PNC Bank 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Our Consolidated Income Statement is presented in Item 8 of

this Report.

Net income for 2012 was $3.0 billion compared with $3.1

billion for 2011. Revenue growth of 8 percent and a decline in

the provision for credit losses were more than offset by a

16 percent increase in noninterest expense in 2012 compared

to 2011. Further detail is included in the Net Interest Income,

Noninterest Income, Provision For Credit Losses and

Noninterest Expense portions of this Consolidated Income

Statement Review.

N

ET

I

NTEREST

I

NCOME

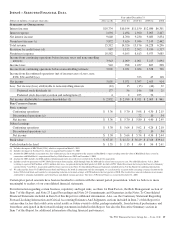

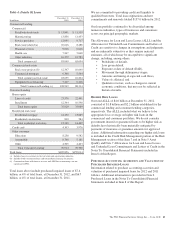

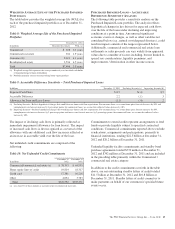

Table 2: Net Interest Income and Net Interest Margin

Year ended December 31

Dollars in millions 2012 2011

Net interest income $9,640 $8,700

Net interest margin 3.94% 3.92%

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related

rates paid, and noninterest-bearing sources of funding. See the

Statistical Information (Unaudited) – Average Consolidated

Balance Sheet And Net Interest Analysis and Analysis Of

Year-To-Year Changes In Net Interest Income in Item 8 of

this Report and the discussion of purchase accounting

accretion of purchased impaired loans in the Consolidated

Balance Sheet Review in this Item 7 for additional

information.

The increase in net interest income in 2012 compared with

2011 was primarily due to the impact of the RBC Bank (USA)

acquisition, organic loan growth and lower funding costs.

Purchase accounting accretion remained stable at $1.1 billion

in both periods.

The net interest margin was 3.94% for 2012 and 3.92% for

2011. The increase in the comparison was primarily due to a

decrease in the weighted-average rate accrued on total interest-

bearing liabilities of 29 basis points, largely offset by a 21 basis

point decrease on the yield on total interest-earning assets. The

decrease in the rate on interest-bearing liabilities was primarily

due to the runoff of maturing retail certificates of deposit and

the redemption of additional trust preferred and hybrid capital

securities during 2012, in addition to an increase in FHLB

borrowings and commercial paper as lower-cost funding

sources. The decrease in the yield on interest-earning assets was

primarily due to lower rates on new loan volume and lower

yields on new securities in the current low rate environment.

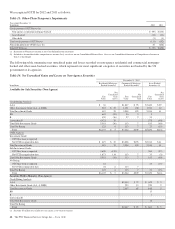

With respect to the first quarter of 2013, we expect net interest

income to decline by two to three percent compared to fourth

quarter 2012 net interest income of $2.4 billion, due to a

decrease in purchase accounting accretion of up to $50 to

$60 million, including lower expected cash recoveries.

For the full year 2013, we expect net interest income to

decrease compared with 2012, assuming an expected decline

in purchase accounting accretion of approximately $400

million, while core net interest income is expected to increase

in the year-over-year comparison. We believe our net interest

margin will come under pressure in 2013, due to the expected

decline in purchase accounting accretion and assuming that

the current low rate environment continues.

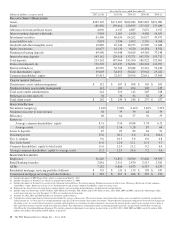

N

ONINTEREST

I

NCOME

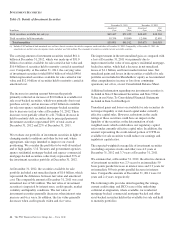

Noninterest income totaled $5.9 billion for 2012 and $5.6

billion for 2011. The overall increase in the comparison was

primarily due to an increase in residential mortgage loan sales

revenue driven by higher loan origination volume, gains on

sales of Visa Class B common shares and higher corporate

service fees, largely offset by higher provision for residential

mortgage repurchase obligations.

Asset management revenue, including BlackRock, totaled

$1.2 billion in 2012 compared with $1.1 billion in 2011. This

increase was primarily due to higher earnings from our

BlackRock investment. Discretionary assets under

management increased to $112 billion at December 31, 2012

compared with $107 billion at December 31, 2011 driven by

stronger average equity markets, positive net flows and strong

sales performance.

For 2012, consumer services fees were $1.1 billion compared

with $1.2 billion in 2011. The decline reflected the regulatory

impact of lower interchange fees on debit card transactions

partially offset by customer growth. As further discussed in

the Retail Banking portion of the Business Segments Review

section of this Item 7, the Dodd-Frank limits on interchange

rates were effective October 1, 2011 and had a negative

impact on revenue of approximately $314 million in 2012 and

$75 million in 2011. This impact was partially offset by higher

volumes of merchant, customer credit card and debit card

transactions and the impact of the RBC Bank (USA)

acquisition.

Corporate services revenue increased by $.3 billion, or 30

percent, to $1.2 billion in 2012 compared with $.9 billion in

2011 due to higher commercial mortgage servicing revenue

and higher merger and acquisition advisory fees in 2012. The

major components of corporate services revenue are treasury

management revenue, corporate finance fees, including

revenue from capital markets-related products and services,

and commercial mortgage servicing revenue, including

commercial mortgage banking activities. See the Product

Revenue portion of this Consolidated Income Statement

Review for further detail.

The PNC Financial Services Group, Inc. – Form 10-K 39