PNC Bank 2012 Annual Report Download - page 82

Download and view the complete annual report

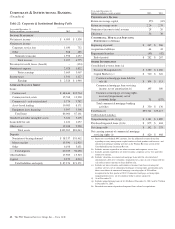

Please find page 82 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Corporate & Institutional Banking earned $2.3 billion in 2012,

compared with $1.9 billion in 2011. The increase in earnings

was primarily due to higher revenue partially offset by higher

noninterest expense and a provision for credit losses of zero in

2012 compared with a benefit of $124 million in 2011. We

continued to focus on building client relationships including

increasing cross sales and adding new clients where the risk-

return profile was attractive.

Results in 2012 include the impact of the RBC Bank (USA)

acquisition in March 2012, which added approximately $7.5

billion of loans and $4.8 billion of deposits at acquisition date.

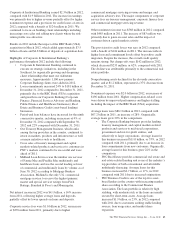

Highlights of Corporate & Institutional Banking’s

performance throughout 2012 include the following:

• Corporate & Institutional Banking continued to

execute on strategic initiatives, including in the

Southeast, by organically growing and deepening

client relationships that meet our risk/return

measures. Approximately 1,100 new primary

Corporate Banking clients were added in 2012.

• Loan commitments increased 24% to $181 billion at

December 31, 2012 compared to December 31, 2011,

primarily due to the RBC Bank (USA) acquisition

and growth in our Corporate Banking (Corporate

Finance, Financial Services Advisory and Banking,

Public Finance and Healthcare businesses), Real

Estate and Business Credit (asset-based lending)

businesses.

• Period-end loan balances have increased for the ninth

consecutive quarter, including an increase of 4% at

December 31, 2012 compared with September 30,

2012 and 22% compared with December 31, 2011.

• Our Treasury Management business, which ranks

among the top providers in the country, continued to

invest in markets, products and infrastructure as well

as major initiatives such as healthcare.

• Cross sales of treasury management and capital

markets-related products and services to customers in

PNC’s markets continued to be successful and were

ahead of 2011.

• Midland Loan Services was the number one servicer

of Fannie Mae and Freddie Mac multifamily and

healthcare loans and was the second leading servicer

of commercial and multifamily loans by volume as of

June 30, 2012 according to Mortgage Bankers

Association. Midland is the only U.S. commercial

mortgage servicer to receive the highest primary,

master and special servicer ratings from Fitch

Ratings, Standard & Poor’s and Morningstar.

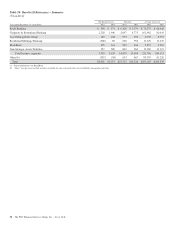

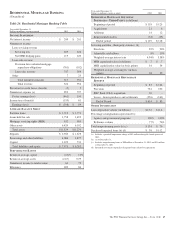

Net interest income in 2012 was $4.1 billion, a 16% increase

from 2011, reflecting higher average loans and deposits,

partially offset by lower spreads on loans and deposits.

Corporate service fees were $1.0 billion in 2012, an increase

of $278 million from 2011, primarily due to higher

commercial mortgage servicing revenue and merger and

acquisition advisory fees. The major components of corporate

service fees are treasury management, corporate finance fees

and commercial mortgage servicing revenue.

Other noninterest income was $568 million in 2012 compared

with $485 million in 2011. The increase of $83 million was

primarily due to gains on asset sales and the impact of

customer driven capital markets activity.

The provision for credit losses was zero in 2012 compared

with a benefit of $124 million in 2011. The increase reflects

higher loan and commitment levels offset by positive credit

migration. Despite the increase, the overall credit quality

remains strong. Net charge-offs were $142 million in 2012,

which decreased $233 million, or 62%, compared with 2011.

The decline was attributable primarily to the commercial real

estate portfolio.

Nonperforming assets declined for the eleventh consecutive

quarter, and at $1.2 billion, represented a 37% decrease from

December 31, 2011.

Noninterest expense was $2.0 billion in 2012, an increase of

$196 million from 2011. Higher compensation-related costs

were driven by improved performance and higher staffing,

including the impact of the RBC Bank (USA) acquisition.

Average loans were $86.1 billion in 2012 compared with

$67.2 billion in 2011, an increase of 28%. Organically,

average loans grew 20% in the comparison.

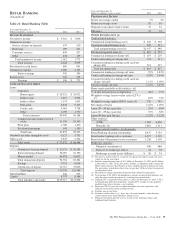

• The Corporate Banking business provides lending,

treasury management, and capital markets-related

products and services to mid-sized corporations,

government and not-for-profit entities, and

selectively to large corporations. Average loans for

this business increased $11.0 billion, or 33%, in 2012

compared with 2011, primarily due to an increase in

loan commitments from new customers. Organically,

average loans for this business grew 22% in the

comparison.

• PNC Real Estate provides commercial real estate and

real estate-related lending and is one of the industry’s

top providers of both conventional and affordable

multifamily financing. Average loans for this

business increased $2.7 billion, or 17%, in 2012

compared with 2011 due to increased originations.

• PNC Business Credit is one of the top five asset-

based lenders in the country with increasing market

share according to the Commercial Finance

Association. The loan portfolio is relatively high

yielding, with moderate risk as the loans are mainly

secured by short-term assets. Average loans

increased $1.9 billion, or 23%, in 2012 compared

with 2011 due to customers seeking stable lending

sources, loan usage rates, and market share

expansion.

The PNC Financial Services Group, Inc. – Form 10-K 63