PNC Bank 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

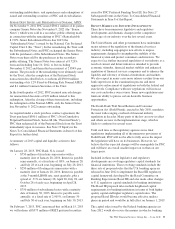

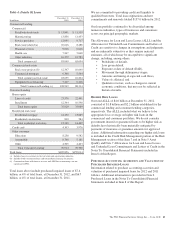

Table 4: Details Of Loans

In millions

December 31

2012

December 31

2011

Commercial Lending

Commercial

Retail/wholesale trade $ 13,801 $ 11,539

Manufacturing 13,856 11,453

Service providers 12,095 9,717

Real estate related (a) 10,616 8,488

Financial services 9,026 6,646

Health care 7,267 5,068

Other industries 16,379 12,783

Total commercial 83,040 65,694

Commercial real estate

Real estate projects (b) 12,347 10,640

Commercial mortgage 6,308 5,564

Total commercial real estate 18,655 16,204

Equipment lease financing 7,247 6,416

Total Commercial Lending (c) 108,942 88,314

Consumer Lending

Home equity

Lines of credit 23,576 22,491

Installment 12,344 10,598

Total home equity 35,920 33,089

Residential real estate

Residential mortgage 14,430 13,885

Residential construction 810 584

Total residential real estate 15,240 14,469

Credit card 4,303 3,976

Other consumer

Education 8,238 9,582

Automobile 8,708 5,181

Other 4,505 4,403

Total Consumer Lending 76,914 70,700

Total loans $185,856 $159,014

(a) Includes loans to customers in the real estate and construction industries.

(b) Includes both construction loans and intermediate financing for projects.

(c) Construction loans with interest reserves and A/B Note restructurings are not

significant to PNC.

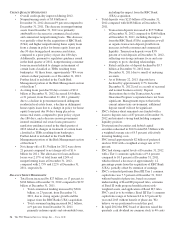

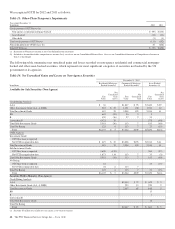

Total loans above include purchased impaired loans of $7.4

billion, or 4% of total loans, at December 31, 2012, and $6.7

billion, or 4% of total loans, at December 31, 2011.

We are committed to providing credit and liquidity to

qualified borrowers. Total loan originations and new

commitments and renewals totaled $157.0 billion for 2012.

Our loan portfolio continued to be diversified among

numerous industries, types of businesses and consumers

across our principal geographic markets.

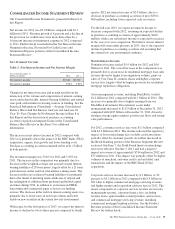

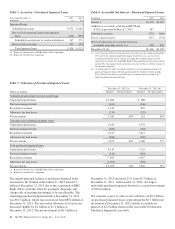

The Allowance for Loan and Lease Losses (ALLL) and the

Allowance for Unfunded Loan Commitments and Letters of

Credit are sensitive to changes in assumptions and judgments

and are inherently subjective as they require material

estimates, all of which may be susceptible to significant

change, including, among others:

• Probability of default,

• Loss given default,

• Exposure at date of default (EAD),

• Movement through delinquency stages,

• Amounts and timing of expected cash flows,

• Value of collateral, and

• Qualitative factors, such as changes in current

economic conditions, that may not be reflected in

historical results.

H

IGHER

R

ISK

L

OANS

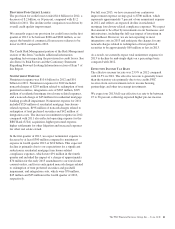

Our total ALLL of $4.0 billion at December 31, 2012

consisted of $1.8 billion and $2.2 billion established for the

commercial lending and consumer lending categories,

respectively. The ALLL included what we believe to be

appropriate loss coverage on higher risk loans in the

commercial and consumer portfolios. We do not consider

government insured or guaranteed loans to be higher risk as

defaults have historically been materially mitigated by

payments of insurance or guarantee amounts for approved

claims. Additional information regarding our higher risk loans

is included in the Credit Risk Management portion of the Risk

Management section of this Item 7 and in Note 5 Asset

Quality and Note 7 Allowances for Loan and Lease Losses

and Unfunded Loan Commitments and Letters of Credit in the

Notes To Consolidated Financial Statements included in

Item 8 of this Report.

P

URCHASE

A

CCOUNTING

A

CCRETION AND

V

ALUATION OF

P

URCHASED

I

MPAIRED

L

OANS

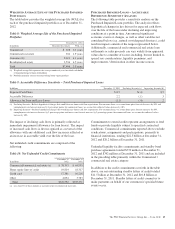

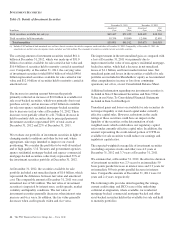

Information related to purchase accounting accretion and

valuation of purchased impaired loans for 2012 and 2011

follows. Additional information is provided in Note 6

Purchased Loans in the Notes To Consolidated Financial

Statements included in Item 8 of this Report.

The PNC Financial Services Group, Inc. – Form 10-K 43