PNC Bank 2012 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

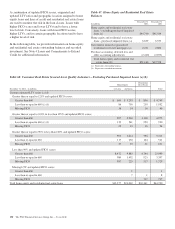

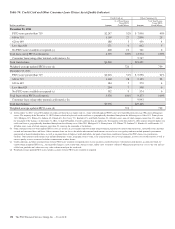

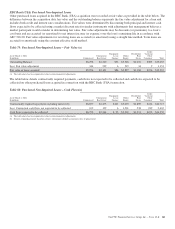

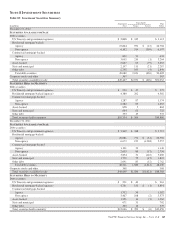

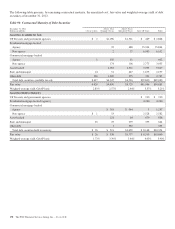

Activity for the accretable yield for 2012 follows:

Table 76: Purchased Impaired Loans – Accretable Yield (a)

In millions 2012

January 1 $2,109

Addition of accretable yield due to RBC Bank (USA)

acquisition on March 2, 2012 587

Accretion (including excess cash recoveries) (828)

Net reclassifications to accretable from non-accretable (b) 327

Disposals (29)

December 31 $2,166

(a) The table above has been updated to reflect certain immaterial adjustments.

(b) Over eighty-five percent of the net reclassifications were driven by the commercial

portfolio. Over half of the commercial portfolio impact related to excess cash

recoveries recognized during the period, with the remaining due to improvements of

cash expected to be collected on both RBC Bank (USA) and National City loans in

future periods. The remaining net reclassifications were due to future cash flow

changes in the consumer portfolio.

RBC B

ANK

(USA) A

CQUISITION

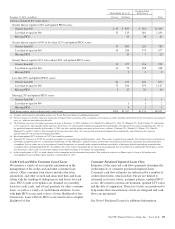

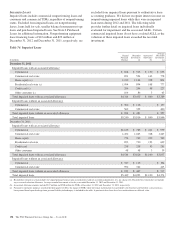

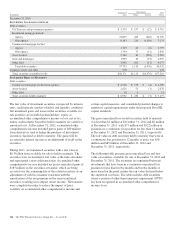

Loans acquired as part of the RBC Bank (USA) acquisition on

March 2, 2012 had an outstanding balance of $16.7 billion. At

purchase, acquired loans were recorded at fair value. No

separate valuation allowance was carried over and no

allowance was created at acquisition. Fair values were

determined by discounting both principal and interest cash

flows expected to be collected using a market discount rate for

similar instruments with adjustments that management

believes a market participant would consider in determining

fair value. Cash flows expected to be collected as of the

acquisition date were estimated using internal models and

third party data that incorporate management’s best estimate

of key assumptions, such as default rates, loss severity,

prepayment speeds, and timing of disposition upon default. In

addition, each loan was reviewed to determine if it should be

classified as a purchased impaired loan accounted for under

ASC 310-30. Loans with evidence of credit quality

deterioration since origination and for which it was probable

at purchase that PNC will be unable to collect all contractually

required payments were considered purchased impaired.

Several factors were considered when evaluating whether a

loan was considered a purchased impaired loan, including the

delinquency status of the loan, updated borrower credit status,

geographic information, and updated loan-to-values (LTV). In

accordance with ASC 310-30, excluded from the purchased

impaired loans were leases, revolving credit arrangements and

loans held for sale.

As of March 2, 2012, loans were classified as purchased

impaired or purchased non-impaired and had a fair value of

$2.0 billion and $12.5 billion, respectively, and an outstanding

balance of $3.0 billion and $13.7 billion, respectively.

