PNC Bank 2012 Annual Report Download - page 261

Download and view the complete annual report

Please find page 261 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

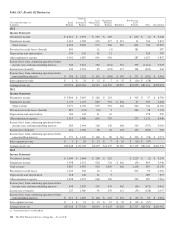

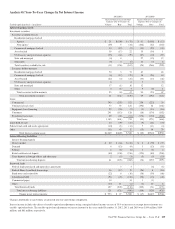

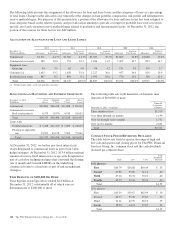

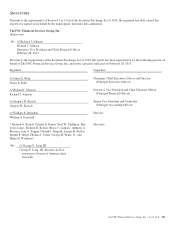

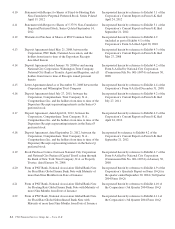

The following table presents the assignment of the allowance for loan and lease losses and the categories of loans as a percentage

of total loans. Changes in the allocation over time reflect the changes in loan portfolio composition, risk profile and refinements to

reserve methodologies. For purposes of this presentation, a portion of the allowance for loan and lease losses has been assigned to

loan categories based on the relative specific and pool allocation amounts to provide coverage for probable losses not covered in

specific, pool and consumer reserve methodologies related to qualitative and measurement factors. At December 31, 2012, the

portion of the reserves for these factors was $42 million.

A

LLOCATION OF

A

LLOWANCE FOR

L

OAN AND

L

EASE

L

OSSES

2012 2011 2010 2009 2008

December 31

Dollars in millions Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans

Commercial $1,131 44.7% $1,180 41.3% $1,387 36.7% $1,869 34.8% $1,668 39.4%

Commercial real estate 589 10.0 753 10.2 1,086 11.9 1,305 14.7 833 14.7

Equipment lease

financing 54 3.9 62 4.0 94 4.2 171 3.9 179 3.7

Consumer (a) 1,415 33.2 1,458 35.4 1,227 36.6 957 34.0 929 29.9

Residential real estate 847 8.2 894 9.1 1,093 10.6 770 12.6 308 12.3

Total $4,036 100.0% $4,347 100.0% $4,887 100.0% $5,072 100.0% $3,917 100.0%

(a) Includes home equity, credit card and other consumer.

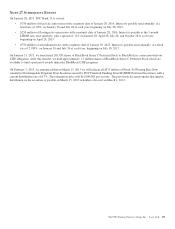

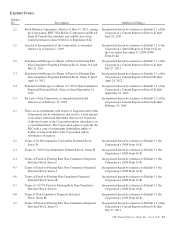

S

ELECTED

L

OAN

M

ATURITIES AND

I

NTEREST

S

ENSITIVITY

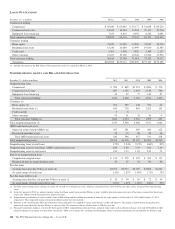

December 31, 2012

In millions

1 Year

or Less

1 Through

5 Years

After

5 Years

Gross

Loans

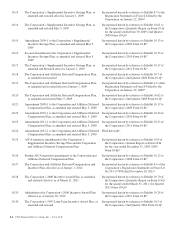

Commercial $22,804 $48,428 $11,808 $ 83,040

Commercial real estate –

Real estate projects 6,575 8,070 4,010 18,655

Total $29,379 $56,498 $15,818 $101,695

Loans with:

Predetermined rate $ 5,458 $11,320 $ 7,855 $ 24,633

Floating or adjustable

rate 23,921 45,178 7,963 77,062

Total $29,379 $56,498 $15,818 $101,695

At December 31, 2012, we had no pay-fixed interest rate

swaps designated to commercial loans as part of fair value

hedge strategies. At December 31, 2012, $13.4 billion notional

amount of receive-fixed interest rate swaps were designated as

part of cash flow hedging strategies that converted the floating

rate (1 month and 3 month LIBOR) on the underlying

commercial loans to a fixed rate as part of risk management

strategies.

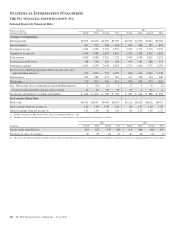

T

IME

D

EPOSITS OF

$100,000 O

R

M

ORE

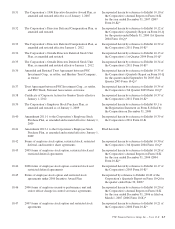

Time deposits in foreign offices totaled $2.0 billion at

December 31, 2012, substantially all of which were in

denominations of $100,000 or more.

