PNC Bank 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

Home Equity Repurchase Obligations

PNC’s repurchase obligations include obligations with respect

to certain brokered home equity loans/lines that were sold to a

limited number of private investors in the financial services

industry by National City prior to our acquisition of National

City. PNC is no longer engaged in the brokered home equity

lending business, and our exposure under these loan

repurchase obligations is limited to repurchases of the loans

sold in these transactions. Repurchase activity associated with

brokered home equity lines/loans is reported in the Non-

Strategic Assets Portfolio segment.

Loan covenants and representations and warranties were

established through loan sale agreements with various

investors to provide assurance that loans PNC sold to the

investors are of sufficient investment quality. Key aspects of

such covenants and representations and warranties include the

loan’s compliance with any applicable loan criteria established

for the transaction, including underwriting standards, delivery

of all required loan documents to the investor or its designated

party, sufficient collateral valuation, and the validity of the

lien securing the loan. As a result of alleged breaches of these

contractual obligations, investors may request PNC to

indemnify them against losses on certain loans or to

repurchase loans.

We investigate every investor claim on a loan by loan basis to

determine the existence of a legitimate claim, and that all

other conditions for indemnification or repurchase have been

met prior to settlement with that investor. Indemnifications for

loss or loan repurchases typically occur when, after review of

the claim, we agree insufficient evidence exists to dispute the

investor’s claim that a breach of a loan covenant and

representation and warranty has occurred, such breach has not

been cured, and the effect of such breach is deemed to have

had a material and adverse effect on the value of the

transferred loan. Depending on the sale agreement and upon

proper notice from the investor, we typically respond to home

equity indemnification and repurchase requests within 60

days, although final resolution of the claim may take a longer

period of time. Most home equity sale agreements do not

provide for penalties or other remedies if we do not respond

timely to investor indemnification or repurchase requests.

Investor indemnification or repurchase claims are typically

settled on an individual loan basis through make-whole

payments or loan repurchases; however, on occasion we may

negotiate pooled settlements with investors. In connection

with pooled settlements, we typically do not repurchase loans

and the consummation of such transactions generally results in

us no longer having indemnification and repurchase exposure

with the investor in the transaction.

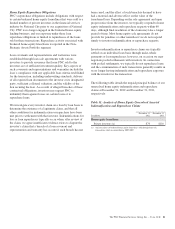

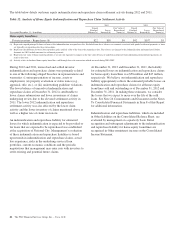

The following table details the unpaid principal balance of our

unresolved home equity indemnification and repurchase

claims at December 31, 2012 and December 31, 2011,

respectively.

Table 31: Analysis of Home Equity Unresolved Asserted

Indemnification and Repurchase Claims

In millions

December 31

2012

December 31

2011

Home equity loans/lines:

Private investors (a) $74 $110

(a) Activity relates to brokered home equity loans/lines sold through loan sale

transactions which occurred during 2005-2007.

The PNC Financial Services Group, Inc. – Form 10-K 81