PNC Bank 2012 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

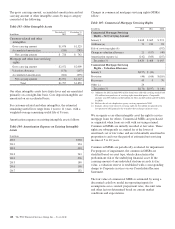

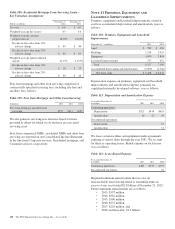

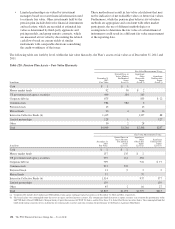

At December 31, 2012, the fair value of the qualified pension

plan assets was less than both the accumulated benefit

obligation and the projected benefit obligation. The

nonqualified pension plan is unfunded. Contributions from

PNC and, in the case of postretirement benefit plans,

participant contributions cover all benefits paid under the

nonqualified pension plan and postretirement benefit plans.

The postretirement plan provides benefits to certain retirees

that are at least actuarially equivalent to those provided by

Medicare Part D and accordingly, we receive a federal subsidy

as shown in the table.

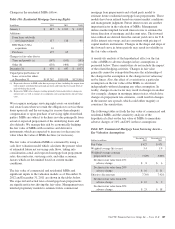

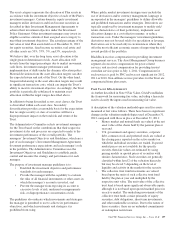

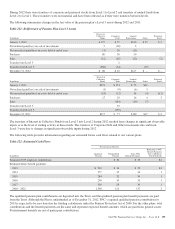

In March 2010, the Patient Protection and Affordable Care

Act (PPACA) was enacted. Key aspects of the PPACA which

are reflected in our financials include the excise tax on high-

cost health plans beginning in 2018 and fees for the

Transitional Reinsurance Program and the Patient-Centered

Outcomes Fund. These provisions did not have a significant

effect on our postretirement medical liability or cost. The

Early Retiree Reinsurance Program (ERRP) was established

by the PPACA. Congress appropriated funding of $5 billion

for this temporary ERRP to provide financial assistance to

employers, unions, and state and local governments to help

them maintain coverage for early retirees age 55 and older

who are not yet eligible for Medicare, including their spouses,

surviving spouses, and dependents. PNC submitted an

application for reimbursement from the ERRP in 2012 for the

2010 and 2011 plan years. In 2012, PNC received

reimbursement of $.9 million related to the 2011 plan year and

received reimbursement of $.6 million related to the 2010 plan

year.

PNC P

ENSION

P

LAN

A

SSETS

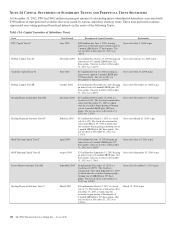

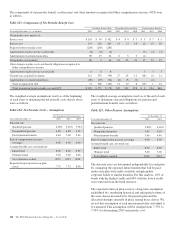

Assets related to our qualified pension plan (the Plan) are held

in trust (the Trust). Effective July 1, 2011, the trustee is The

Bank of New York Mellon; prior to that date, the trustee was

PNC Bank, National Association, (PNC Bank, N.A). The

Trust is exempt from tax pursuant to section 501(a) of the

Internal Revenue Code (the Code). The Plan is qualified under

section 401(a) of the Code. Plan assets consist primarily of

listed domestic and international equity securities, U.S.

government and agency securities, corporate debt securities,

and real estate investments. Plan assets as of December 31,

2011 included $11 million of PNC common stock. The Plan

held no PNC common stock as of December 31, 2012.

The PNC Financial Services Group, Inc. Administrative

Committee (the Administrative Committee) adopted the

Pension Plan Investment Policy Statement, including target

allocations and allowable ranges, on August 13, 2008. On

February 25, 2010, the Administrative Committee amended

the investment policy to include a dynamic asset allocation

approach and also updated target allocation ranges for certain

asset categories. On March 1, 2011, the Administrative

Committee amended the investment policy to update the target

allocation ranges for certain asset categories.

The long-term investment strategy for pension plan assets is

to:

• Meet present and future benefit obligations to all

participants and beneficiaries,

• Cover reasonable expenses incurred to provide such

benefits, including expenses incurred in the

administration of the Trust and the Plan,

• Provide sufficient liquidity to meet benefit and

expense payment requirements on a timely basis, and

• Provide a total return that, over the long term,

maximizes the ratio of trust assets to liabilities by

maximizing investment return, at an appropriate level

of risk.

Under the dynamic asset allocation strategy, scenarios are

outlined in which the Administrative Committee has the ability

to make short to intermediate term asset allocation shifts based

on factors such as the Plan’s funded status, the Administrative

Committee’s view of return on equities relative to long term

expectations, the Administrative Committee’s view on the

direction of interest rates and credit spreads, and other relevant

financial or economic factors which would be expected to

impact the ability of the Trust to meet its obligation to

beneficiaries. Accordingly, the allowable asset allocation ranges

have been updated to incorporate the flexibility required by the

dynamic allocation policy.

The Plan’s specific investment objective is to meet or exceed

the investment policy benchmark over the long term. The

investment policy benchmark compares actual performance to

a weighted market index, and measures the contribution of

active investment management and policy implementation.

This investment objective is expected to be achieved over the

long term (one or more market cycles) and is measured over

rolling five-year periods. Total return calculations are time-

weighted and are net of investment-related fees and expenses.

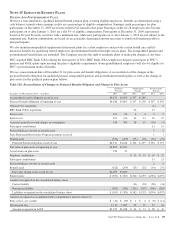

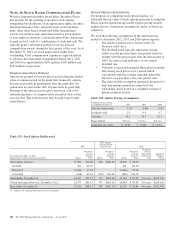

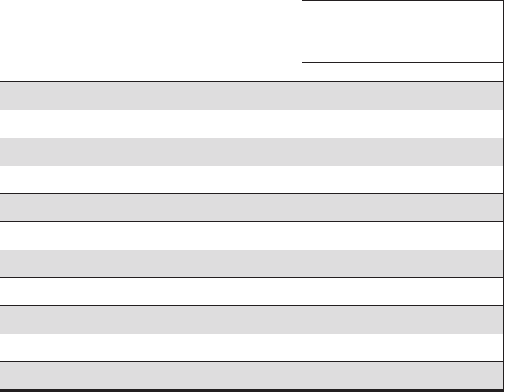

The asset strategy allocations for the Trust at the end of 2012

and 2011, and the target allocation range at the end of 2012,

by asset category, are as follows.

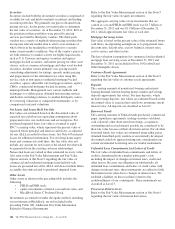

Table 119: Asset Strategy Allocations

Target

Allocation

Range

Percentage of

Plan Assets by

Strategy at

December 31

PNC Pension Plan 2012 2011

Asset Category

Domestic Equity 20 - 40% 34% 41%

International Equity 10 - 25% 22% 21%

Private Equity 0 - 10% 3% 3%

Total Equity 40 - 70% 59% 65%

Domestic Fixed Income 20 - 40% 21% 20%

High Yield Fixed Income 0 - 15% 14% 12%

Total Fixed Income 20 - 55% 35% 32%

Real estate 0 - 10% 5% 3%

Other 0 - 5% 1% 0%

Total 100% 100%

196 The PNC Financial Services Group, Inc. – Form 10-K