PNC Bank 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

ONPERFORMING

A

SSETS AND

L

OAN

D

ELINQUENCIES

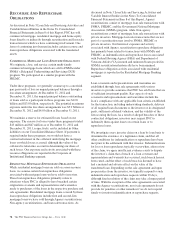

Nonperforming Assets, including OREO and Foreclosed

Assets

Nonperforming assets include nonaccrual loans and leases for

which ultimate collectability of the full amount of contractual

principal and interest is not probable and include

nonperforming TDRs, OREO and foreclosed assets. Loans

held for sale, certain government insured or guaranteed loans,

purchased impaired loans and loans accounted for under the

fair value option are excluded from nonperforming loans.

Additional information regarding our nonaccrual policies is

included in Note 1 Accounting Policies in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

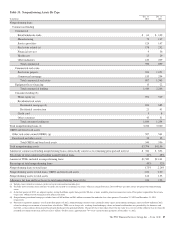

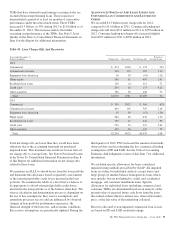

The major categories of nonperforming assets are presented in

the table below.

Nonperforming assets decreased $362 million from

December 31, 2011, to $3.8 billion at December 31, 2012, as

discussed above. Nonperforming loans decreased $306 million

to $3.3 billion and OREO and foreclosed assets decreased $56

million to $540 million. The ratio of nonperforming assets to

total loans, OREO and foreclosed assets decreased to 2.04% at

December 31, 2012 from 2.60% at December 31, 2011. The

ratio of nonperforming loans to total loans declined to 1.75%

at December 31, 2012, compared to 2.24% at December 31,

2011. Total nonperforming assets have declined $2.6 billion,

or 41%, from their peak of $6.4 billion at March 31, 2010.

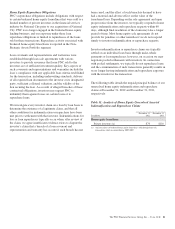

Management continues to evaluate nonaccrual and charge-off

policies for second-lien consumer loans (residential mortgages

and home equity loans and lines) pursuant to interagency

supervisory guidance on practices for loans and lines of credit

secured by junior liens on 1-4 family residential properties.

This will result in future classification of performing second-

lien consumer loans as nonperforming where the first-lien

loan is 90 days or more past due. Pursuant to the guidance, the

Company will adopt a policy in the first quarter of 2013,

subsequent to operationalizing related procedures, to charge-

off a portion of certain second-lien consumer loans

(residential mortgage and home equity lines of credit) where

the first-lien loan is 90 days or more past due. Additionally,

given these operational enhancements and pursuant to

interagency supervisory guidance, the company will update

certain additional nonaccrual and charge-off policies. We

estimate adding approximately $350 million to $450 million

to the nonaccrual consumer loan population in the first quarter

of 2013. If these policies had been in effect as of

December 31, 2012, there would have been an estimated

cumulative charge-off of approximately $140 million. The

credit loss policies for these loans are considered in our

reserving process and the risk of loss associated with these

loans was considered in the determination of our ALLL at

December 31, 2012.

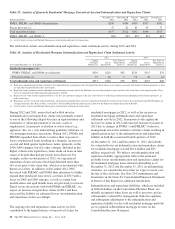

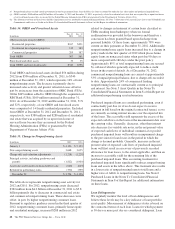

At December 31, 2012, TDRs included in nonperforming

loans were $1.6 billion or 49% of total nonperforming loans

compared to $1.1 billion or 32% of nonperforming loans as of

December 31, 2011. Within consumer nonperforming loans,

residential real estate TDRs comprise 64% of total residential

real estate nonperforming loans at December 31, 2012, up

from 51% at December 31, 2011. Home equity TDRs

comprise 70% of home equity nonperforming loans at

December 31, 2012, down from 77% at December 31, 2011.

The level of TDRs in these portfolios is expected to result in

elevated nonperforming loan levels because TDRs remain in

nonperforming status until a borrower has made at least six

consecutive months of payments under the modified terms or

ultimate resolution occurs.

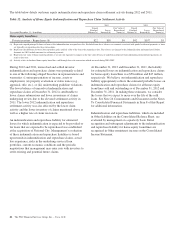

At December 31, 2012, our largest nonperforming asset was

$38 million and in the Real Estate Rental and Leasing

Industry. Our average nonperforming loans associated with

commercial lending were under $1 million. Eight of our ten

largest outstanding nonperforming assets are from the

commercial lending portfolio and represent 11% and 4% of

total commercial lending nonperforming loans and total

nonperforming assets, respectively, as of December 31, 2012.

86 The PNC Financial Services Group, Inc. – Form 10-K