PNC Bank 2012 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

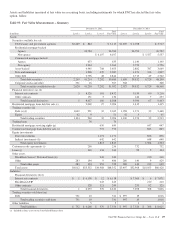

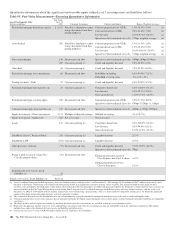

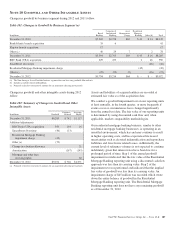

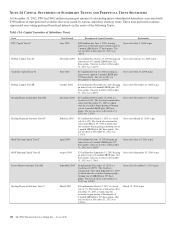

Quantitative information about the significant unobservable inputs within Level 3 nonrecurring assets follows.

Table 97: Fair Value Measurements – Nonrecurring Quantitative Information

Level 3 Instruments Only

Dollars in millions

Fair Value

December 31,

2012 Valuation Techniques Unobservable Inputs Range (Weighted Average)

Assets

Nonaccrual loans (a) $ 90 Fair value of collateral Loss severity 4.6% - 97.2% (58.1%)

Loans held for sale 315 Discounted cash flow Spread over the benchmark curve (b) 40bps - 233bps (86bps)

Embedded servicing value .8% - 2.6% (2.0%)

Equity investments 12 Discounted cash flow Market rate of return 4.6% - 6.5% (5.4%)

Commercial mortgage

servicing rights 191

Discounted cash flow Constant prepayment rate (CPR)

Discount rate

7.1% - 20.1% (7.8%)

5.6% - 7.8% (7.7%)

Other (c)

299

Fair value of property or

collateral

Appraised value/sales price Not meaningful

Total Assets $907

(a) The fair value of nonaccrual loans included in this line item is determined based on internal loss rates. The fair value of nonaccrual loans where the fair value is determined based on

the appraised value or sales price is included within Other, below.

(b) The assumed yield spread over benchmark curve for each instrument is generally intended to incorporate non-interest-rate risks such as credit and liquidity risks.

(c) Other includes nonaccrual loans of $68 million, OREO and foreclosed assets of $207 million and Long-lived assets held for sale of $24 million as of December 31, 2012. The fair

value of these assets is determined based on appraised value or sales price, the range of which is not meaningful to disclose.

F

INANCIAL

A

SSETS

A

CCOUNTED

F

OR

U

NDER

F

AIR

V

ALUE

O

PTION

Refer to the Fair Value Measurement section of this Note 9

regarding the fair value of commercial mortgage loans held

for sale, residential mortgage loans held for sale, certain

portfolio loans, customer resale agreements, and BlackRock

Series C Preferred Stock.

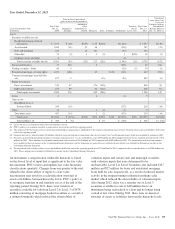

Commercial Mortgage Loans Held for Sale

Interest income on these loans is recorded as earned and

reported on the Consolidated Income Statement in Other

interest income. The impact on earnings of offsetting

economic hedges is not reflected in these amounts. Changes in

fair value due to instrument-specific credit risk for both 2012

and 2011 were not material.

Residential Mortgage Loans Held for Sale and in Portfolio

Interest income on these loans is recorded as earned and

reported on the Consolidated Income Statement in Other

interest income. Throughout 2012 and 2011, certain

residential mortgage loans for which we elected the fair value

option were subsequently reclassified to portfolio loans.

Changes in fair value due to instrument-specific credit risk for

2012 and 2011 were not material.

Customer Resale Agreements

Interest income on structured resale agreements is reported on

the Consolidated Income Statement in Other interest income.

Changes in fair value due to instrument-specific credit risk for

2012 and 2011 were not material.

Residential Mortgage-Backed Agency Securities with

Embedded Derivatives

Interest income on securities is reported on the Consolidated

Income Statement in Interest income.

The changes in fair value included in Noninterest income for

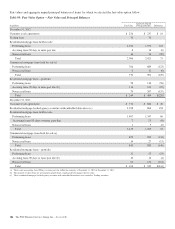

items for which we elected the fair value option follow.

