PNC Bank 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

consist of first and second liens, the charge-off amounts for

the pool are proportionate to the composition of first and

second liens in the pool. Our experience has been that the ratio

of first to second lien loans has been consistent over time and

is appropriately represented in our pools used for roll-rate

calculations.

Generally, our variable-rate home equity lines of credit have

either a seven or ten year draw period, followed by a 20 year

amortization term. During the draw period, we have home

equity lines of credit where borrowers pay interest only and

home equity lines of credit where borrowers pay principal and

interest. Based upon outstanding balances at December 31,

2012, the following table presents the periods when home

equity lines of credit draw periods are scheduled to end.

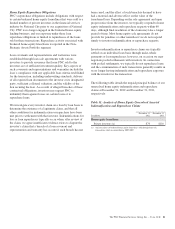

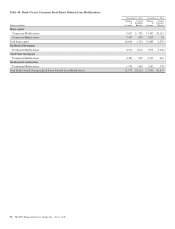

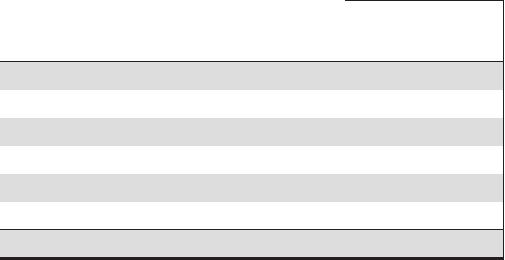

Table 39: Home Equity Lines of Credit – Draw Period End

Dates

In millions

Interest

Only

Product

Principal

and

Interest

Product

2013 $ 1,338 $ 221

2014 2,048 475

2015 2,024 654

2016 1,571 504

2017 3,075 697

2018 and thereafter 5,497 4,825

Total (a) $15,553 $7,376

(a) Includes approximately $166 million, $208 million, $213 million, $61 million, $70

million and $526 million of home equity lines of credit with balloon payments with

draw periods scheduled to end in 2013, 2014, 2015, 2016, 2017 and 2018 and

thereafter, respectively.

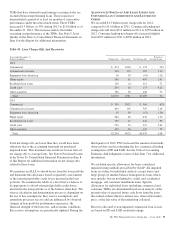

We view home equity lines of credit where borrowers are

paying principal and interest under the draw period as less

risky than those where the borrowers are paying interest only,

as these borrowers have a demonstrated ability to make some

level of principal and interest payments.

Based upon outstanding balances, and excluding purchased

impaired loans, at December 31, 2012, for home equity lines

of credit for which the borrower can no longer draw (e.g.,

draw period has ended or borrowing privileges have been

terminated), approximately 3.86% were 30-89 days past due

and approximately 5.96% were greater than or equal to 90

days past due. Generally, when a borrower becomes 60 days

past due, we terminate borrowing privileges, and those

privileges are not subsequently reinstated. At that point, we

continue our collection/recovery processes, which may

include a loss mitigation loan modification resulting in a loan

that is classified as a TDR.

See Note 5 Asset Quality in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information.

L

OAN

M

ODIFICATIONS AND

T

ROUBLED

D

EBT

R

ESTRUCTURINGS

Consumer Loan Modifications

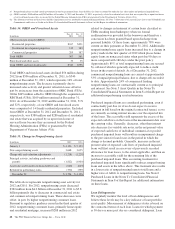

We modify loans under government and PNC-developed

programs based upon our commitment to help eligible

homeowners and borrowers avoid foreclosure, where

appropriate. Initially, a borrower is evaluated for a

modification under a government program. If a borrower does

not qualify under a government program, the borrower is then

evaluated under a PNC program. Our programs utilize both

temporary and permanent modifications and typically reduce

the interest rate, extend the term and/or defer principal.

Temporary and permanent modifications under programs

involving a change to loan terms are generally classified as

TDRs. Further, certain payment plans and trial payment

arrangements which do not include a contractual change to

loan terms may be classified as TDRs. Additional detail on

TDRs is discussed below as well as in Note 5 Asset Quality in

the Notes To Consolidated Financial Statements in Item 8 of

this Report.

A temporary modification, with a term between three and 60

months, involves a change in original loan terms for a period of

time and reverts to a calculated exit rate for the remaining term

of the loan as of a specific date. A permanent modification, with

a term greater than 60 months, is a modification in which the

terms of the original loan are changed. Permanent modifications

primarily include the government-created Home Affordable

Modification Program (HAMP) or PNC-developed HAMP-like

modification programs.

For consumer loan programs, such as residential mortgages and

home equity loans and lines, we will enter into a temporary

modification when the borrower has indicated a temporary

hardship and a willingness to bring current the delinquent loan

balance. Examples of this situation often include delinquency

due to illness or death in the family, or a loss of employment.

Permanent modifications are entered into when it is confirmed

that the borrower does not possess the income necessary to

continue making loan payments at the current amount, but our

expectation is that payments at lower amounts can be made.

Residential mortgage and home equity loans and lines have

been modified with changes in terms for up to 60 months,

although the majority involve periods of three to 24 months.

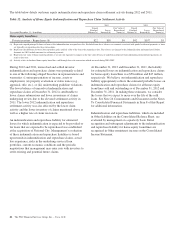

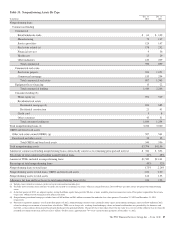

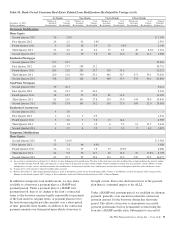

We also monitor the success rates and delinquency status of our

loan modification programs to assess their effectiveness in

serving our customers’ needs while mitigating credit losses. The

following tables provide the number of accounts and unpaid

principal balance of modified consumer real estate related loans

as well as the number of accounts and unpaid principal balance

of modified loans that were 60 days or more past due as of six

months, nine months, twelve months and fifteen months after

the modification date.

The PNC Financial Services Group, Inc. – Form 10-K 91