PNC Bank 2012 Annual Report Download - page 94

Download and view the complete annual report

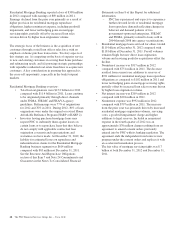

Please find page 94 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.forward interest rates to estimate the future direction of

mortgage and discount rates. The forward rates utilized are

derived from the current yield curve for U.S. dollar interest

rate swaps and are consistent with pricing of capital markets

instruments. Changes in the shape and slope of the forward

curve in future periods may result in volatility in the fair value

estimate.

A sensitivity analysis of the hypothetical effect on the fair

value of MSRs to adverse changes in key assumptions is

presented in Note 10 Goodwill and Other Intangible Assets in

the Notes To Consolidated Financial Statements in Item 8 of

this Report. These sensitivities do not include the impact of

the related hedging activities. Changes in fair value generally

cannot be extrapolated because the relationship of the change

in the assumption to the change in fair value may not be

linear. Also, the effect of a variation in a particular assumption

on the fair value of the MSRs is calculated independently

without changing any other assumption. In reality, changes in

one factor may result in changes in another (for example,

changes in mortgage interest rates, which drive changes in

prepayment rate estimates, could result in changes in the

interest rate spread), which could either magnify or counteract

the sensitivities.

Income Taxes

In the normal course of business, we and our subsidiaries enter

into transactions for which the tax treatment is unclear or

subject to varying interpretations. In addition, filing

requirements, methods of filing and the calculation of taxable

income in various state and local jurisdictions are subject to

differing interpretations.

We evaluate and assess the relative risks and merits of the tax

treatment of transactions, filing positions, filing methods and

taxable income calculations after considering statutes,

regulations, judicial precedent, and other information, and

maintain tax accruals consistent with our evaluation of these

relative risks and merits. The result of our evaluation and

assessment is by its nature an estimate. We and our

subsidiaries are routinely subject to audit and challenges from

taxing authorities. In the event we resolve a challenge for an

amount different than amounts previously accrued, we will

account for the difference in the period in which we resolve

the matter.

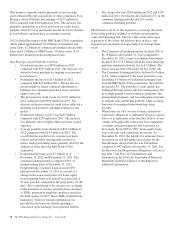

Proposed Accounting Standards

The Financial Accounting Standards Board (FASB) issued

several Exposure Drafts for comment during 2012 as well as

the beginning of 2013.

In January 2013, the FASB issued Proposed Accounting

Standards Update (ASU) Transfers and Servicing (Topic 860):

Effective Control for Transfers with Forward Agreements to

Repurchase Assets and Accounting for Repurchase

Financings. This exposure draft would change the accounting

for repurchase-to-maturity agreements (“repos-to-maturity”).

Under the existing guidance, repos-to-maturity may meet the

criteria to be accounted for as sales, but the proposed guidance

would require them to be accounted for as secured

borrowings. It would also clarify the evaluation of whether

financial assets that will be repurchased are “substantially the

same” as those transferred. Additionally, the exposure draft

proposes a change to the accounting for repurchases that are

part of repurchase financings, such that the initial transfer and

repurchase are evaluated as two separate transactions. The

effective date has not yet been determined. We are evaluating

the impact of this proposal on our financial statements.

In December 2012, the FASB issued Proposed ASU Financial

Instruments – Credit Losses (Subtopic 825-15). The FASB has

exposed a single-model approach which would apply to all

financial instruments carried at amortized cost or at fair-value

through other comprehensive income (replacing the current

ASC 450, Contingencies, ASC 310-10, Receivables – Overall,

ASC 310-30, Receivables – Loans and Debt Securities

Acquired with Deteriorated Credit Quality and ASC 320,

Investments –Debt and Equity Securities approaches). This

model would require reserves for all expected credit losses

over the life of the instrument. Under the proposal,

retrospective application with cumulative adjustment to

retained earnings will be required and early adoption would

not be permitted. The effective date has not yet been

determined. We are evaluating the impact of this proposal on

our financial statements.

In October 2012, the FASB issued Proposed ASU

Consolidation (Topic 810): Accounting for the Difference

between the Fair Value of the Assets and the Fair Value of the

Liabilities of a Consolidated Collateralized Financing Entity.

This exposure draft would define “collateralized financing

entity” and require a reporting entity that consolidates a

collateralized financing entity and measures the associated

financial assets and financial liabilities at fair value, to

measure that fair value consistently with how a market

participant would price the reporting entity’s net exposure.

The reporting entity would allocate portfolio-level

adjustments to the individual assets and liabilities on a

reasonable and consistent basis. The exposure draft would

require a modified retrospective approach to be applied at

adoption for only those collateralized financing entities that

exist at the date of adoption. Early adoption would be

permitted. An effective date has not yet been determined. We

are evaluating the impact of this proposal on our financial

statements.

In October 2012, the FASB issued Proposed ASU Foreign

Currency Matters (Topic 830): Parent’s Accounting for the

Cumulative Translation Adjustment upon Derecognition of

Certain Subsidiaries or Groups of Assets within a Foreign

Entity or of an Investment in a Foreign Entity. This exposure

draft would clarify the timing of release of Currency

Translation Adjustments (CTA) from Accumulated Other

Comprehensive Income (AOCI) upon deconsolidation or

The PNC Financial Services Group, Inc. – Form 10-K 75