PNC Bank 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TDRs that have returned to performing (accruing) status are

excluded from nonperforming loans. These loans have

demonstrated a period of at least six months of consecutive

performance under the restructured terms. These TDRs

increased $.3 billion, or 35% during 2012 to $1.0 billion as of

December 31, 2012. This increase reflects the further

seasoning and performance of the TDRs. See Note 5 Asset

Quality in the Notes to Consolidated Financial Statements in

Item 8 of this Report for additional information.

A

LLOWANCES

F

OR

L

OAN

A

ND

L

EASE

L

OSSES

A

ND

U

NFUNDED

L

OAN

C

OMMITMENTS

A

ND

L

ETTERS

O

F

C

REDIT

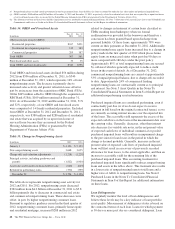

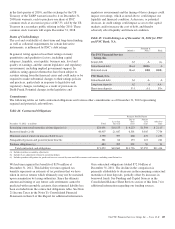

We recorded $1.3 billion in net charge-offs for 2012,

compared to $1.6 billion in 2011. Commercial lending net

charge-offs fell from $712 million in 2011 to $359 million in

2012. Consumer lending net charge-offs increased slightly

from $927 million in 2011 to $930 million in 2012.

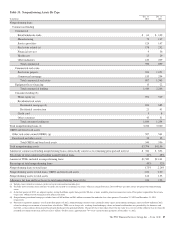

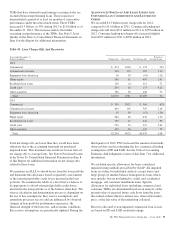

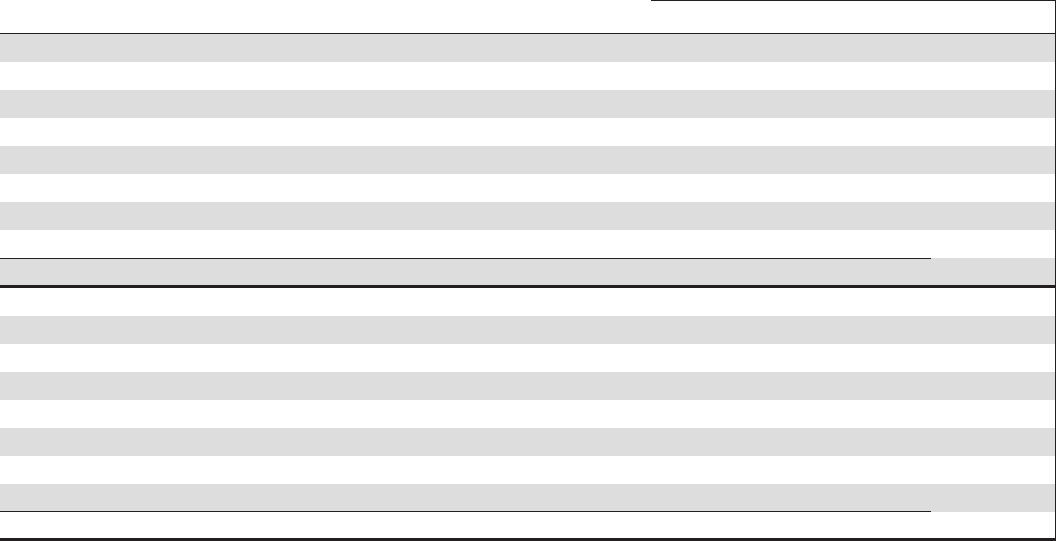

Table 43: Loan Charge-Offs And Recoveries

Year ended December 31

Dollars in millions Charge-offs Recoveries Net Charge-offs

Percent of

Average Loans

2012

Commercial $ 474 $300 $ 174 .23%

Commercial real estate 314 115 199 1.10

Equipment lease financing 16 30 (14) (.21)

Home equity 560 61 499 1.41

Residential real estate 110 (1) 111 .72

Credit card 200 26 174 4.26

Other consumer 196 50 146 .72

Total $1,870 $581 $1,289 .73

2011

Commercial $ 700 $332 $ 368 .62%

Commercial real estate 464 105 359 2.14

Equipment lease financing 35 50 (15) (.24)

Home equity 484 48 436 1.30

Residential real estate 153 11 142 .95

Credit card 235 23 212 5.62

Other consumer 193 56 137 .79

Total $2,264 $625 $1,639 1.08

Total net charge-offs are lower than they would have been

otherwise due to the accounting treatment for purchased

impaired loans. This treatment also results in a lower ratio of

net charge-offs to average loans. See Note 6 Purchased Loans

in the Notes To Consolidated Financial Statements in Item 8

of this Report for additional information on net charge-offs

related to these loans.

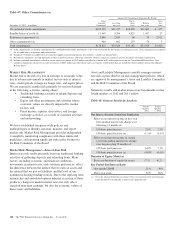

We maintain an ALLL to absorb losses from the loan portfolio

and determine this allowance based on quarterly assessments

of the estimated probable credit losses incurred in the loan

portfolio. We maintain the ALLL at a level that we believe to

be appropriate to absorb estimated probable credit losses

incurred in the loan portfolio as of the balance sheet date. The

reserve calculation and determination process is dependent on

the use of key assumptions. Key reserve assumptions and

estimation processes react to and are influenced by observed

changes in loan portfolio performance experience, the

financial strength of the borrower, and economic conditions.

Key reserve assumptions are periodically updated. During the

third quarter of 2012, PNC increased the amount of internally

observed data used in estimating the key commercial lending

assumptions of PD and LGD. See the Critical Accounting

Estimates And Judgments section of this Item 7 for additional

information.

We establish specific allowances for loans considered

impaired using methods prescribed by GAAP. All impaired

loans are subject to individual analysis, except leases and

large groups of smaller-balance homogeneous loans which

may include, but are not limited to, credit card, residential

mortgage, and consumer installment loans. Specific

allowances for individual loans (including commercial and

consumer TDRs) are determined based on an analysis of the

present value of expected future cash flows from the loans

discounted at their effective interest rate, observable market

price, or the fair value of the underlying collateral.

Reserves allocated to non-impaired commercial loan classes

are based on PD and LGD credit risk ratings.

The PNC Financial Services Group, Inc. – Form 10-K 95