The following table sets forth maturities of domestic time

deposits of $100,000 or more:

December 31, 2012 – in millions

Domestic

Certificates

of Deposit

Three months or less $1,719

Over three through six months 1,190

Over six through twelve months 1,731

Over twelve months 2,691

Total $7,331

C

OMMON

S

TOCK

P

RICES

/D

IVIDENDS

D

ECLARED

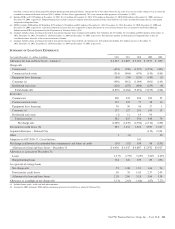

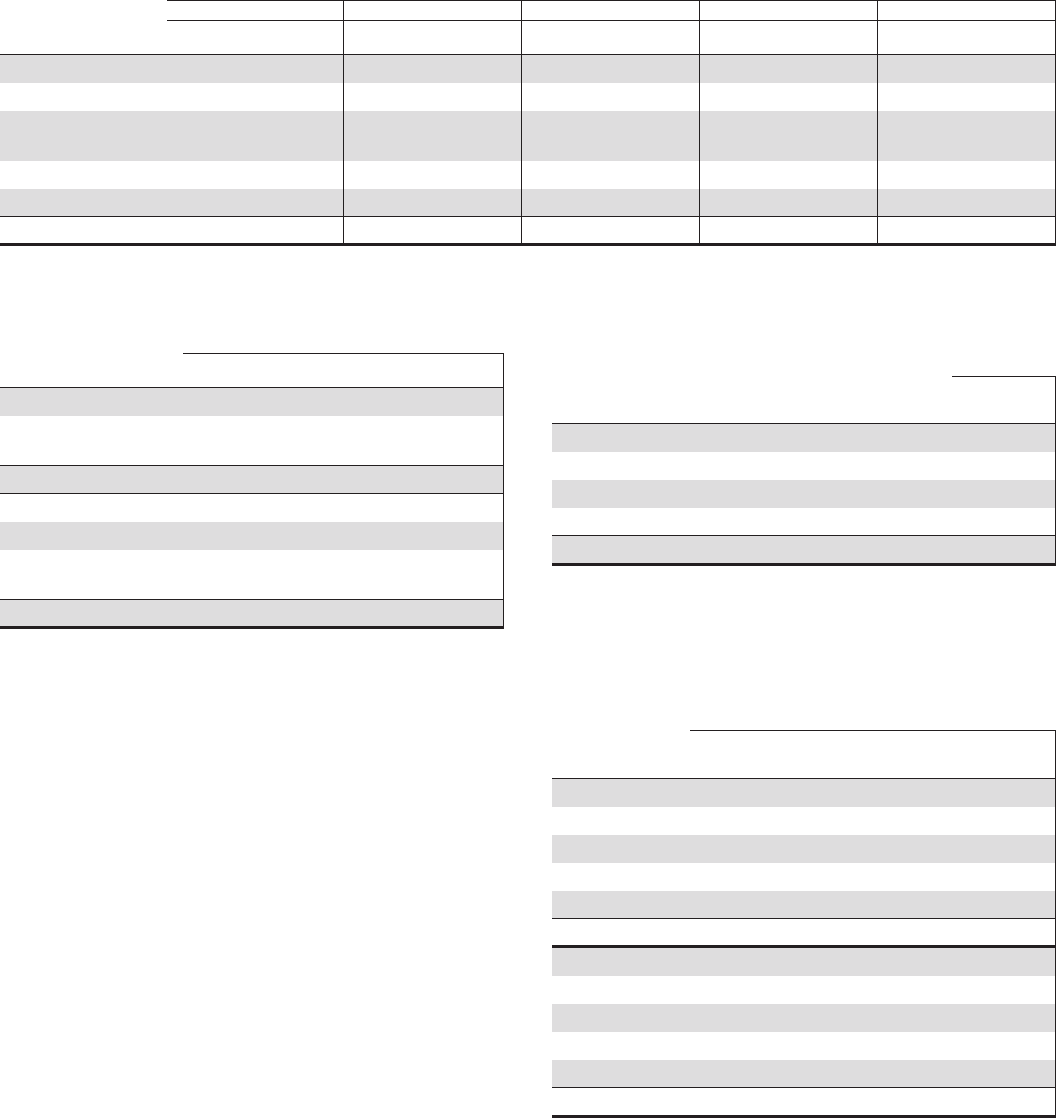

The table below sets forth by quarter the range of high and

low sale and quarter-end closing prices for The PNC Financial

Services Group, Inc. common stock and the cash dividends

declared per common share.

High Low Close

Cash

Dividends

Declared

2012 Quarter

First $64.79 $56.88 $64.49 $ .35

Second 67.89 55.60 61.11 .40

Third 67.04 56.76 63.10 .40

Fourth 65.73 53.36 58.31 .40

Total $1.55

2011 Quarter

First $65.19 $59.67 $62.99 $ .10

Second 64.37 55.56 59.61 .35

Third 61.21 42.70 48.19 .35

Fourth 58.70 44.74 57.67 .35

Total $1.15

242 The PNC Financial Services Group, Inc. – Form 10-K