PNC Bank 2012 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

See Note 10 Goodwill and Other Intangible Assets for further

discussion of the accounting for goodwill and other intangible

assets.

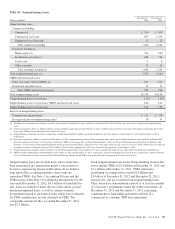

The estimated amount of RBC Bank (USA) revenue and net

income (excluding integration costs) included in PNC’s

consolidated income statement for 2012 was $1.0 billion and

$273 million, respectively. Upon closing and conversion of

the RBC Bank (USA) transaction, subsequent to March 2,

2012, separate records for RBC Bank (USA) as a stand-alone

business have not been maintained as the operations of RBC

Bank (USA) have been fully integrated into PNC. RBC Bank

(USA) revenue and earnings disclosed above reflect

management’s best estimate, based on information available at

the reporting date.

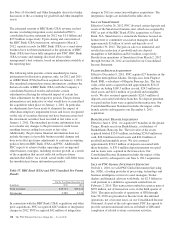

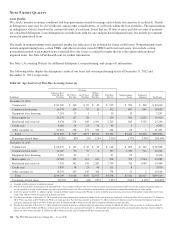

The following table presents certain unaudited pro forma

information for illustrative purposes only, for 2012 and 2011

as if RBC Bank (USA) had been acquired on January 1, 2011.

The unaudited estimated pro forma information combines the

historical results of RBC Bank (USA) with the Company’s

consolidated historical results and includes certain

adjustments reflecting the estimated impact of certain fair

value adjustments for the respective periods. The pro forma

information is not indicative of what would have occurred had

the acquisition taken place on January 1, 2011. In particular,

no adjustments have been made to eliminate the impact of

other-than-temporary impairment losses and losses recognized

on the sale of securities that may not have been necessary had

the investment securities been recorded at fair value as of

January 1, 2011. The unaudited pro forma information does

not consider any changes to the provision for credit losses

resulting from recording loan assets at fair value.

Additionally, the pro forma financial information does not

include the impact of possible business model changes and

does not reflect pro forma adjustments to conform accounting

policies between RBC Bank (USA) and PNC. Additionally,

PNC expects to achieve further operating cost savings and

other business synergies, including revenue growth, as a result

of the acquisition that are not reflected in the pro forma

amounts that follow. As a result, actual results will differ from

the unaudited pro forma information presented.

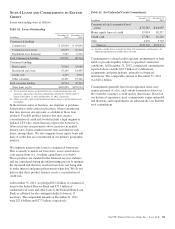

Table 57: RBC Bank (USA) and PNC Unaudited Pro Forma

Results

For the Year Ended December 31

In millions 2012 2011

Total revenues $15,721 $15,421

Net income 2,989 2,911

In connection with the RBC Bank (USA) acquisition and other

prior acquisitions, PNC recognized $267 million of integration

charges in 2012. PNC recognized $42 million of integration

charges in 2011 in connection with prior acquisitions. The

integration charges are included in the table above.

S

ALE OF

S

MARTSTREET

Effective October 26, 2012, PNC divested certain deposits and

assets of the Smartstreet business unit, which was acquired by

PNC as part of the RBC Bank (USA) acquisition, to Union

Bank, N.A. Smartstreet is a nationwide business focused on

homeowner or community association managers and had

approximately $1 billion of assets and deposits as of

September 30, 2012. The gain on sale was immaterial and

resulted in a reduction of goodwill and core deposit

intangibles of $46 million and $13 million, respectively.

Results from operations of Smartstreet from March 2, 2012

through October 26, 2012 are included in our Consolidated

Income Statement.

F

LAGSTAR

B

RANCH

A

CQUISITION

Effective December 9, 2011, PNC acquired 27 branches in the

northern metropolitan Atlanta, Georgia area from Flagstar

Bank, FSB, a subsidiary of Flagstar Bancorp, Inc. The fair

value of the assets acquired totaled approximately $211.8

million, including $169.3 million in cash, $24.3 million in

fixed assets and $18.2 million of goodwill and intangible

assets. We also assumed approximately $210.5 million of

deposits associated with these branches. No deposit premium

was paid and no loans were acquired in the transaction. Our

Consolidated Income Statement includes the impact of the

branch activity subsequent to our December 9, 2011

acquisition.

B

ANK

A

TLANTIC

B

RANCH

A

CQUISITION

Effective June 6, 2011, we acquired 19 branches in the greater

Tampa, Florida area from BankAtlantic, a subsidiary of

BankAtlantic Bancorp, Inc. The fair value of the assets

acquired totaled $324.9 million, including $256.9 million in

cash, $26.0 million in fixed assets and $42.0 million of

goodwill and intangible assets. We also assumed

approximately $324.5 million of deposits associated with

these branches. A $39.0 million deposit premium was paid

and no loans were acquired in the transaction. Our

Consolidated Income Statement includes the impact of the

branch activity subsequent to our June 6, 2011 acquisition.

S

ALE OF

PNC G

LOBAL

I

NVESTMENT

S

ERVICING

On July 1, 2010, we sold PNC Global Investment Servicing

Inc. (GIS), a leading provider of processing, technology and

business intelligence services to asset managers, broker-

dealers and financial advisors worldwide, for $2.3 billion in

cash pursuant to a definitive agreement entered into on

February 2, 2010. This transaction resulted in a pretax gain of

$639 million, net of transaction costs, in the third quarter of

2010. This gain and results of operations of GIS through

June 30, 2010 are presented as Income from discontinued

operations, net of income taxes, on our Consolidated Income

Statement. As part of the sale agreement, PNC has agreed to

provide certain transitional services on behalf of GIS until

completion of related systems conversion activities.

138 The PNC Financial Services Group, Inc. – Form 10-K