PNC Bank 2012 Annual Report Download - page 251

Download and view the complete annual report

Please find page 251 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

OTE

26 S

EGMENT

R

EPORTING

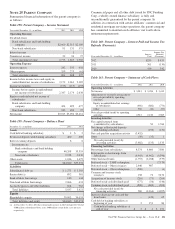

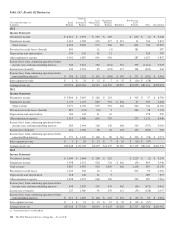

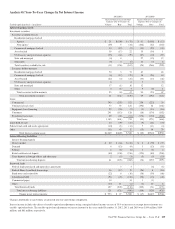

We have six reportable business segments:

• Retail Banking

• Corporate & Institutional Banking

• Asset Management Group

• Residential Mortgage Banking

• BlackRock

• Non-Strategic Assets Portfolio

Results of individual businesses are presented based on our

internal management reporting practices. There is no

comprehensive, authoritative body of guidance for

management accounting equivalent to GAAP; therefore, the

financial results of our individual businesses are not

necessarily comparable with similar information for any other

company. We periodically refine our internal methodologies

as management reporting practices are enhanced. To the

extent practicable, retrospective application of new

methodologies is made to prior period reportable business

segment results and disclosures to create comparability to the

current period presentation to reflect any such refinements.

Financial results are presented, to the extent practicable, as if

each business operated on a stand-alone basis. Additionally,

we have aggregated the results for corporate support functions

within “Other” for financial reporting purposes.

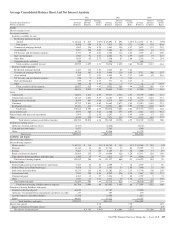

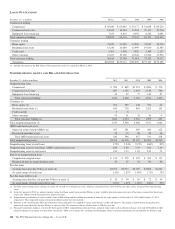

Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing

methodology that incorporates product maturities, duration

and other factors. During the second quarter of 2012,

enhancements were made to the funds transfer pricing

methodology. Retrospective application of our new funds

transfer pricing methodology has been made to the prior

period reportable business segment results and disclosures to

create comparability to the current period presentation, which

we believe is more meaningful to readers of our financial

statements.

A portion of capital is intended to cover unexpected losses and

is assigned to our business segments using our risk-based

economic capital model, including consideration of the

goodwill and other intangible assets at those business

segments, as well as the diversification of risk among the

business segments.

We have allocated the allowances for loan and lease losses

and for unfunded loan commitments and letters of credit based

on our assessment of risk in each business segment’s loan

portfolio. Our allocation of the costs incurred by operations

and other shared support areas not directly aligned with the

businesses is primarily based on the use of services. Key

reserve assumptions and estimation processes react to and are

influenced by observed changes in loan portfolio performance

experience, the financial strength of the borrower, and

economic conditions. Key reserve assumptions are

periodically updated. During the third quarter of 2012, PNC

increased the amount of internally observed data used in

estimating the key commercial lending assumptions of PDs

and LGDs. Prior periods are not presented on a comparable

basis as it is not practicable to do so.

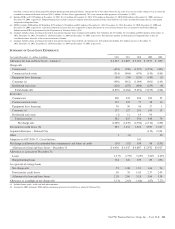

Total business segment financial results differ from

consolidated income from continuing operations before

noncontrolling interests, which itself excludes the earnings

and revenue attributable to GIS through June 30, 2010 and the

related third quarter 2010 after-tax gain on the sale of GIS that

are reflected in discontinued operations. The impact of these

differences is reflected in the “Other” category in the business

segment tables. “Other” includes residual activities that do not

meet the criteria for disclosure as a separate reportable

business, such as gains or losses related to BlackRock

transactions, integration costs, asset and liability management

activities including net securities gains or losses, other-than-

temporary impairment of investment securities and certain

trading activities, exited businesses, alternative investments

including private equity, intercompany eliminations, most

corporate overhead, tax adjustments that are not allocated to

business segments and differences between business segment

performance reporting and financial statement reporting

(GAAP), including the presentation of net income attributable

to noncontrolling interests as the segments’ results exclude

their portion of net income attributable to noncontrolling

interests. Assets, revenue and earnings attributable to foreign

activities were not material in the periods presented for

comparative purposes.

B

USINESS

S

EGMENT

P

RODUCTS AND

S

ERVICES

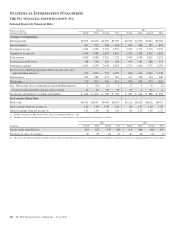

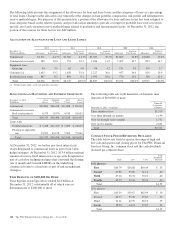

Retail Banking provides deposit, lending, brokerage,

investment management, and cash management services to

consumer and small business customers within our primary

geographic markets. Our customers are serviced through our

branch network, call centers, online banking and mobile

channels. The branch network is located primarily in

Pennsylvania, Ohio, New Jersey, Michigan, Illinois,

Maryland, Indiana, North Carolina, Florida, Kentucky,

Washington, D.C., Delaware, Alabama, Virginia, Georgia,

Missouri, Wisconsin and South Carolina.

Corporate & Institutional Banking provides lending, treasury

management and capital markets-related products and services

to mid-sized corporations, government and not-for-profit

entities and selectively to large corporations. Lending

products include secured and unsecured loans, letters of credit

and equipment leases. Treasury management services include

cash and investment management, receivables management,

disbursement services, funds transfer services, information

reporting and global trade services. Capital markets-related

products and services include foreign exchange, derivatives,

loan syndications, mergers and acquisitions advisory and

related services to middle-market companies, our multi-seller

conduit, securities underwriting and securities sales and

trading. Corporate & Institutional Banking also provides

commercial loan servicing, and real estate advisory and

232 The PNC Financial Services Group, Inc. – Form 10-K