PNC Bank 2012 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2012 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Variable Interest Entities, Agency securitizations consist of

mortgage loan sale transactions with FNMA, FHLMC, and the

GNMA program, while Non-agency securitizations consist of

mortgage loan sale transactions with private investors.

Mortgage loan sale transactions that are not part of a

securitization may involve FNMA, FHLMC or private

investors. Our historical exposure and activity associated with

Agency securitization repurchase obligations has primarily

been related to transactions with FNMA and FHLMC, as

indemnification and repurchase losses associated with FHA

and VA-insured and uninsured loans pooled in GNMA

securitizations historically have been minimal. Repurchase

obligation activity associated with residential mortgages is

reported in the Residential Mortgage Banking segment.

PNC’s repurchase obligations also include certain brokered

home equity loans/lines that were sold to a limited number of

private investors in the financial services industry by National

City prior to our acquisition of National City. PNC is no longer

engaged in the brokered home equity lending business, and our

exposure under these loan repurchase obligations is limited to

repurchases of loans sold in these transactions. Repurchase

activity associated with brokered home equity loans/lines is

reported in the Non-Strategic Assets Portfolio segment.

Loan covenants and representations and warranties are

established through loan sale agreements with various

investors to provide assurance that PNC has sold loans that are

of sufficient investment quality. Key aspects of such

covenants and representations and warranties include the

loan’s compliance with any applicable loan criteria established

for the transaction, including underwriting standards, delivery

of all required loan documents to the investor or its designated

party, sufficient collateral valuation, and the validity of the

lien securing the loan. As a result of alleged breaches of these

contractual obligations, investors may request PNC to

indemnify them against losses on certain loans or to

repurchase loans.

Indemnification and repurchase liabilities are initially

recognized when loans are sold to investors and are

subsequently evaluated by management. Initial recognition

and subsequent adjustments to the indemnification and

repurchase liability for the sold residential mortgage portfolio

are recognized in Residential mortgage revenue on the

Consolidated Income Statement. Since PNC is no longer

engaged in the brokered home equity lending business, only

subsequent adjustments are recognized to the home equity

loans/lines indemnification and repurchase liability. These

adjustments are recognized in Other noninterest income on the

Consolidated Income Statement.

Management’s subsequent evaluation of these indemnification

and repurchase liabilities is based upon trends in

indemnification and repurchase requests, actual loss

experience, risks in the underlying serviced loan portfolios,

and current economic conditions. As part of its evaluation,

management considers estimated loss projections over the life

of the subject loan portfolio. At December 31, 2012 and

December 31, 2011, the total indemnification and repurchase

liability for estimated losses on indemnification and

repurchase claims totaled $672 million and $130 million,

respectively, and was included in Other liabilities on the

Consolidated Balance Sheet. An analysis of the changes in this

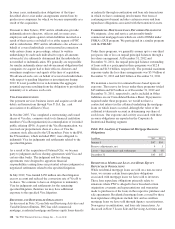

liability during 2012 and 2011 follows:

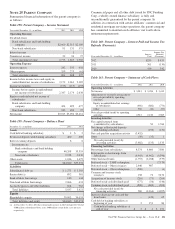

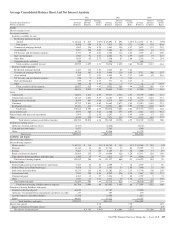

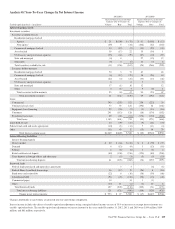

Table 155: Analysis of Indemnification and Repurchase Liability for Asserted Claims and Unasserted Claims

2012 2011

In millions

Residential

Mortgages (a)

Home

Equity

Loans/

Lines (b) Total

Residential

Mortgages (a)

Home

Equity

Loans/

Lines (b) Total

January 1 $ 83 $47 $130 $144 $150 $ 294

Reserve adjustments, net 32 12 44 14 14

RBC Bank (USA) acquisition 26 26

Losses – loan repurchases and settlements (40) (8) (48) (34) (22) (56)

March 31 $101 $51 $152 $124 $128 $ 252

Reserve adjustments, net 438 15 453 21 3 24

Losses – loan repurchases and settlements (77) (5) (82) (50) (76) (126)

June 30 $462 $61 $523 $ 95 $ 55 $ 150

Reserve adjustments, net 37 4 41 31 31

Losses – loan repurchases and settlements (78) (3) (81) (41) (4) (45)

September 30 $421 $62 $483 $ 85 $ 51 $ 136

Reserve adjustments, net 254 (2) 252 36 1 37

Losses – loan repurchases and settlements (61) (2) (63) (38) (5) (43)

December 31 $614 $58 $672 $ 83 $ 47 $ 130

(a) Repurchase obligation associated with sold loan portfolios of $105.8 billion and $121.4 billion at December 31, 2012 and December 31, 2011, respectively.

(b) Repurchase obligation associated with sold loan portfolios of $4.3 billion and $4.5 billion at December 31, 2012 and December 31, 2011, respectively. PNC is no longer engaged in

the brokered home equity lending business, which was acquired with National City.

The PNC Financial Services Group, Inc. – Form 10-K 229