PNC Bank 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

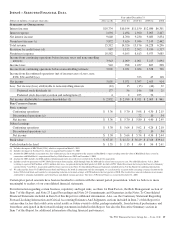

We refer you to Item 1 of this Report under the captions

Business Overview and Review of Business Segments for an

overview of our business segments and to the Business

Segments Review section of this Item 7 for the Results Of

Businesses – Summary table and further analysis of business

segment results for 2012 and 2011, including presentation

differences from Note 26 Segment Reporting in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

We provide a reconciliation of total business segment earnings

to PNC consolidated income from continuing operations

before noncontrolling interests as reported according to

accounting principles generally accepted in the United States

of America (GAAP) in Note 26 Segment Reporting in our

Notes To Consolidated Financial Statements of Item 8 of this

Report.

R

ETAIL

B

ANKING

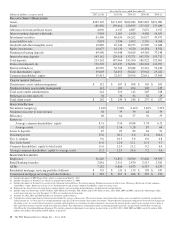

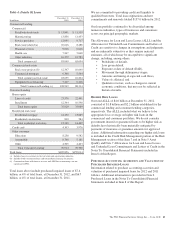

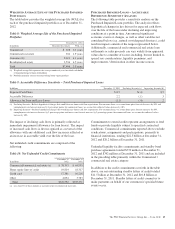

Retail Banking earned $596 million in 2012 compared with

$371 million in 2011. The increase in earnings resulted from

organic growth in transaction deposit balances, gains on sales

of Visa Class B common shares, lower rates paid on deposits,

higher levels of customer-initiated transactions, a lower

provision for credit losses, and the impact of the RBC Bank

(USA) acquisition, partially offset by the regulatory impact of

lower interchange fees on debit card transactions and higher

additions to legal reserves.

C

ORPORATE

&I

NSTITUTIONAL

B

ANKING

Corporate & Institutional Banking earned $2.3 billion in 2012

compared with $1.9 billion in 2011. The increase in earnings

was primarily due to higher revenue partially offset by higher

noninterest expense and a provision for credit losses of zero in

2012 compared with a benefit of $124 million in 2011. We

continued to focus on building client relationships including

increasing cross sales and adding new clients where the risk-

return profile was attractive.

A

SSET

M

ANAGEMENT

G

ROUP

Asset Management Group earned $145 million in 2012

compared with $168 million in 2011. Assets under

administration increased to $224 billion at December 31, 2012

from $210 billion at December 31, 2011 driven by stronger

average equity markets. Revenue increased $44 million in the

year over year comparison as strong sales and higher average

equity markets increased noninterest income by 4% and

higher average deposit balances increased net interest income

by 6%. The revenue increase was offset by higher noninterest

expense from strategic business investments and higher

provision for credit losses.

R

ESIDENTIAL

M

ORTGAGE

B

ANKING

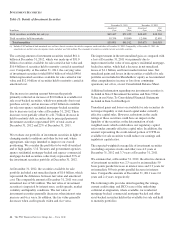

Residential Mortgage Banking reported a loss of $308 million

in 2012 compared with earnings of $89 million in 2011.

Earnings declined from the prior year primarily as a result of

higher provision for residential mortgage repurchase

obligations, higher noninterest expense, including goodwill

impairment, and lower net hedging gains on mortgage

servicing rights, partially offset by increased loan sales

revenue driven by higher loan origination volume.

B

LACK

R

OCK

Our BlackRock business segment earned $395 million in 2012

and $361 million in 2011. We hold an equity investment in

BlackRock, which is a key component of our diversified

revenue strategy. BlackRock is a publicly traded company,

and additional information regarding its business is available

in its filings with the SEC.

N

ON

-S

TRATEGIC

A

SSETS

P

ORTFOLIO

This business segment consists primarily of non-strategic

assets obtained through acquisitions of other companies. Non-

Strategic Assets Portfolio had earnings of $237 million for

2012 compared with $200 million in 2011. The increase was

primarily attributable to a lower provision for credit losses,

partially offset by lower net interest income driven by declines

in loan balances and purchase accounting accretion.

O

THER

“Other” had a loss of $392 million in 2012 compared with a

loss of $58 million in 2011. The increase in loss in the 2012

period was primarily due to higher integration costs and

noncash charges related to redemption of trust preferred

securities.

38 The PNC Financial Services Group, Inc. – Form 10-K