PNC Bank 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial derivatives involve, to varying degrees, interest rate,

market and credit risk. For interest rate swaps and total return

swaps, options and futures contracts, only periodic cash

payments and, with respect to options, premiums are

exchanged. Therefore, cash requirements and exposure to

credit risk are significantly less than the notional amount on

these instruments.

Further information on our financial derivatives is presented

in Note 1 Accounting Policies and Note 17 Financial

Derivatives in the Notes To Consolidated Financial

Statements in Item 8 of this Report, which is incorporated here

by reference.

Not all elements of interest rate, market and credit risk are

addressed through the use of financial or other derivatives,

and such instruments may be ineffective for their intended

purposes due to unanticipated market changes, among other

reasons.

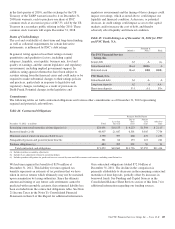

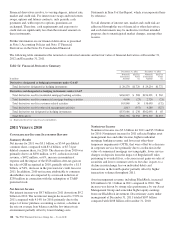

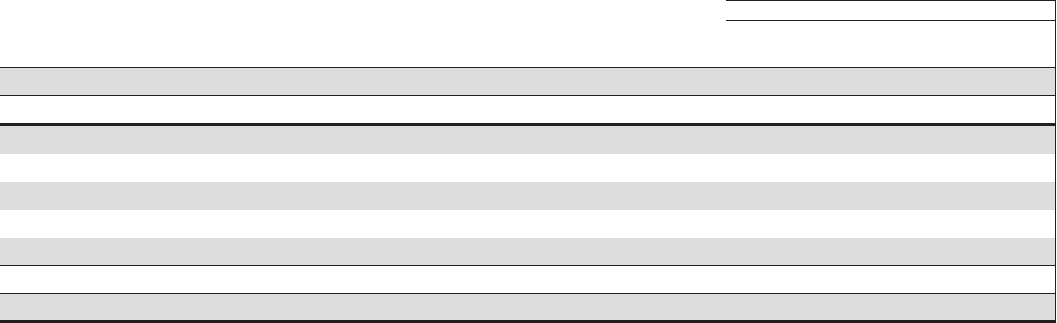

The following table summarizes the notional or contractual amounts and net fair value of financial derivatives at December 31,

2012 and December 31, 2011.

Table 54: Financial Derivatives Summary

December 31, 2012 December 31, 2011

In millions

Notional/

Contractual

Amount

Net Fair

Value

(a)

Notional/

Contractual

Amount

Net Fair

Value

(a)

Derivatives designated as hedging instruments under GAAP

Total derivatives designated as hedging instruments $ 29,270 $1,720 $ 29,234 $1,772

Derivatives not designated as hedging instruments under GAAP

Total derivatives used for residential mortgage banking activities $166,819 $ 588 $196,991 $ 565

Total derivatives used for commercial mortgage banking activities 4,606 (23) 2,720 (21)

Total derivatives used for customer-related activities 163,848 30 158,095 (132)

Total derivatives used for other risk management activities 1,813 (357) 4,289 (327)

Total derivatives not designated as hedging instruments $337,086 $ 238 $362,095 $ 85

Total Derivatives $366,356 $1,958 $391,329 $1,857

(a) Represents the net fair value of assets and liabilities.

2011 V

ERSUS

2010

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Summary Results

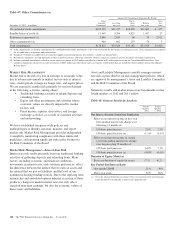

Net income for 2011 was $3.1 billion, or $5.64 per diluted

common share, compared with $3.4 billion, or $5.74 per

diluted common share, for 2010. The decrease from 2010 was

primarily due to an $850 million, or 6%, reduction in total

revenue, a $492 million, or 6%, increase in noninterest

expense and the impact of the $328 million after-tax gain on

the sale of GIS recognized in 2010, partially offset by a $1.3

billion, or 54%, decrease in the provision for credit losses in

2011. In addition, 2010 net income attributable to common

shareholders was also impacted by a noncash reduction of

$250 million in connection with the redemption of TARP

preferred stock.

Net Interest Income

Net interest income was $8.7 billion for 2011 down from $9.2

billion in 2010. The net interest margin decreased to 3.92% in

2011 compared with 4.14% for 2010, primarily due to the

impact of lower purchase accounting accretion, a decline in

the rate on average loan balances and the low interest rate

environment partially offset by lower funding costs.

Noninterest Income

Noninterest income was $5.6 billion for 2011 and $5.9 billion

for 2010. Noninterest income for 2011 reflected higher asset

management fees and other income, higher residential

mortgage banking revenue, and lower net other-than-

temporary impairments (OTTI), that were offset by a decrease

in corporate service fees primarily due to a reduction in the

value of commercial mortgage servicing rights, lower service

charges on deposits from the impact of Regulation E rules

pertaining to overdraft fees, a decrease in net gains on sales of

securities and lower consumer services fees due, in part, to a

decline in interchange fees on individual debit card

transactions in the fourth quarter partially offset by higher

transaction volumes throughout 2011.

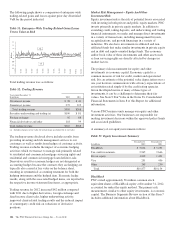

Asset management revenue, including BlackRock, increased

$34 million to $1.1 billion in 2011 compared to 2010. The

increase was driven by strong sales performance by our Asset

Management Group and somewhat higher equity earnings

from our BlackRock investment. Discretionary assets under

management at December 31, 2011 totaled $107 billion

compared with $108 billion at December 31, 2010.

108 The PNC Financial Services Group, Inc. – Form 10-K