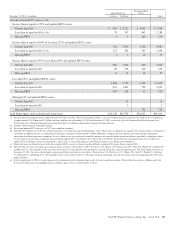

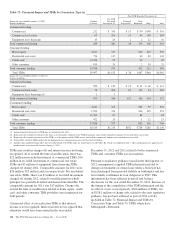

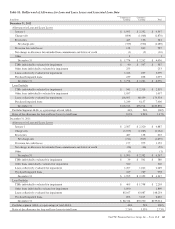

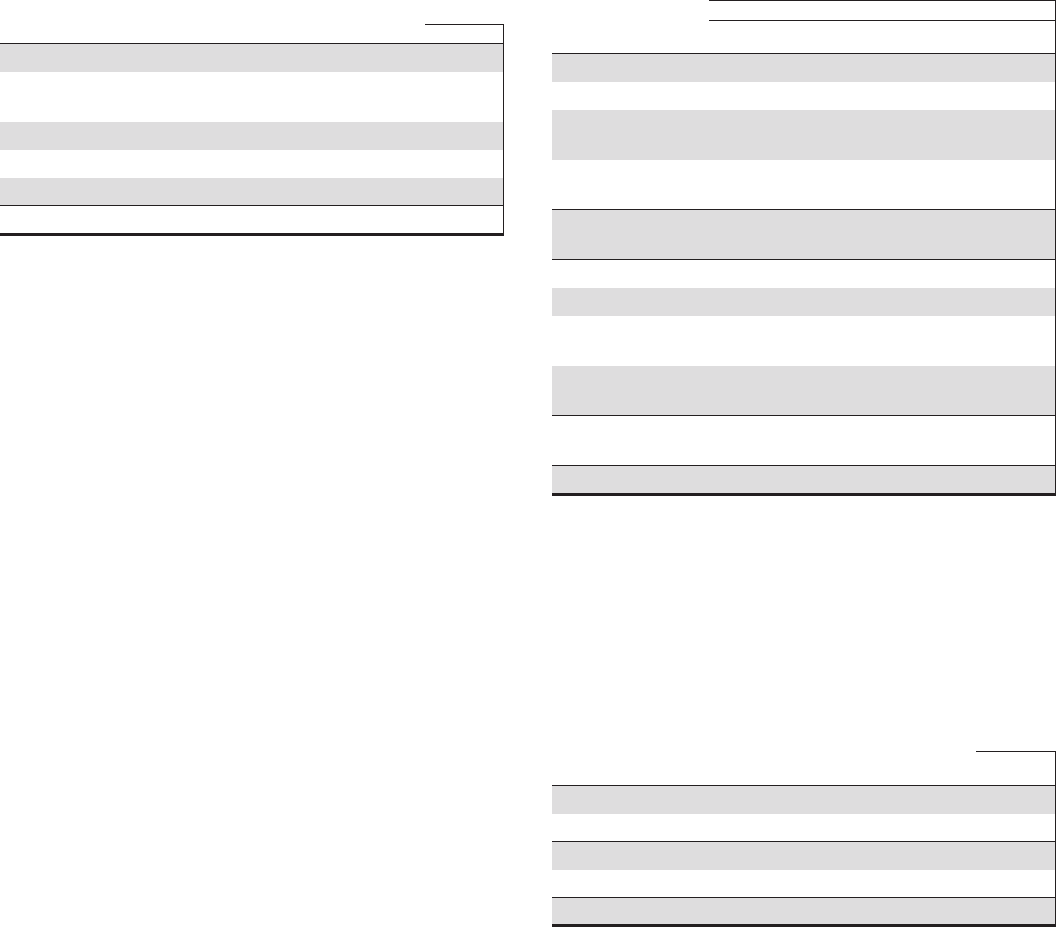

Table 77: RBC Bank (USA) Acquisition – Purchased Loans

Balances (a)

Purchased Impaired Loans Other Purchased Loans

As of March 2, 2012

In millions Fair Value

Outstanding

Balance Fair Value

Outstanding

Balance

Commercial Lending

Commercial $ 330 $ 564 $ 5,954 $ 6,298

Commercial real

estate 597 1,018 2,101 2,340

Equipment lease

financing 86 92

Total Commercial

Lending 927 1,582 8,141 8,730

Consumer Lending

Home equity 175 215 2,827 3,346

Residential real

estate 896 1,214 1,168 1,202

Credit card and

other consumer 376 385

Total Consumer

Lending 1,071 1,429 4,371 4,933

Total $1,998 $3,011 $12,512 $13,663

(a) The table above has been updated to reflect certain immaterial adjustments and

reclassifications between commercial and commercial real estate.

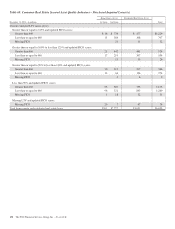

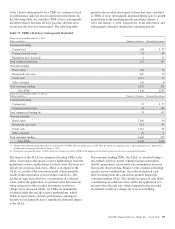

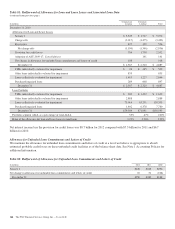

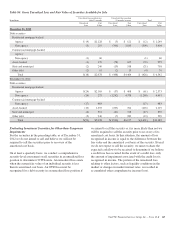

The table below details the contractually required payments,

non-accretable difference, accretable yield, and fair value for

purchased impaired loans acquired in the RBC Bank (USA)

acquisition as of March 2, 2012.

Table 78: Purchased Impaired Loans – RBC Bank (USA)

Acquisition(a)

In millions

March 2,

2012

Contractually required payments including interest $3,769

Less: Nonaccretable difference 1,184

Cash flows expected to be collected 2,585

Less: Accretable yield 587

Fair value of loans acquired $1,998

(a) The table above has been updated to reflect certain immaterial adjustments.

160 The PNC Financial Services Group, Inc. – Form 10-K