PNC Bank 2012 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

5A

SSET

Q

UALITY

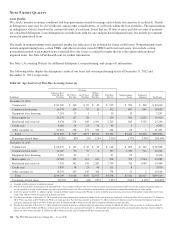

Asset Quality

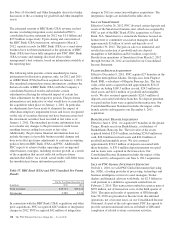

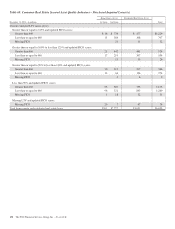

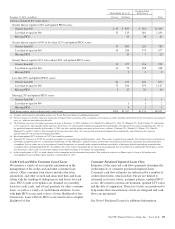

We closely monitor economic conditions and loan performance trends to manage and evaluate our exposure to credit risk. Trends

in delinquency rates may be a key indicator, among other considerations, of credit risk within the loan portfolios. The measurement

of delinquency status is based on the contractual terms of each loan. Loans that are 30 days or more past due in terms of payment

are considered delinquent. Loan delinquencies exclude loans held for sale and purchased impaired loans, but include government

insured or guaranteed loans.

The trends in nonperforming assets represent another key indicator of the potential for future credit losses. Nonperforming assets

include nonperforming loans, certain TDRs, and other real estate owned (OREO) and foreclosed assets, but exclude certain

government insured or guaranteed loans, loans held for sale, loans accounted for under the fair value option and purchased

impaired loans. See Note 6 Purchased Loans for further information.

See Note 1 Accounting Policies for additional delinquency, nonperforming, and charge-off information.

The following tables display the delinquency status of our loans and our nonperforming assets at December 31, 2012 and

December 31, 2011, respectively.

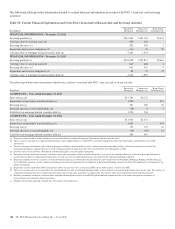

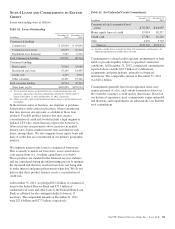

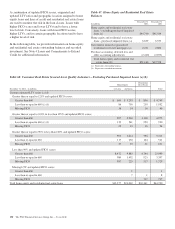

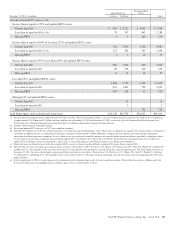

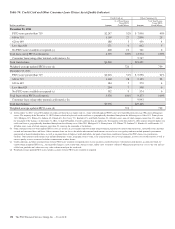

Table 64: Age Analysis of Past Due Accruing Loans (a)

Accruing

In millions

Current or Less

Than 30 Days

Past Due

30-59 Days

Past Due

60-89 Days

Past Due

90 Days

Or More

Past Due

Total Past

Due (b)

Nonperforming

Loans

Purchased

Impaired Total Loans

December 31, 2012

Commercial $ 81,930 $ 115 $ 55 $ 42 $ 212 $ 590 $ 308 $ 83,040

Commercial real estate 16,735 100 57 15 172 807 941 18,655

Equipment lease financing 7,214 17 1 2 20 13 7,247

Home equity (c) 32,174 117 58 175 951 2,620 35,920

Residential real estate (d) 8,534 278 146 1,901 2,325 845 3,536 15,240

Credit card 4,205 34 23 36 93 5 4,303

Other consumer (e) 20,663 258 131 355 744 43 1 21,451

Total $171,455 $ 919 $471 $2,351 $3,741 $3,254 $7,406 $185,856

Percentage of total loans 92.26% .49% .25% 1.26% 2.00% 1.75% 3.99% 100.00%

December 31, 2011

Commercial $ 64,437 $ 122 $ 47 $ 49 $ 218 $ 899 $ 140 $ 65,694

Commercial real estate 14,010 96 35 6 137 1,345 712 16,204

Equipment lease financing 6,367 22 5 27 22 6,416

Home equity (c) 29,288 173 114 221 508 529 2,764 33,089

Residential real estate (d) 7,935 302 176 2,281 2,759 726 3,049 14,469

Credit card 3,857 38 25 48 111 8 3,976

Other consumer (e) 18,355 265 145 368 778 31 2 19,166

Total $144,249 $1,018 $547 $2,973 $4,538 $3,560 $6,667 $159,014

Percentage of total loans 90.72% .64% .34% 1.87% 2.85% 2.24% 4.19% 100.00%

(a) Amounts in table represent recorded investment.

(b) Past due loan amounts exclude purchased impaired loans, even if contractually past due (or if we do not expect to receive payment in full based on the original contractual terms), as

we are currently accreting interest income over the expected life of the loans. Also excluded are loans held for sale and loans accounted for under the fair value option.

(c) In the first quarter of 2012, we adopted a policy stating that Home equity loans past due 90 days or more would be placed on nonaccrual status. Prior policy required that these loans

be past due 180 days before being placed on nonaccrual status.

(d) Past due loan amounts at December 31, 2012 include government insured or guaranteed residential real estate mortgages, totaling $.1 billion for 30 to 59 days past due, $.1 billion for

60 to 89 days past due and $1.9 billion for 90 days or more past due. Past due loan amounts at December 31, 2011 include government insured or guaranteed residential real estate

mortgages totaling $.1 billion for 30 to 59 days past due, $.1 billion for 60 to 89 days past due and $2.1 billion for 90 days or more past due.

(e) Past due loan amounts at December 31, 2012 include government insured or guaranteed other consumer loans totaling $.2 billion for 30 to 59 days past due, $.1 billion for 60 to 89

days past due and $.3 billion for 90 days or more past due. Past due loan amounts at December 31, 2011 include government insured or guaranteed other consumer loans totaling $.2

billion for 30 to 59 days past due, $.1 billion for 60 to 89 days past due and $.3 billion for 90 days or more past due.

146 The PNC Financial Services Group, Inc. – Form 10-K