PNC Bank 2012 Annual Report Download - page 87

Download and view the complete annual report

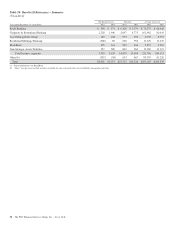

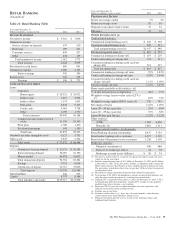

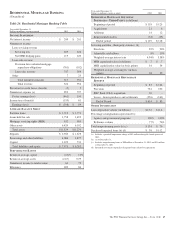

Please find page 87 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Residential Mortgage Banking reported a loss of $308 million

in 2012 compared with earnings of $89 million in 2011.

Earnings declined from the prior year primarily as a result of

higher provision for residential mortgage repurchase

obligations, higher noninterest expense, including goodwill

impairment, and lower net hedging gains on mortgage

servicing rights, partially offset by increased loan sales

revenue driven by higher loan origination volume.

The strategic focus of the business is the acquisition of new

customers through a retail loan officer sales force with an

emphasis on home purchase transactions. Two key aspects of

this strategy are: (i) competing on the basis of superior service

to new and existing customers in serving their home purchase

and refinancing needs; and (ii) pursuing strategic partnerships

with reputable residential real estate franchises to acquire new

customers. A key consideration in pursuing this approach is

the cross-sell opportunity, especially in the bank footprint

markets.

Residential Mortgage Banking overview:

• Total loan originations were $15.2 billion for 2012

compared with $11.4 billion in 2011. Loans continue

to be originated primarily through direct channels

under FNMA, FHLMC and FHA/VA agency

guidelines. Refinancings were 77% of originations

for 2012 and 76% in 2011. During 2012, 30% of loan

originations were under the original or revised Home

Affordable Refinance Program (HARP or HARP 2).

• Investors having purchased mortgage loans may

request PNC to indemnify them against losses on

certain loans or to repurchase loans that they believe

do not comply with applicable contractual loan

origination covenants and representations and

warranties we have made. At December 31, 2012, the

liability for estimated losses on repurchase and

indemnification claims for the Residential Mortgage

Banking business segment was $614 million

compared with $83 million at December 31, 2011.

See the Recourse And Repurchase Obligations

section of this Item 7 and Note 24 Commitments and

Guarantees in the Notes To Consolidated Financial

Statements in Item 8 of this Report for additional

information.

– PNC has experienced and expects to experience

further elevated levels of residential mortgage

loan repurchase demands reflecting changes in

behavior and demand patterns of two

government-sponsored enterprises, FHLMC

and FNMA, primarily related to loans sold in

2004 through 2008 into agency securitizations.

• Residential mortgage loans serviced for others totaled

$119 billion at December 31, 2012 compared with

$118 billion at December 31, 2011. Payoff volumes

remained high, but new direct loan origination

volume and servicing portfolio acquisitions offset the

decline.

• Noninterest income was $317 million in 2012

compared with $751 million in 2011. The decrease

resulted from current year additions to reserves of

$761 million for residential mortgage loan repurchase

obligations as compared to $102 million in 2011 and

lower net hedging gains on mortgage servicing rights,

partially offset by increased loan sales revenue driven

by higher loan origination volume.

• Net interest income was $209 million in 2012

compared with $201 million in 2011.

• Noninterest expense was $992 million in 2012

compared with $797 million in 2011. The increase

from the prior year was primarily driven by increased

residential mortgage origination volumes, servicing

costs, a goodwill impairment charge and higher

additions to legal reserves. Included in noninterest

expense in the fourth quarter of 2012 was an

approximately $70 million charge resulting from an

agreement to amend consent orders previously

entered into by PNC with its banking regulators. The

agreement ends the independent foreclosure review

program under the consent orders and replaces it with

an accelerated remediation process.

• The fair value of mortgage servicing rights was $.7

billion at both December 31, 2012 and December 31,

2011.

68 The PNC Financial Services Group, Inc. – Form 10-K