

“Trust”) dated January 30, 2008. PNC immediately redeemed

all $500.1 million of the Series M Preferred Stock from the

Trust and the Trust in turn redeemed all $500.0 million

outstanding of its 12% Fixed-to-Floating Rate Normal APEX

and all $.1 million of its Common Securities.

The replacement capital covenants with respect to the Normal

APEX Securities, our Series M shares and our 6,000,000 of

Depositary Shares (each representing 1/4,000th of an interest

in a share of our 9.875% Fixed-to-Floating Rate Non-

Cumulative Preferred Stock, Series L) were terminated on

November 5, 2010 as a result of a successful consent

solicitation.

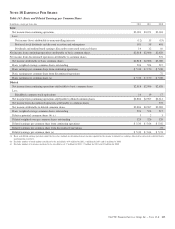

In connection with the redemption of the Series N Preferred

Stock, we accelerated the accretion of the remaining issuance

discount on the Series N Preferred Stock, recorded a

corresponding reduction in retained earnings of $250 million

during the first quarter of 2010 and paid dividends of $89

million to the US Treasury. This resulted in a noncash

reduction in net income attributable to common shareholders

and related basic and diluted earnings per share.

W

ARRANTS

We have outstanding 16,885,192 warrants, each to purchase

one share of PNC common stock at an exercise price of

$67.33 per share. These warrants were sold by the US

Treasury in a secondary public offering that closed on May 5,

2010 after the US Treasury exchanged its TARP Warrant

(issued on December 31, 2008 under the TARP Capital

Purchase Program in relation to the Series N preferred stock

referred to above) for 16,885,192 warrants. These warrants

expire December 31, 2018.

O

THER

S

HAREHOLDERS

’E

QUITY

M

ATTERS

We have a dividend reinvestment and stock purchase plan.

Holders of preferred stock and PNC common stock may

participate in the plan, which provides that additional shares

of common stock may be purchased at market value with

reinvested dividends and voluntary cash payments. Common

shares issued pursuant to this plan were: 422,642 shares in

2012, 379,459 shares in 2011 and 149,088 shares in 2010.

At December 31, 2012, we had reserved approximately

108.4 million common shares to be issued in connection with

certain stock plans and the conversion of certain debt and

equity securities.

Effective October 4, 2007, our Board of Directors approved a

stock repurchase program to purchase up to 25 million shares

of PNC common stock on the open market or in privately

negotiated transactions. A maximum of 21.551 million shares

remained available for repurchase under this program at

December 31, 2012. This program will remain in effect until

fully utilized or until modified, superseded or terminated. We

repurchased 3.2 million shares in 2012 and did not repurchase

any shares during 2011 or 2010 under this program.

The PNC Financial Services Group, Inc. – Form 10-K 215