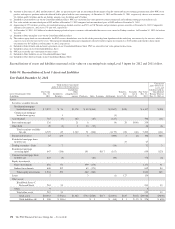

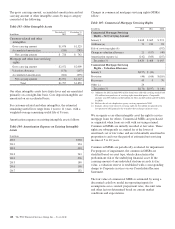

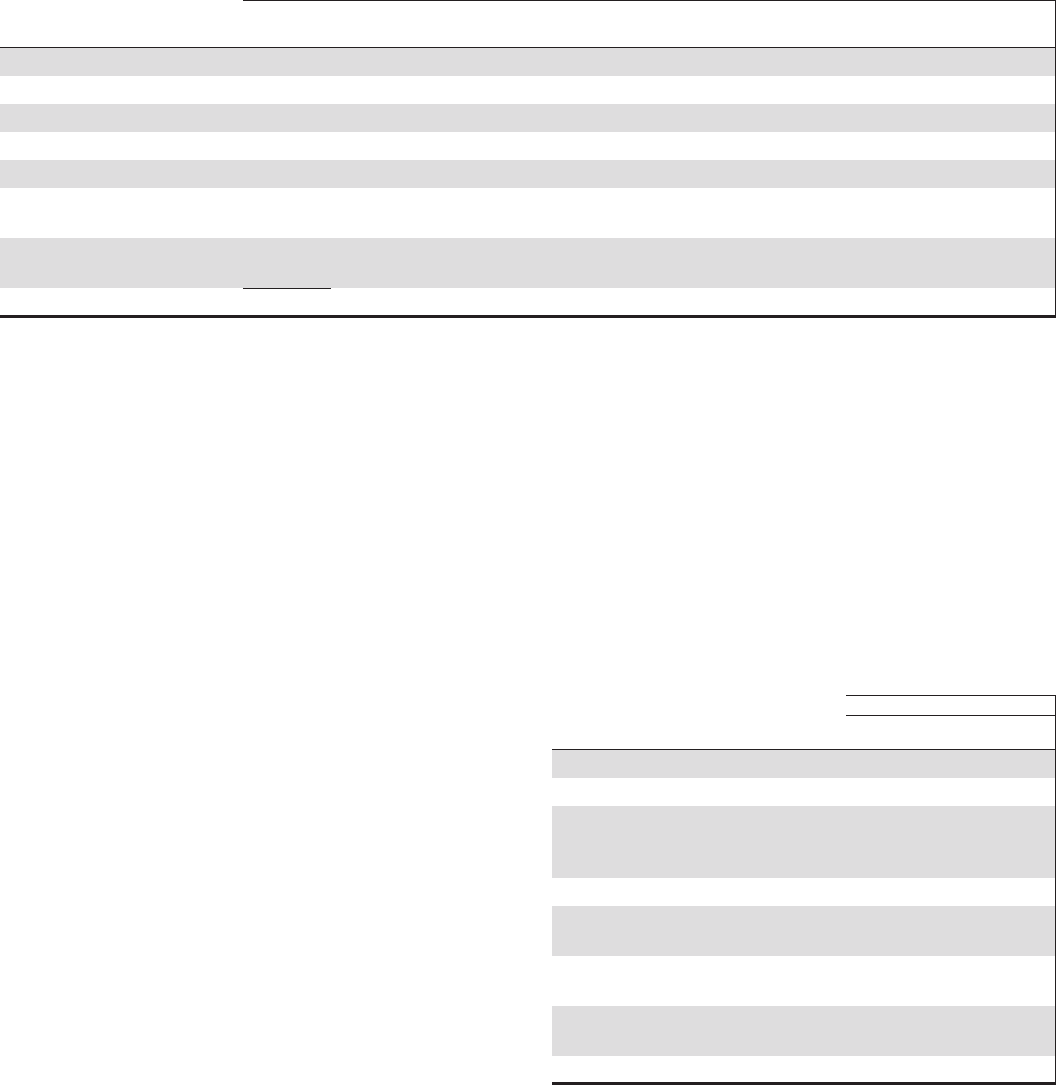

Table 98: Fair Value Option – Changes in Fair Value (a)

Gains (Losses)

Year ended December 31

In millions 2012 2011 2010

Assets

Customer resale agreements $ (10) $ (12) $ 1

Residential mortgage-backed agency

securities with embedded

derivatives (b) 13 24

Trading loans 2

Commercial mortgage loans held for

sale (5) 3 16

Residential mortgage loans held for

sale (180) 172 280

Residential mortgage loans –

portfolio (36) (17)

BlackRock Series C Preferred Stock 33 (14) (86)

(a) The impact on earnings of offsetting hedged items or hedging instruments is not

reflected in these amounts.

(b) These residential mortgage-backed agency securities with embedded derivatives

were carried as Trading securities.

The PNC Financial Services Group, Inc. – Form 10-K 183