PNC Bank 2012 Annual Report Download - page 89

Download and view the complete annual report

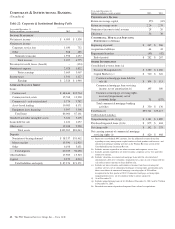

Please find page 89 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.This business segment consists primarily of non-strategic

assets obtained through acquisitions of other companies. Non-

Strategic Assets Portfolio had earnings of $237 million in

2012 compared with $200 million in 2011. The increase was

primarily attributable to a lower provision for credit losses,

partially offset by lower net interest income driven by declines

in loan balances and purchase accounting accretion.

2012 included the impact of the RBC Bank (USA) acquisition,

which added approximately $1.0 billion of residential real

estate loans, $.2 billion of commercial/commercial real estate

loans and $.2 billion of OREO assets. Of these assets, $1.0

billion were deemed purchased impaired loans.

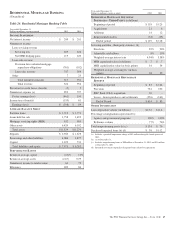

Non-Strategic Assets Portfolio overview:

• Net interest income was $830 million in 2012

compared with $913 million 2011. The decrease was

driven by lower purchase accounting accretion and

loan balances.

• Noninterest income was $13 million in 2012

compared with $47 million 2011. The decline was

driven mainly by larger valuation adjustments to

liabilities for estimated repurchase losses on home

equity loans sold.

• The provision for credit losses was $181 million in

2012 compared with $366 million in 2011. The

decrease in the provision for credit losses reflected a

declining loan portfolio and improvement in asset

quality.

• Noninterest expense in 2012 was $287 million

compared with $275 million in 2011. The increase

was primarily due to higher other real estate owned

expenses.

• Average portfolio loans declined to $12.4 billion in

2012 compared with $13.4 billion in 2011. The

overall decline was driven by customer payment

activity and portfolio management activities to

reduce under-performing assets partially offset by the

addition of loans from the RBC Bank (USA)

acquisition.

• Nonperforming loans were $.7 billion as of

December 31, 2012 and December 31, 2011. The

consumer lending portfolio comprised 80% of

nonperforming loans at December 31, 2012.

Nonperforming consumer loans increased $83

million from December 31, 2011 as a result of a

change in the nonaccrual policy for home equity

loans requiring loans to be placed on nonaccrual at

90 days past due compared to the prior policy of 180

days. Also contributing to the increase was a change

in the treatment of certain consumer loans classified

as TDRs, pursuant to regulatory guidance issued in

the third quarter of 2012. These TDRs resulted from

bankruptcy where no formal reaffirmation was

provided by the borrower thereby granting a

concession upon discharge from personal liability.

• Net charge-offs were $299 million in 2012 and $370

million in 2011. Net charge-offs declined 17% on the

consumer lending portfolio and 23% on the

commercial lending portfolio.

The business activity of this segment is to manage the wind-

down of the portfolio assigned to it while maximizing the

value and mitigating risk. The fair value marks taken upon

acquisition of the assets, the team we have in place, and

targeted asset resolution strategies help us to manage these

assets.

• The Commercial Lending portfolio declined 18% to

$1.35 billion at December 31, 2012 compared to

December 31, 2011. Loans to residential developers

declined 32% to $.7 billion while the lease financing

portfolio remained relatively flat at $.7 billion. The

leases are long-term with relatively low credit risk.

• The Consumer Lending portfolio declined $.4 billion,

or 4%, when compared to the same period last year.

Excluding $.9 billion of residential mortgage loans

from the RBC Bank (USA) acquisition, the portfolio

decreased 13%. The portfolio’s credit quality has

stabilized through actions taken by management. We

have implemented various refinance programs, line

management programs, and loss mitigation programs

to mitigate risks within this portfolio while assisting

borrowers to maintain homeownership when

possible.

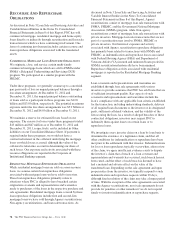

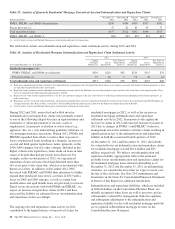

• When loans are sold, we may assume certain loan

repurchase obligations to indemnify investors against

losses or to repurchase loans that they believe do not

comply with applicable contractual loan origination

covenants and representations and warranties we

have made. From 2005 to 2007, home equity loans

were sold with such contractual provisions. At

December 31, 2012, the liability for estimated losses

on repurchase and indemnification claims for the

Non-Strategic Assets Portfolio was $58 million

compared to $47 million at December 31, 2011. See

the Recourse And Repurchase Obligations section of

this Item 7 and Note 24 Commitments and

Guarantees in the Notes To Consolidated Financial

Statements included in Item 8 of this Report for

additional information.

70 The PNC Financial Services Group, Inc. – Form 10-K