PNC Bank 2012 Annual Report Download - page 216

Download and view the complete annual report

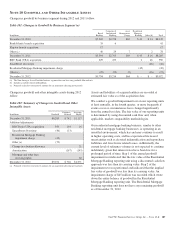

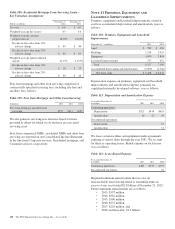

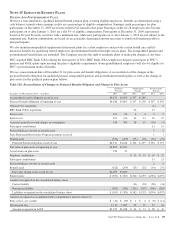

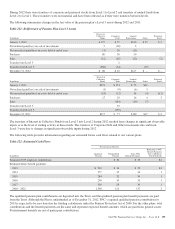

Please find page 216 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The asset category represents the allocation of Plan assets in

accordance with the investment objective of each of the Plan’s

investment managers. Certain domestic equity investment

managers utilize derivatives and fixed income securities as

described in their Investment Management Agreements to

achieve their investment objective under the Investment

Policy Statement. Other investment managers may invest in

eligible securities outside of their assigned asset category to

meet their investment objectives. The actual percentage of the

fair value of total Plan assets held as of December 31, 2012

for equity securities, fixed income securities, real estate and

all other assets are 59%, 33%, 5%, and 3%, respectively.

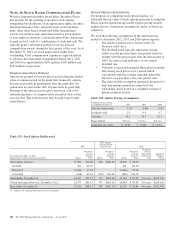

We believe that, over the long term, asset allocation is the

single greatest determinant of risk. Asset allocation will

deviate from the target percentages due to market movement,

cash flows, investment manager performance and

implementation of shifts under the dynamic allocation policy.

Material deviations from the asset allocation targets can alter

the expected return and risk of the Trust. On the other hand,

frequent rebalancing to the asset allocation targets may result

in significant transaction costs, which can impair the Trust’s

ability to meet its investment objective. Accordingly, the Trust

portfolio is periodically rebalanced to maintain asset

allocation within the target ranges described above.

In addition to being diversified across asset classes, the Trust

is diversified within each asset class. Secondary

diversification provides a reasonable basis for the expectation

that no single security or class of securities will have a

disproportionate impact on the total risk and return of the

Trust.

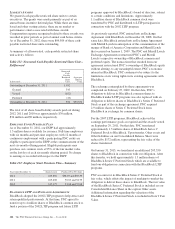

The Administrative Committee selects investment managers

for the Trust based on the contributions that their respective

investment styles and processes are expected to make to the

investment performance of the overall portfolio. The

managers’ Investment Objectives and Guidelines, which are a

part of each manager’s Investment Management Agreement,

document performance expectations and each manager’s role

in the portfolio. The Administrative Committee uses the

Investment Objectives and Guidelines to establish, guide,

control and measure the strategy and performance for each

manager.

The purpose of investment manager guidelines is to:

• Establish the investment objective and performance

standards for each manager,

• Provide the manager with the capability to evaluate

the risks of all financial instruments or other assets in

which the manager’s account is invested, and

• Prevent the manager from exposing its account to

excessive levels of risk, undesired or inappropriate

risk, or disproportionate concentration of risk.

The guidelines also indicate which investments and strategies

the manager is permitted to use to achieve its performance

objectives, and which investments and strategies it is

prohibited from using.

Where public market investment strategies may include the

use of derivatives and/or currency management, language is

incorporated in the managers’ guidelines to define allowable

and prohibited transactions and/or strategies. Derivatives are

typically employed by investment managers to modify risk/

return characteristics of their portfolio(s), implement asset

allocation changes in a cost-effective manner, or reduce

transaction costs. Under the managers’ investment guidelines,

derivatives may not be used solely for speculation or leverage.

Derivatives are to be used only in circumstances where they

offer the most efficient economic means of improving the risk/

reward profile of the portfolio.

BlackRock receives compensation for providing investment

management services. The Asset Management Group business

segment also receives compensation for payor-related

services, and received compensation for providing trustee/

custodian services prior to July 1, 2011. Compensation for

such services is paid by PNC and was not significant for 2012,

2011 or 2010. Non-affiliate service providers for the Trust are

compensated from plan assets.

F

AIR

V

ALUE

M

EASUREMENTS

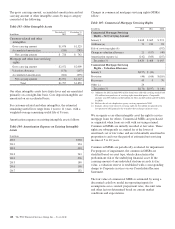

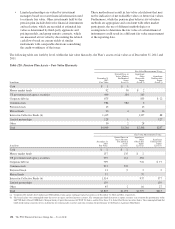

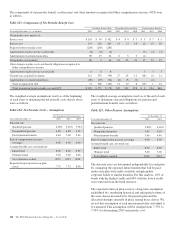

As further described in Note 9 Fair Value, GAAP establishes

the framework for measuring fair value, including a hierarchy

used to classify the inputs used in measuring fair value.

A description of the valuation methodologies used for assets

measured at fair value follows. There have been no significant

changes in the valuation methodologies used at December 31,

2012 compared with those in place at December 31, 2011:

• Money market and mutual funds are valued at the net

asset value of the shares held by the pension plan at

year end.

• U.S. government and agency securities, corporate

debt, common stock and preferred stock are valued at

the closing price reported on the active market on

which the individual securities are traded. If quoted

market prices are not available for the specific

security, then fair values are estimated by using

pricing models or quoted prices of securities with

similar characteristics. Such securities are generally

classified within level 2 of the valuation hierarchy

but may be a level 3 depending on the level of

liquidity and activity in the market for the security.

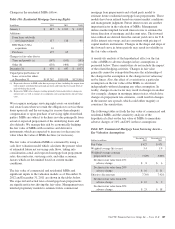

• The collective trust fund investments are valued

based upon the units of such collective trust fund

held by the plan at year end multiplied by the

respective unit value. The unit value of the collective

trust fund is based upon significant observable inputs,

although it is not based upon quoted marked prices in

an active market. The underlying investments of the

collective trust funds consist primarily of equity

securities, debt obligations, short-term investments,

and other marketable securities. Due to the nature of

these securities, there are no unfunded commitments

or redemption restrictions.

The PNC Financial Services Group, Inc. – Form 10-K 197