PNC Bank 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

outstanding indebtedness, and repurchases and redemptions of

issued and outstanding securities of PNC and its subsidiaries.

S

ENIOR

D

EBT

I

SSUED AND

R

EDEMPTION OF

N

ORMAL

APEX

On November 9, 2012 PNC issued $500.1 million of its parent

company Senior Notes due November 9, 2022 (the “Senior

Notes”) which were sold in a secondary public offering made

in connection with the remarketing of PNC’s Remarketable

8.729% Junior Subordinated Notes due 2043 (the

“Subordinated Notes”) owned by the National City Preferred

Capital Trust I (the “Trust”). In the remarketing the Trust sold

the Subordinated Notes and PNC exchanged the Senior Notes

with the purchasers of the Subordinated Notes. The Senior

Notes were then sold by the purchasers in the secondary

public offering. The Senior Notes bore interest at 8.729%

from and including June 10, 2012, to but excluding

November 9, 2012 and thereafter bear interest at 2.854% per

annum. The proceeds of the remarketing were ultimately used

by the Trust, after the completion of the Preferred Stock

transactions described below, to redeem all $500.0 million

outstanding of its 12% Fixed-to-Floating Rate Normal APEX

and $.1 million Common Securities of the Trust.

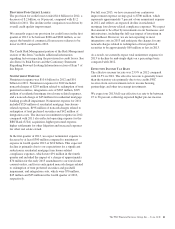

In the fourth quarter of 2012, PNC incurred noncash charges

for unamortized discounts of $70 million related to this

redemption. After the closing of these transactions, including

the redemption of the Normal APEX, only the Senior Notes

due November 9, 2022 remain outstanding.

As required under a stock purchase contract agreement, the

Trust purchased $500.1 million of PNC’s Non-Cumulative

Perpetual Preferred Stock, Series M (the “Preferred Stock”).

PNC then redeemed all of the Preferred Stock from the Trust

immediately upon its issuance. See Note 19 Equity in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for further detail.

A summary of 2013 capital and liquidity actions to date

follows.

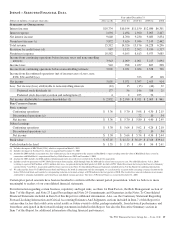

On January 28, 2013, PNC Bank, N.A. issued:

• $750 million of fixed rate senior notes with a

maturity date of January 28, 2016. Interest is payable

semi-annually, at a fixed rate of .80%, on January 28

and July 28 of each year, beginning on July 28, 2013.

• $250 million of floating rate senior notes with a

maturity date of January 28, 2016. Interest is payable

at the 3-month LIBOR rate, reset quarterly, plus a

spread of .31% on January 28, April 28, July 28, and

October 28 of each year, beginning on April 28,

2013.

• $750 million of subordinated notes with a maturity

date of January 30, 2023. Interest is payable semi-

annually, at a fixed rate of 2.905%, on January 30

and July 30 of each year, beginning on July 30, 2013.

On February 7, 2013, PNC announced that on March 15, 2013

we will redeem all $375 million of REIT preferred securities

issued by PNC Preferred Funding Trust III. See Note 27

Subsequent Events in the Notes To Consolidated Financial

Statements in Item 8 of this Report.

R

ECENT

M

ARKET AND

I

NDUSTRY

D

EVELOPMENTS

There have been numerous legislative and regulatory

developments and dramatic changes in the competitive

landscape of our industry over the last several years.

The United States and other governments have undertaken

major reform of the regulation of the financial services

industry, including engaging in new efforts to impose

requirements designed to strengthen the stability of the

financial system and protect consumers and investors. We

expect to face further increased regulation of our industry as a

result of current and future initiatives intended to provide

economic stimulus, financial market stability and enhanced

regulation of financial services companies and to enhance the

liquidity and solvency of financial institutions and markets.

We also expect in many cases more intense scrutiny from our

bank supervisors in the examination process and more

aggressive enforcement of regulations on both the federal and

state levels. Compliance with new regulations will increase

our costs and reduce our revenue. Some new regulations may

limit our ability to pursue certain desirable business

opportunities.

The Dodd-Frank Wall Street Reform and Consumer

Protection Act (Dodd-Frank), enacted in July 2010, mandates

the most wide-ranging overhaul of financial industry

regulation in decades. Many parts of the law are now in effect

and others are now in the implementation stage, which is

likely to continue for several years.

Until such time as the regulatory agencies issue final

regulations implementing all of the numerous provisions of

Dodd-Frank, PNC will not be able to fully assess the impact

the legislation will have on its businesses. However, we

believe that the expected changes will be manageable for PNC

and will have an overall smaller impact on us than on our

larger peers.

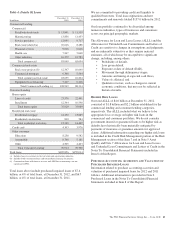

Included in these recent legislative and regulatory

developments are evolving regulatory capital standards for

financial institutions. These evolving standards include the

three sets of proposed rules that the U.S. banking agencies

released in June 2012 to implement the Basel III regulatory

capital framework developed by the Basel Committee on

Banking Supervision (Basel III) and also make other changes

to U.S. regulatory capital standards for banking institutions.

The Basel III proposed rules include heightened capital

requirements for banking institutions in terms of both higher

quality capital and higher regulatory capital ratios. The

proposed Basel III rules would become effective under a

phase-in period and would be in full effect on January 1, 2019.

The capital rules issued by the Federal banking agencies in

June 2012 would also revise the manner in which a banking

The PNC Financial Services Group, Inc. – Form 10-K 33