PNC Bank 2012 Annual Report Download - page 259

Download and view the complete annual report

Please find page 259 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

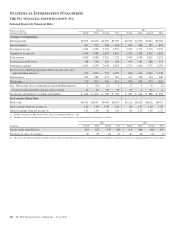

L

OANS

O

UTSTANDING

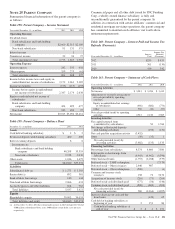

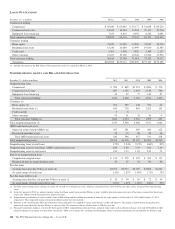

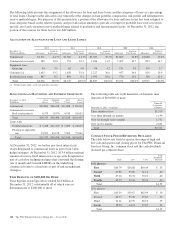

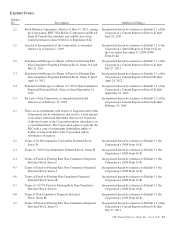

December 31 – in millions 2012(a) 2011 2010 2009 2008

Commercial lending

Commercial $ 83,040 $ 65,694 $ 55,177 $ 54,818 $ 69,220

Commercial real estate 18,655 16,204 17,934 23,131 25,736

Equipment lease financing 7,247 6,416 6,393 6,202 6,461

Total commercial lending 108,942 88,314 79,504 84,151 101,417

Consumer lending

Home equity 35,920 33,089 34,226 35,947 38,276

Residential real estate 15,240 14,469 15,999 19,810 21,583

Credit card 4,303 3,976 3,920 2,569 2,237

Other consumer 21,451 19,166 16,946 15,066 11,976

Total consumer lending 76,914 70,700 71,091 73,392 74,072

Total loans $185,856 $159,014 $150,595 $157,543 $175,489

(a) Includes the impact of the RBC Bank (USA) acquisition, which we acquired on March 2, 2012.

N

ONPERFORMING

A

SSETS AND

R

ELATED

I

NFORMATION

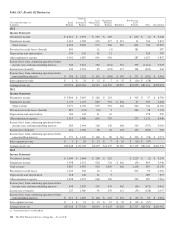

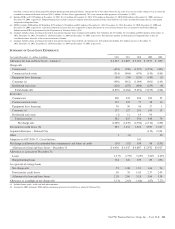

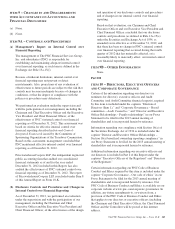

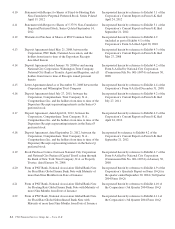

December 31 – dollars in millions 2012 2011 2010 2009 2008

Nonperforming loans

Commercial $ 590 $ 899 $1,253 $1,806 $ 576

Commercial real estate 807 1,345 1,835 2,140 766

Equipment lease financing 13 22 77 130 97

Total commercial lending 1,410 2,266 3,165 4,076 1,439

Consumer (a)

Home equity (b) 951 529 448 356 66

Residential real estate (c) 845 726 818 1,203 153

Credit card (d) 58

Other consumer 43 31 35 36 4

Total consumer lending (e) 1,844 1,294 1,301 1,595 223

Total nonperforming loans (f) 3,254 3,560 4,466 5,671 1,662

OREO and foreclosed assets

Other real estate owned (OREO) (g) 507 561 589 484 422

Foreclosed and other assets 33 35 68 49 16

Total OREO and foreclosed assets 540 596 657 533 438

Total nonperforming assets $3,794 $4,156 $5,123 $6,204 $2,100

Nonperforming loans to total loans 1.75% 2.24% 2.97% 3.60% .95%

Nonperforming assets to total loans, OREO and foreclosed assets 2.04 2.60 3.39 3.92 1.19

Nonperforming assets to total assets 1.24 1.53 1.94 2.30 .72

Interest on nonperforming loans

Computed on original terms $ 212 $ 278 $ 329 $ 302 $ 115

Recognized prior to nonperforming status 30 47 53 90 60

Past due loans

Accruing loans past due 90 days or more (h) $2,351 $2,973 $2,709 $2,698 $1,321

As a percentage of total loans 1.26% 1.87% 1.80% 1.71% .75%

Past due loans held for sale

Accruing loans held for sale past due 90 days or more (i) $ 38 $ 49 $ 65 $ 72 $ 40

As a percentage of total loans held for sale 1.03% 1.67% 1.86% 2.84% .92%

(a) Excludes most consumer loans and lines of credit, not secured by residential real estate, which are charged off after 120 to 180 days past due and are not placed on nonperforming

status.

(b) In the first quarter of 2012, we adopted a policy stating that Home equity loans past due 90 days or more would be placed on nonaccrual status. Prior policy required that these loans

be past due 180 days before being placed on nonaccrual status.

(c) Nonperforming residential real estate excludes loans of $69 million and $61 million accounted for under the fair value option as of December 31, 2012 and December 31, 2011,

respectively. The comparable balances for prior periods presented were not material.

(d) Effective in the second quarter 2011, the commercial nonaccrual policy was applied to certain small business credit card balances. This change resulted in loans being placed on

nonaccrual status when they become 90 days or more past due. We continue to charge off these loans at 180 days past due.

(e) Pursuant to regulatory guidance, issued in the third quarter of 2012, nonperforming consumer loans, primarily home equity and residential mortgage, increased $288 million in 2012

related to changes in treatment of certain loans classified as TDRs, net of charge-offs, resulting from bankruptcy where no formal reaffirmation was provided by the borrower and

240 The PNC Financial Services Group, Inc. – Form 10-K