PNC Bank 2012 Annual Report Download - page 75

Download and view the complete annual report

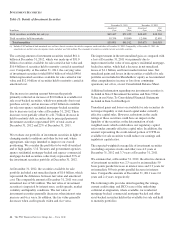

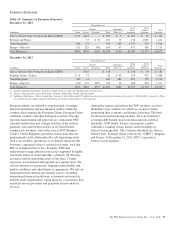

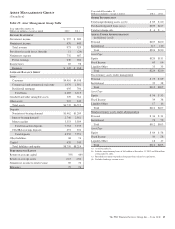

Please find page 75 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Direct exposure primarily consists of loans, leases, securities,

derivatives, letters of credit and unfunded contractual

commitments with European entities. As of December 31,

2012, the $1.9 billion of funded direct exposure (.61% of

PNC’s total assets) primarily represented $645 million for

cross-border leases in support of national infrastructure, which

were supported by letters of credit and other collateral having

trigger mechanisms that require replacement or collateral in

the form of cash or United States Treasury or government

securities, $600 million for United Kingdom foreign office

loans and $168 million of securities issued by AAA-rated

sovereigns. The comparable level of direct exposure

outstanding at December 31, 2011 was $1.6 billion (.59% of

PNC’s total assets), which primarily included $625 million for

cross-border leases in support of national infrastructure, $382

million for United Kingdom foreign office loans and $357

million of securities issued by AAA-rated sovereigns.

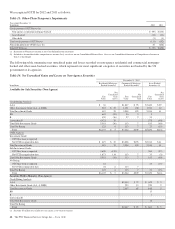

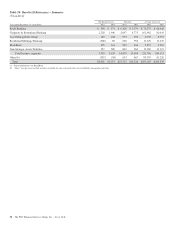

The $550 million of unfunded direct exposure as of

December 31, 2012 was largely comprised of $449 million for

unfunded contractual commitments primarily for United

Kingdom local office commitments to PNC Business Credit

corporate customers on a secured basis or activities supporting

our domestic customers export activities through the

confirmation of trade letters of credit. Comparably, the $485

million of unfunded direct exposure as of December 31, 2011

was largely comprised of $440 million for unfunded

contractual commitments primarily for United Kingdom local

office commitments to PNC Business Credit corporate

customers on a secured basis.

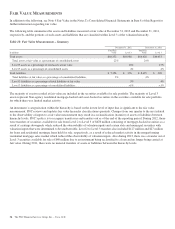

We also track European financial exposures where our clients,

primarily U.S. entities, appoint PNC as a letter of credit

issuing bank and we elect to assume the joint probability of

default risk. As of December 31, 2012 and December 31,

2011, PNC had $2.5 billion and $2.3 billion, respectively, of

indirect exposure. For PNC to incur a loss in these indirect

exposures, both the obligor and the financial counterparty

participating bank would need to default. PNC assesses both

the corporate customers and the participating banks for

counterparty risk and where PNC has found that a

participating bank exposes PNC to unacceptable risk, PNC

will reject the participating bank as an acceptable counterparty

and will ask the corporate customer to find an acceptable

participating bank.

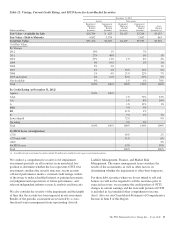

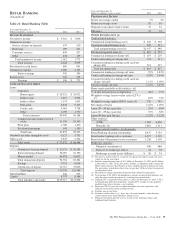

Direct and indirect exposure to entities in the GIIPS countries

totaled $241 million as of December 31, 2012, of which $122

million was direct exposure for cross-border leases within

Portugal, $67 million represented direct exposure for loans

outstanding within Ireland and $31 million represented

indirect exposure for letters of credit with strong underlying

obligors, primarily U.S. entities, with participating banks in

Ireland, Italy and Spain. The comparable amounts as of

December 31, 2011 were total direct and indirect exposure of

$181 million, consisting of $118 million of direct exposure for

cross-border leases within Portugal, indirect exposure of $48

million for letters of credit with strong underlying obligors,

primarily U.S. entities, with participating banks in Ireland,

Italy and Spain and $15 million for unfunded contractual

commitments in Spain.

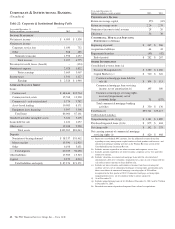

Direct and indirect exposure to entities in Belgium and France

totaled $1.2 billion as of December 31, 2012. Direct exposure

of $138 million primarily consisted of $69 million for cross-

border leases within Belgium, $35 million for unfunded

contractual commitments in France and $30 million of

covered bonds issued by a financial institution in France.

Indirect exposure was $1.1 billion for letters of credit with

strong underlying obligors, primarily U.S. entities, with

creditworthy participant banks in France and Belgium. The

comparable amounts as of December 31, 2011 were total

direct and indirect exposure of $1.1 billion as of December 31,

2011 of which there was $154 million of direct exposure

primarily consisting of $75 million for cross-border leases

within Belgium and $62 million for unfunded contractual

commitments in France. In addition, direct exposure at

December 31, 2011 included $11 million for 90% Overseas

Private Investment Corporation (“OPIC”) guaranteed Turkish

loans. Indirect exposure at December 31, 2011 was $935

million for letters of credit with strong underlying obligors

and creditworthy participant banks in France and Belgium.

56 The PNC Financial Services Group, Inc. – Form 10-K