PNC Bank 2012 Annual Report Download - page 128

Download and view the complete annual report

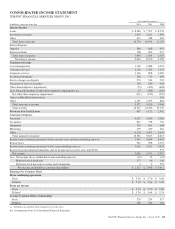

Please find page 128 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For 2011, consumer services fees totaled $1.2 billion

compared with $1.3 billion in 2010. The decrease was due to

lower interchange rates on debit card transactions, lower

brokerage related revenue, and lower ATM related fees,

partially offset by higher volumes of customer-initiated

transactions including debit and credit cards. The Dodd-Frank

limits on interchange rates were effective October 1, 2011 and

had a negative impact on revenues of approximately $75

million in the fourth quarter of 2011.

Corporate services revenue totaled $.9 billion in 2011 and

$1.1 billion in 2010. Lower values of commercial mortgage

servicing rights, largely driven by lower interest rates and

higher loan prepayment rates, and lower special servicing fees

drove the decline.

Residential mortgage revenue totaled $713 million in 2011

compared with $699 million in 2010. Higher loan sales

revenue drove the comparison, largely offset by lower net

hedging gains on mortgage servicing rights and lower

servicing fees. Loan sales revenue included the impact of a

decrease in the provision for residential mortgage repurchase

reserves, which decreased to $102 million in 2011 compared

to $120 million in 2010.

Service charges on deposits totaled $534 million for 2011 and

$705 million for 2010. The decline resulted primarily from the

impact of Regulation E rules pertaining to overdraft fees.

Net gains on sales of securities totaled $249 million in 2011

and $426 million for 2010. The net credit component of OTTI

of securities recognized in earnings was a loss of $152 million

in 2011, compared with a loss of $325 million in 2010.

Gains on BlackRock related transactions included a fourth

quarter 2010 pretax gain of $160 million from our sale of

7.5 million BlackRock common shares as part of a BlackRock

secondary common stock offering.

Other noninterest income totaled $1.1 billion for 2011

compared with $.9 billion for 2010.

Provision For Credit Losses

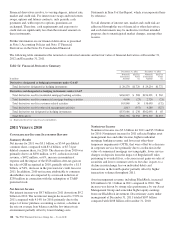

The provision for credit losses declined to $1.2 billion in 2011

compared with $2.5 billion for 2010 as overall credit quality

continued to improve due to slowly improving economic

conditions and actions we took to reduce exposure levels

during 2011.

Noninterest Expense

Noninterest expense was $9.1 billion for 2011 and $8.6 billion

for 2010. Noninterest expense for 2011 included $324 million

of residential mortgage foreclosure-related expenses primarily

as a result of ongoing governmental matters, a noncash charge

of $198 million for the unamortized discount related to

redemption of trust preferred securities, and $42 million for

integration costs. The comparable amounts for 2010 were $71

million, zero and $387 million, respectively.

Effective Income Tax Rate

Our effective income tax rate was 24.5% for 2011 and 25.5%

for 2010. The low effective tax rates were primarily

attributable to the impact of tax-exempt income and tax

credits.

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

Loans

Loans increased $8.4 billion, or 6%, to $159.0 billion as of

December 31, 2011 compared with December 31, 2010.

Growth in commercial loans of $10.5 billion, auto loans of

$2.2 billion, and education loans of $.4 billion was partially

offset by declines of $1.7 billion in commercial real estate

loans, $1.5 billion of residential real estate loans and $1.1

billion of home equity loans compared with December 31,

2010. Commercial loans increased due to a combination of

new client acquisition and improved utilization. Auto loans

increased due to the expansion of sales force and product

introduction to acquired markets, as well as overall increases

in auto sales. Education loans increased due to portfolio

purchases in 2011. Commercial and residential real estate

along with home equity loans declined due to loan demand

being outpaced by paydowns, refinancing, and charge-offs.

Average total loans decreased $1.8 billion or 1%, to $152.0

billion, in 2011 compared with 2010 primarily as loan growth

during the second half of 2011 was offset by loan decreases

during the first half of 2011. The decrease in average total

loans primarily reflected declines in commercial real estate of

$3.7 billion and residential real estate of $2.8 billion, partially

offset by a $5.1 billion increase in commercial loans.

Commercial real estate loans declined due to loan sales,

paydowns, and charge-offs. The decrease in residential real

estate was impacted by portfolio management activities,

paydowns and net charge-offs. Commercial loans increased

due to a combination of new client acquisition and improved

utilization. Loans represented 68% of average interest-earning

assets for 2011 and for 2010.

The total loan balance above includes purchased impaired

loans of $6.7 billion, or 4% of total loans, at December 31,

2011, and $7.8 billion, or 5% of total loans, at December 31,

2010.

Loans represented 59% of total assets at December 31, 2011

and 57% at December 31, 2010. Commercial lending

represented 56% of the loan portfolio at December 31, 2011

and 53% at December 31, 2010. Consumer lending

represented 44% at December 31, 2011 and 47% at

December 31, 2010. Commercial real estate loans represented

6% of total assets at December 31, 2011 and 7% of total assets

at December 31, 2010.

The PNC Financial Services Group, Inc. – Form 10-K 109