PNC Bank 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.institution determines its risk-weighted assets for risk-based

capital purposes under the Basel II framework applicable to

large or internationally active banks (referred to as the

advanced approaches) and under the Basel I framework

applicable to all banking institutions (referred to as the

standardized approach). For additional information on the

proposed capital rules issued by the U.S. banking agencies in

June 2012 and the potential impact of such rules on PNC,

please see Risk Factors in Item 1A of this Report.

The public comment period on these three sets of proposed

rules closed on October 22, 2012, and final rules have not yet

been issued. The agencies originally proposed that the Basel

III and advanced approaches proposal would become effective

on January 1, 2013, but subsequently indicated that the

effective date of these rules remains under consideration. The

standardized approach proposal is proposed to become

effective on January 1, 2015.

In June 2012, the Federal banking agencies also adopted final

market risk capital rules to implement the enhancements to the

market risk framework adopted by the Basel Committee

(commonly referred to as “Basel II.5”). The final rules, which

apply to PNC, became effective January 1, 2013 and, among

other things, narrow the types of positions that are subject to

the market risk capital framework, establish a new stressed

Value at Risk (“VaR”) charge for covered trading positions,

provide for certain market risk-related public disclosures and

replace references to credit ratings in the market risk rules

with alternative methodologies for assessing credit risk.

A number of other reform provisions are likely to significantly

impact the ways in which banks and bank holding companies,

including PNC, do business. We provide additional

information on a number of these provisions (including new

regulatory agencies (such as the Consumer Financial

Protection Bureau (CFPB)), consumer protection regulation,

enhanced prudential standards (including stress test

requirements), limitations on investment in and sponsorship of

funds, risk retention by securitization participants, new

regulation of derivatives, and potential applicability of state

consumer protection laws) and some of their potential impacts

on PNC in Item 1 Business–Supervision and Regulation and

Item 1A Risk Factors of this Report.

As noted in prior filings, in April 2011, PNC and other

mortgage servicers entered into Consent Orders with the OCC

and Federal Reserve Board requiring, among other matters,

that the servicers retain independent consultants to conduct

reviews of default and foreclosure files from the 2009-2010

timeframe regarding possible improper financial harm to

borrowers as a result of such default and foreclosure activities.

In early 2013, PNC and 12 other servicers agreed with the

OCC and the Federal Reserve to end the independent

consultants’ files review program and to replace it with an

accelerated remediation process. PNC agreed to pay

approximately $70 million for distribution to potentially

affected borrowers in the review population, and agreed to

provide approximately $111 million in additional loss

mitigation or other foreclosure prevention relief, which may

be satisfied pursuant to the amended consent orders by a

variety of borrower relief actions or by additional cash

payments or resource commitments to borrower counseling or

education. PNC expects residential mortgage foreclosure-

related compliance expenses to decrease substantially in 2013

compared with 2012.

There have been, and continue to be, numerous other

governmental, legislative and regulatory inquiries and

investigations on this topic and other issues related to

mortgage lending and servicing. These inquiries and

investigations may result in significant additional actions,

penalties or other remedies.

For additional information, including with respect to some of

the governmental, legislative and regulatory inquiries and

investigations, please see Risk Factors in Item 1A of this

Report and Note 23 Legal Proceedings and Note 24

Commitments and Guarantees in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

The mortgage industry, including PNC, has seen further

changes in behavior and demand patterns of government-

sponsored enterprises, FHLMC and FNMA, for loans sold into

agency securitizations, primarily focused on loans originated

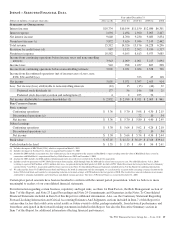

prior to 2008. PNC recorded an additional pre-tax provision of

$761 million in 2012 for residential mortgage repurchase

obligations related to expected elevated levels of repurchase

demands bringing the total reserve on our balance sheet for

residential mortgage repurchase claims at December 31, 2012

to $614 million.

H

URRICANE

S

ANDY

During the last week of October 2012, Hurricane Sandy

caused widespread damage along the East Coast particularly

in New Jersey, a key market area for us. The storm resulted in

significant property damage to our customers, the closing or

disruption of many businesses and damage to the community

infrastructure. Despite the damage and disruption to some of

its branches and facilities, PNC assisted its customers, clients

and borrowers in the affected areas. PNC waived a number of

checking account and loan fees, including late payment fees

on business and consumer loans, which did not have a

significant impact to PNC’s financial statements. PNC also

incurred expenses related to Hurricane Sandy the majority of

which are related to damage to branches in the affected areas.

In addition, PNC also experienced some credit-related

expenses. These expenses did not have a significant impact to

PNC’s financial statements.

34 The PNC Financial Services Group, Inc. – Form 10-K