PNC Bank 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

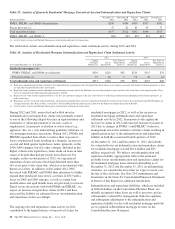

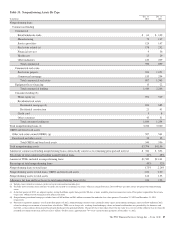

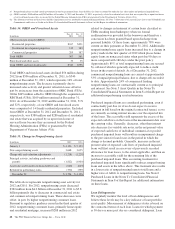

Table 38: Accruing Loans Past Due 90 Days Or More (a)

Amount

Percentage of Total

Outstandings

Dollars in millions

Dec. 31

2012

Dec. 31

2011

Dec. 31

2012

Dec. 31

2011

Commercial $ 42 $ 49 .05% .07%

Commercial real estate 15 6 .08 .04

Equipment lease financing 2 .03

Home equity (b) 221 .67

Residential real estate

Non government insured 46 152 .30 1.05

Government insured 1,855 2,129 12.17 14.71

Credit card 36 48 .84 1.21

Other consumer

Non government insured 18 23 .08 .12

Government insured 337 345 1.57 1.80

Total $2,351 $2,973 1.26 1.87

(a) Amounts in table represent recorded investment.

(b) In the first quarter of 2012, we adopted a policy stating that Home equity loans past due 90 days or more would be placed on nonaccrual status. Prior policy required that these loans

be past due 180 days before being placed on nonaccrual status.

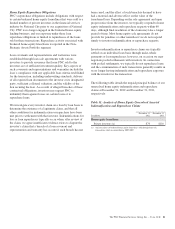

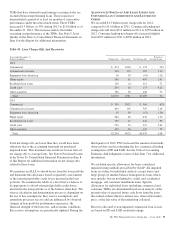

On a regular basis our Special Asset Committee closely

monitors loans, primarily commercial loans, that are not

included in the nonperforming or accruing past due categories

and for which we are uncertain about the borrower’s ability to

comply with existing repayment terms over the next six

months. These loans totaled $242 million at December 31,

2012 and $438 million at December 31, 2011.

Home Equity Loan Portfolio

Our home equity loan portfolio totaled $35.9 billion as of

December 31, 2012, or 19% of the total loan portfolio. Of that

total, $23.6 billion, or 66%, was outstanding under primarily

variable-rate home equity lines of credit and $12.3 billion, or

34%, consisted of closed-end home equity installment loans.

Approximately 3% of the home equity portfolio was on

nonperforming status as of December 31, 2012.

As of December 31, 2012, we are in an originated first lien

position for approximately 37% of the total portfolio and,

where originated as a second lien, we currently hold or service

the first lien position for approximately an additional 2% of

the portfolio. Historically, we have originated and sold first

lien residential real estate mortgages which resulted in a low

percentage of home equity loans where we hold the first lien

mortgage position. The remaining 61% of the portfolio was

secured by second liens where we do not hold the first lien

position. For the majority of the home equity portfolio where

we are in, hold or service the first lien position, the credit

performance of this portion of the portfolio is superior to the

portion of the portfolio where we hold the second lien position

but do not hold the first lien.

Subsequent to origination, PNC is not typically notified when

a senior lien position that is not held by PNC is satisfied.

Therefore, information about the current lien status of the

loans is limited, for loans that were originated in subordinated

lien positions where PNC does not also hold the senior lien, to

what can be obtained from external sources. PNC contracted

with a third-party service provider to provide updated loan,

lien and collateral data that is aggregated from public and

private sources.

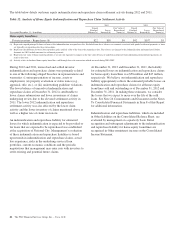

We track borrower performance monthly, including obtaining

updated FICO scores at least quarterly, original LTVs,

updated LTVs semi-annually, and other credit metrics at least

quarterly, including the historical performance of any

mortgage loans regardless of lien position that we may or may

not hold. This information is used for internal reporting and

risk management purposes. For internal reporting and risk

management purposes we also segment the population into

pools based on product type (e.g., home equity loans, brokered

home equity loans, home equity lines of credit, brokered home

equity lines of credit). As part of our overall risk analytics

monitoring, we segment the home equity portfolio based upon

the delinquency, modification status, and bankruptcy status of

these loans, as well as based upon the delinquency,

modification status, and bankruptcy status of any mortgage

loan with the same borrower (regardless of whether it is a first

lien senior to our second lien).

In establishing our ALLL for non-impaired loans, we utilize a

delinquency roll-rate methodology for pools of loans. In

accordance with accounting principles, under this

methodology, we establish our allowance based upon incurred

losses and not lifetime expected losses. The roll-rate

methodology estimates transition/roll of loan balances from

one delinquency state (e.g., 30-59 days past due) to another

delinquency state (e.g., 60-89 days past due), and ultimately

charge-off. The roll through to charge-off is based on PNC’s

actual loss experience for each type of pool. Since a pool may

90 The PNC Financial Services Group, Inc. – Form 10-K