PNC Bank 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

C

ORPORATE

&I

NSTITUTIONAL

B

ANKING

(Unaudited)

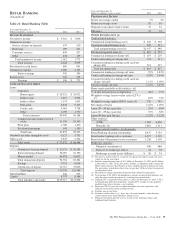

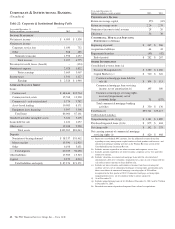

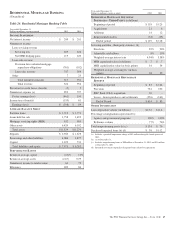

Table 22: Corporate & Institutional Banking Table

Year ended December 31

Dollars in millions, except as noted 2012 2011

I

NCOME

S

TATEMENT

Net interest income $ 4,099 $ 3,538

Noninterest income

Corporate service fees 1,030 752

Other 568 485

Noninterest income 1,598 1,237

Total revenue 5,697 4,775

Provision for credit losses (benefit) – (124)

Noninterest expense 2,028 1,832

Pretax earnings 3,669 3,067

Income taxes 1,341 1,127

Earnings $ 2,328 $ 1,940

A

VERAGE

B

ALANCE

S

HEET

Loans

Commercial $ 48,444 $35,764

Commercial real estate 15,768 13,938

Commercial – real estate related 5,774 3,782

Asset-based lending 10,083 8,171

Equipment lease financing 5,997 5,506

Total loans 86,066 67,161

Goodwill and other intangible assets 3,656 3,405

Loans held for sale 1,222 1,257

Other assets 12,018 9,220

Total assets $102,962 $81,043

Deposits

Noninterest-bearing demand $ 38,337 $31,462

Money market 15,590 12,925

Other 6,108 5,651

Total deposits 60,035 50,038

Other liabilities 17,969 13,323

Capital 9,272 8,010

Total liabilities and equity $ 87,276 $71,371

Year ended December 31

Dollars in millions, except as noted 2012 2011

P

ERFORMANCE

R

ATIOS

Return on average capital 25% 24%

Return on average assets 2.26 2.39

Noninterest income to total revenue 28 26

Efficiency 36 38

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

P

ORTFOLIO

(in billions)

Beginning of period $ 267 $ 266

Acquisitions/additions 64 43

Repayments/transfers (49) (42)

End of period $ 282 $ 267

O

THER

I

NFORMATION

Consolidated revenue from: (a)

Treasury Management (b) $ 1,380 $ 1,266

Capital Markets (c) $ 710 $ 622

Commercial mortgage loans held for

sale (d) $ 104 $ 113

Commercial mortgage loan servicing

income, net of amortization (e) 195 180

Commercial mortgage servicing rights

recovery/(impairment), net of

economic hedge 31 (157)

Total commercial mortgage banking

activities $ 330 $ 136

Total loans (f) $93,721 $73,417

Credit-related statistics:

Nonperforming assets (f) (g) $ 1,181 $ 1,889

Purchased impaired loans (f) (h) $ 875 $ 404

Net charge-offs $ 142 $ 375

Net carrying amount of commercial mortgage

servicing rights (f) $ 420 $ 468

(a) Represents consolidated PNC amounts. See the additional revenue discussion

regarding treasury management, capital markets-related products and services, and

commercial mortgage banking activities in the Product Revenue section of the

Consolidated Income Statement Review.

(b) Includes amounts reported in net interest income and corporate service fees.

(c) Includes amounts reported in net interest income, corporate service fees and other

noninterest income.

(d) Includes valuations on commercial mortgage loans held for sale and related

commitments, derivative valuations, origination fees, gains on sale of loans held for

sale and net interest income on loans held for sale.

(e) Includes net interest income and noninterest income from loan servicing and

ancillary services, net of commercial mortgage servicing rights amortization and a

direct write-down of commercial mortgage servicing rights of $24 million

recognized in the first quarter of 2012. Commercial mortgage servicing rights

(impairment)/recovery, net of economic hedge is shown separately.

(f) As of December 31.

(g) Includes nonperforming loans of $ 1.0 billion at December 31, 2012 and $1.7 billion

at December 31, 2011.

(h) Recorded investment of purchased impaired loans related to acquisitions.

62 The PNC Financial Services Group, Inc. – Form 10-K