PNC Bank 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tax Credit Investments

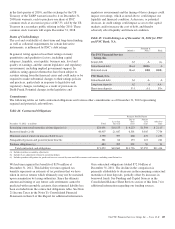

Included in our equity investments are tax credit investments

which are accounted for under the equity method. These

investments, as well as equity investments held by

consolidated partnerships, totaled $3.0 billion at December 31,

2012 and $2.6 billion at December 31, 2011. These equity

investment balances include unfunded commitments totaling

$685 million and $420 million, respectively. These unfunded

commitments are included in Other Liabilities on our

Consolidated Balance Sheet.

Note 3 Loan Sale and Servicing Activities and Variable

Interest Entities in the Notes To Consolidated Financial

Statements in Item 8 of this Report has further information on

Tax Credit Investments.

Private Equity

The private equity portfolio is an illiquid portfolio comprised

of mezzanine and equity investments that vary by industry,

stage and type of investment.

Private equity investments carried at estimated fair value

totaled $1.8 billion at December 31, 2012 and $1.5 billion at

December 31, 2011. As of December 31, 2012, $1.2 billion

was invested directly in a variety of companies and $.6 billion

was invested indirectly through various private equity funds.

Included in direct investments are investment activities of two

private equity funds that are consolidated for financial

reporting purposes. The noncontrolling interests of these funds

totaled $266 million as of December 31, 2012. The indirect

private equity funds are not redeemable, but PNC receives

distributions over the life of the partnership from liquidation

of the underlying investments by the investee. See Item 1

Business – Supervision and Regulation and Item 1A Risk

Factors of this Report for discussion of potential impacts of

the Volcker Rule provisions of Dodd-Frank on our holding

interests in and sponsorship of private equity or hedge funds.

Our unfunded commitments related to private equity totaled

$182 million at December 31, 2012 compared with $247

million at December 31, 2011.

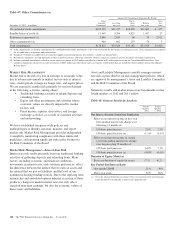

Visa

In 2012, we sold 9 million of Visa Class B common shares

and entered into swap agreements with the purchaser of the

shares. See Note 9 Fair Value and Note 17 Financial

Derivatives in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional information.

At December 31, 2012, our investment in Visa Class B

common shares totaled approximately 14 million shares and

was recorded at $251 million. Based on the December 31,

2012 closing price of $151.58 for the Visa Class A common

shares, the fair value of our total investment was

approximately $916 million at the current conversion rate

which reflects adjustments in respect of all litigation funding

by Visa to date. The Visa Class B common shares that we own

are transferable only under limited circumstances (including

those applicable to the sales in 2012) until they can be

converted into shares of the publicly traded class of stock,

which cannot happen until the settlement of all of the

specified litigation. It is expected that Visa will continue to

adjust the conversion rate of Visa Class B common shares to

Class A common shares in connection with any settlements of

the specified litigation in excess of any amounts then in

escrow for that purpose and will also reduce the conversion

rate to the extent that it adds any funds to the escrow in the

future.

Note 24 Commitments and Guarantees in the Notes To

Consolidated Financial Statements in Item 8 of this Report has

further information on our Visa indemnification obligation.

Other Investments

We also make investments in affiliated and non-affiliated

funds with both traditional and alternative investment

strategies. The economic values could be driven by either the

fixed-income market or the equity markets, or both. At

December 31, 2012, other investments totaled $245 million

compared with $250 million at December 31, 2011. We

recognized net gains related to these investments of $55

million during 2012, compared with $1 million during 2011.

Given the nature of these investments, if market conditions

affecting their valuation were to worsen, we could incur future

losses.

Our unfunded commitments related to other investments

totaled $3 million at both December 31, 2012 and

December 31, 2011.

Impact of Inflation

Our assets and liabilities are primarily financial in nature and

typically have varying maturity dates. Accordingly, future

changes in prices do not affect the obligations to pay or

receive fixed and determinable amounts of money. However,

during periods of inflation, there may be a subsequent impact

affecting certain fixed costs or expenses, an erosion of

consumer and customer purchasing power, and fluctuations in

the need or demand for our products and services. Should

significant levels of inflation occur, our business could

potentially be impacted by, among other things, reducing our

tolerance for extending credit or causing us to incur additional

credit losses resulting from possible increased default rates.

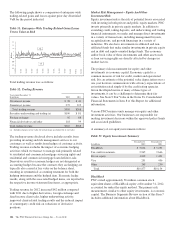

Financial Derivatives

We use a variety of financial derivatives as part of the overall

asset and liability risk management process to help manage

exposure to interest rate, market and credit risk inherent in our

business activities. Substantially all such instruments are used

to manage risk related to changes in interest rates. Interest rate

and total return swaps, interest rate caps and floors, swaptions,

options, forwards and futures contracts are the primary

instruments we use for interest rate risk management. We also

enter into derivatives with customers to facilitate their risk

management activities.

The PNC Financial Services Group, Inc. – Form 10-K 107