PNC Bank 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the first quarter of 2010), and the exchange by the US

Treasury of the TARP warrant issued to it on December 31,

2008 into warrants, each to purchase one share of PNC

common stock at an exercise price of $67.33, sold by the US

Treasury in a secondary public offering in May 2010. These

common stock warrants will expire December 31, 2018.

Status of Credit Ratings

The cost and availability of short-term and long-term funding,

as well as collateral requirements for certain derivative

instruments, is influenced by PNC’s debt ratings.

In general, rating agencies base their ratings on many

quantitative and qualitative factors, including capital

adequacy, liquidity, asset quality, business mix, level and

quality of earnings, and the current legislative and regulatory

environment, including implied government support. In

addition, rating agencies themselves have been subject to

scrutiny arising from the financial crisis and could make or be

required to make substantial changes to their ratings policies

and practices, particularly in response to legislative and

regulatory changes, including as a result of provisions in

Dodd-Frank. Potential changes in the legislative and

regulatory environment and the timing of those changes could

impact our ratings, which as noted above, could impact our

liquidity and financial condition. A decrease, or potential

decrease, in credit ratings could impact access to the capital

markets and/or increase the cost of debt, and thereby

adversely affect liquidity and financial condition.

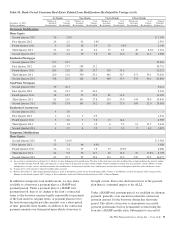

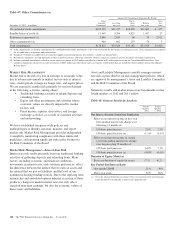

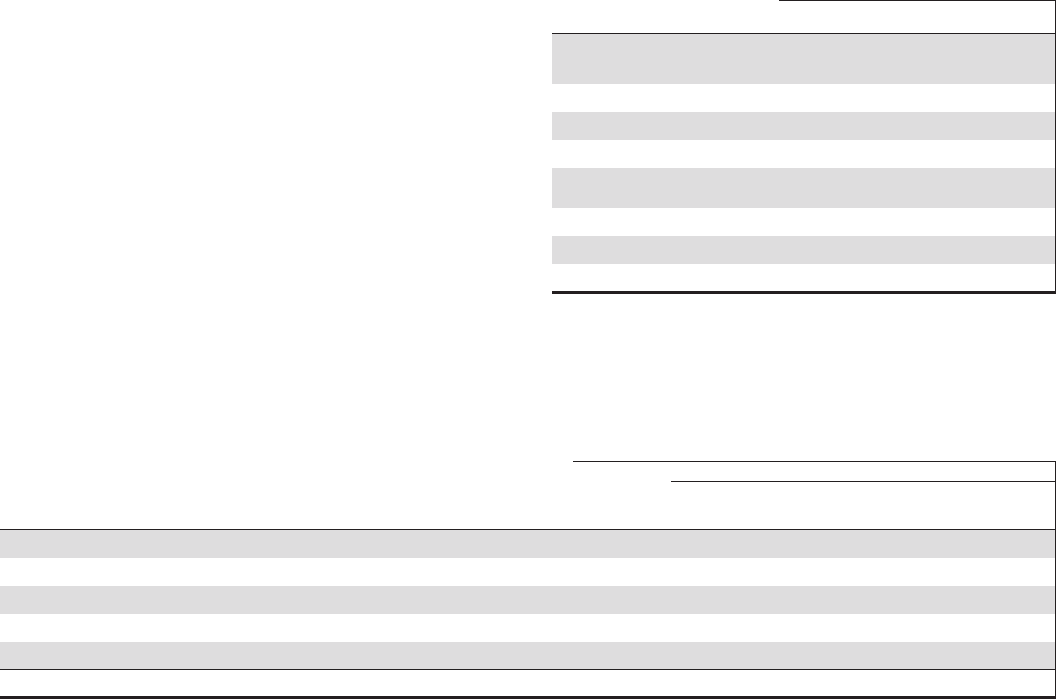

Table 45: Credit Ratings as of December 31, 2012 for PNC

and PNC Bank, N.A.

Moody’s

Standard &

Poor’s Fitch

The PNC Financial Services

Group, Inc.

Senior debt A3 A- A+

Subordinated debt Baa1 BBB+ A

Preferred stock Baa3 BBB BBB-

PNC Bank, N.A.

Subordinated debt A3 A- A

Long-term deposits A2 A AA-

Short-term deposits P-1 A-1 F1+

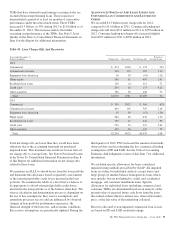

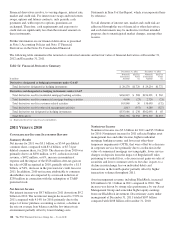

Commitments

The following tables set forth contractual obligations and various other commitments as of December 31, 2012 representing

required and potential cash outflows.

Table 46: Contractual Obligations

Payment Due By Period

December 31, 2012 – in millions Total

Less than

one year

One to

three

years

Four to

five

years

After five

years

Remaining contractual maturities of time deposits (a) $26,091 $18,155 $ 4,223 $1,598 $ 2,115

Borrowed funds (a) (b) 40,907 21,647 6,501 5,005 7,754

Minimum annual rentals on noncancellable leases 2,790 397 668 472 1,253

Nonqualified pension and postretirement benefits 581 66 133 121 261

Purchase obligations (c) 683 395 201 56 31

Total contractual cash obligations $71,052 $40,660 $11,726 $7,252 $11,414

(a) Includes purchase accounting adjustments.

(b) Includes basis adjustment relating to accounting hedges.

(c) Includes purchase obligations for goods and services covered by noncancellable contracts and contracts including cancellation fees.

We had unrecognized tax benefits of $176 million at

December 31, 2012. This liability for unrecognized tax

benefits represents an estimate of tax positions that we have

taken in our tax returns which ultimately may not be sustained

upon examination by taxing authorities. Since the ultimate

amount and timing of any future cash settlements cannot be

predicted with reasonable certainty, this estimated liability has

been excluded from the contractual obligations table. See Note

21 Income Taxes in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional information.

Our contractual obligations totaled $72.0 billion at

December 31, 2011. The decline in the comparison is

primarily attributable to decreases in the remaining contractual

maturities of time deposits, partially offset by increases in

borrowed funds. See Funding and Capital Sources in the

Consolidated Balance Sheet Review section of this Item 7 for

additional information regarding our funding sources.

The PNC Financial Services Group, Inc. – Form 10-K 103